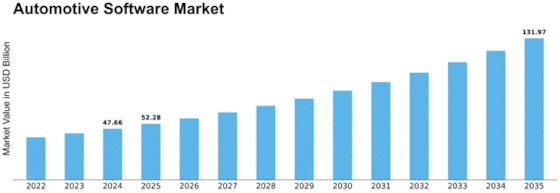

Automotive Software Size

Automotive Software Market Growth Projections and Opportunities

The automotive software market is a quickly extending industry that is being driven by the rising requirement for associated and independent vehicles. The preference of clients for keen ascribes requires the improvement of cutting-edge auto programming to guarantee steady availability, route, and robotization. The fuse of trend setting innovations, including IoT and simulated intelligence, into auto programming improves the driving experience in general, consequently driving the extension of the market. Wellbeing guidelines and unofficial laws are driving the market, bringing about expanded reception of cutting-edge programming for purposes, for example, ADAS and V2X cooperation, which adds to showcase development. Expanding interest for programming that screens battery frameworks, charging foundation, and energy proficiency is being powered by the expansion of electric vehicles (EVs), in this manner giving auto designers and merchants new possibilities. Serious scenes influence the automotive software market, with significant entertainers putting resources into coordinated effort and advancement to further develop vehicle execution, security, and client experience. Makers and designers push market development through essential unions. Possibilities and buyer inclinations impact the market, with mechanically educated purchasers wanting upgraded highlights and customization choices. Auto producers assign assets towards cutting edge programming arrangements, which incorporate instinctive connection points, rational cell phone combination, and remote updates. Market patterns and the worldwide economy additionally significantly affect the automotive software market. Exchange arrangements, financial vacillations, and changes in the car business can all affect the ventures and methodologies of vehicle producers. The responsiveness of the market to outer powers highlights the need for car programming to have flexibility and inventive reasoning. The automotive software sector is dependent upon an intricate interchange of elements, enveloping innovative headways, business techniques, shopper inclinations, and worldwide monetary patterns. As the car business keeps on going through huge changes, there is supposed to be an expanded interest for complex programming game plans. This improvement will give accomplices in this unmistakable market the two difficulties and valuable open doors.

Leave a Comment