Research Methodology on Automotive Software Market

1. Introduction

The Automotive Software market is a rapidly growing and lucrative global market, driven by steadily increasing vehicle sales worldwide and consumer preferences for more connected and automated vehicles, in terms of comfort and convenience.

Automotive software is increasingly playing a major role in the automotive industry as it streamlines the production process and finally contributes to improved quality and cost of components or systems. With the rapid development in automotive software and the surging awareness for safety-critical applications, the trends for this software is on a rise in recent years. Some of the factors that are driving the growth of the market include rising demand for connected services, increasing popularity of autonomous vehicles and an overall increase in the implementation of software in vehicles for diverse functionalities.

2. Research Objectives

The primary objective of this research project is to analyse the Automotive Software market and the factors affecting the market. The following research objectives were made:

- To identify the market size of the automotive software market and its various segments.

- To identify the factors driving the growth of the market.

- To analyse the competitive landscape of the automotive software market.

- To analyze the future trends of the automotive software market.

3. Research Methodology

The research methodology used in this project is based on Secondary research and Primary research.

3.1 Secondary Research

Secondary research involves the assessment and validation of data gathered by various sources to provide an in-depth understanding of the market scenario, historical data, and current trends. Secondary research provides information about market size, industry analysis, market dynamics and key market players. Moreover, the key manufacturers’ orders and the related market data are studied by leveraging our extensive network of industry experts. Industry websites, press releases, relevant magazines, and other publications are examined to retrieve data used to prepare the research report.

3.2 Primary Research

Primary research focuses on understanding the customer’s needs and preferences. Primary research is used to assess the market size of the automotive software market and various related market components. An online survey is conducted to estimate the demand for automotive software services. The questionnaire includes questions on automotive usage, the purpose of using automotive software, and customer expectations. The survey is conducted among automotive software users. In order to validate the data, interviews are conducted with industry experts including product developers, civil engineers, automotive engineers, and other experts from related industries.

4. Data Collection and Analysis

Data collected from the secondary and primary research methods are quality checked, analyzed and validated by a team of professional experts for accuracy. The data is then used to generate reports. The data analysis approach used in this research study includes analysis of market sizing, segmentation, competitive landscape, and pricing structure.

-

Market Sizing: The estimated data is gathered from marketplace intelligence reports as well as industry survey reports. It is analysed by research analysts and validated by industry experts.

-

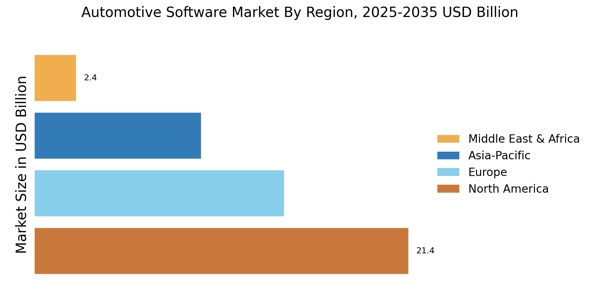

Segmentation: The data values are used to segment the automotive software market into various regions, vehicle segments, types, automakers, and sales channels. The market size and growth rate of various segments are calculated.

-

Competitive Landscape: Analysis of data is done to understand the competitive landscape of the Automotive Software market. The data gathered from the research studies are consolidated to study the strength and weaknesses of the key stakeholders in the market.

-

Pricing Structure: The pricing structure of the Automotive Software market is also analyzed. The cost associated with each type of automotive software is considered and compared.