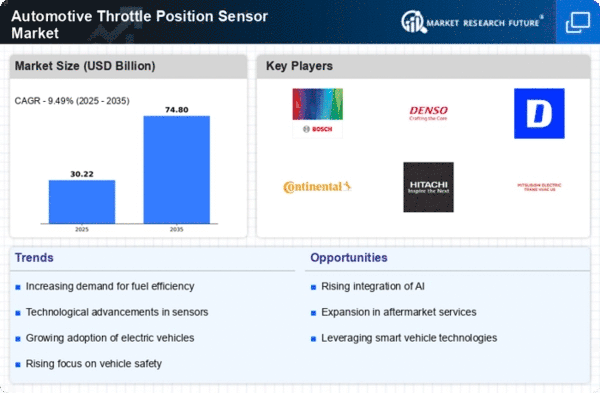

Market Share

Automotive Throttle Position Sensor Market Share Analysis

The Automotive TPS sensors (TPS) are a part of the fast changing environment which illustrates two major trends which simultaneously affect the technical solutions and the automotive industry development. The major shift in the market today is the rising demand for fuel efficiency and the environments looking at emission reduction. Since tougher regulations are written at the global level, manufacturers are increasingly relying on advanced throttle position sensors that provide for the automotive benefit of proper fuel injection and more efficient combustion processes The careful and precise adjustment of the throttle positioning enable better engine efficiency; with less fuel consumption and emissions being released in the atmosphere, this overlaps with the environmental sustainability efforts within the auto industry.

The shift towards the electrification of cars and hybrids is one of the most critical factors that are going to impact the automotive TPS market in the near future. EVs have increasingly gained the limelight with the IC engines, however, they are still prominent as most of the EVs on the road today are in hybrid format. The roadmaps of throttle position sensors can be mostly seen in regulating the power production in both types of vehicles, regardless of the electric or internal combustion modes used. The automotive industry is responding to the market demand for a bespoke technological solution that will help designers build vehicles for numerous powertrain solutions.

Furthermore, growth of sensor technology and connectivity aspect introduces a new growth area for the automotive TPS market. Nowadays, TPS stock modern OBD II with advanced sensors and data communication, making it possible to realize the real time monitoring and the precision throttle control at all the times. This not only allows the car to be more responsive but also is needed for autonomous driving technologies. So the persistent evolution of motor vehicles moving towards the smart and self-driving ones and constantly stresses the importance of precise and response throttle position sensor implementation for the sake of safe and effective vehicle operation.

The market gets more quality concerns about durability and reliability of the throttle position sensors positions. As vehicles become more ingenious and clients request more enduring attributes, manufacturers are focusing in designing products from premium quality materials and incorporating complex designs in this sector. Thus, following the auto-manufacturing industry's mission to deliver faultless vehicles that consume less maintenance costs, the customers experience an unmatched level of satisfaction with their vehicle.

Airplane technology is being shared, and cybersecurity is now one of them. However, auto TPS market is affected also. Now that more and more electronics and connectivity capabilities are built around TPS, manufacturers emphasize cybersecurity measures in the fluctuating and pulsing sensory equipment to prevent cyberattacks. Keeping the information as well as other sensor as well as vehicle system safe is critically important for maintaining strong safety and reliability of newest car model.

Leave a Comment