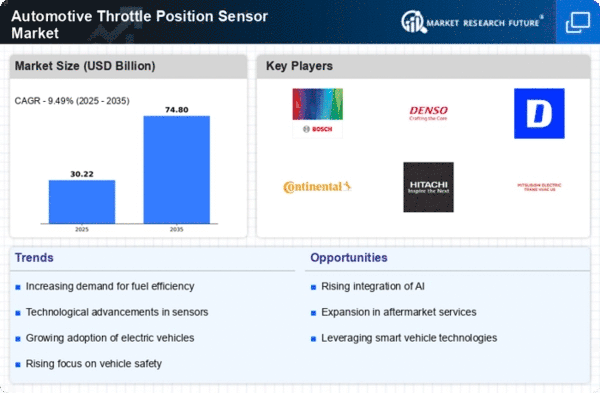

Market Growth Projections

The Global Automotive Throttle Position Sensor Market Industry is poised for substantial growth, with projections indicating a market size of 37.1 USD Billion in 2024 and an anticipated increase to 104.8 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate (CAGR) of 9.89% from 2025 to 2035. The increasing demand for fuel-efficient vehicles, coupled with advancements in sensor technology and the rise of electric vehicles, contributes to this optimistic outlook. As the industry evolves, the integration of innovative throttle position sensors will likely play a pivotal role in meeting consumer expectations and regulatory requirements.

Growing Demand for Fuel Efficiency

The Global Automotive Throttle Position Sensor Market Industry experiences a surge in demand for fuel-efficient vehicles. As consumers become increasingly environmentally conscious, automakers are compelled to enhance fuel economy in their offerings. Throttle position sensors play a crucial role in optimizing engine performance, thereby improving fuel efficiency. For instance, the integration of advanced throttle position sensors in hybrid and electric vehicles is expected to drive market growth. The market is projected to reach 37.1 USD Billion in 2024, reflecting the industry's response to consumer preferences for sustainable transportation solutions.

Increasing Adoption of Electric Vehicles

The rise in electric vehicle adoption is a pivotal driver for the Global Automotive Throttle Position Sensor Market Industry. Governments worldwide are implementing stringent emissions regulations, encouraging consumers to transition to electric vehicles. Throttle position sensors are integral to the efficient operation of electric drivetrains, ensuring optimal power delivery and energy management. As electric vehicle sales continue to climb, the demand for advanced throttle position sensors is expected to increase correspondingly. By 2035, the market is projected to reach 104.8 USD Billion, reflecting the significant impact of electric vehicle proliferation on sensor demand.

Regulatory Compliance and Emission Standards

Stringent regulatory compliance and emission standards are critical factors shaping the Global Automotive Throttle Position Sensor Market Industry. Governments are enforcing regulations that mandate lower emissions from vehicles, compelling manufacturers to adopt advanced technologies, including throttle position sensors. These sensors facilitate precise control of air-fuel mixtures, thereby reducing harmful emissions. As automotive manufacturers strive to meet these regulations, the demand for high-quality throttle position sensors is likely to increase. This trend underscores the importance of regulatory frameworks in driving market growth and innovation within the industry.

Technological Advancements in Sensor Technology

Technological innovations in sensor technology significantly influence the Global Automotive Throttle Position Sensor Market Industry. The development of more precise and reliable sensors enhances vehicle performance and safety. For example, the introduction of contactless throttle position sensors, which utilize magnetic or optical technologies, offers improved durability and accuracy. These advancements not only meet regulatory standards but also cater to the growing consumer demand for high-performance vehicles. As a result, the market is anticipated to grow at a CAGR of 9.89% from 2025 to 2035, indicating a robust trajectory driven by ongoing technological enhancements.

Rising Consumer Awareness of Vehicle Performance

Rising consumer awareness regarding vehicle performance and efficiency is a notable driver for the Global Automotive Throttle Position Sensor Market Industry. Consumers are increasingly informed about how throttle position sensors contribute to overall vehicle performance, including acceleration and responsiveness. This awareness drives demand for vehicles equipped with advanced throttle position sensors, as consumers seek enhanced driving experiences. Consequently, automotive manufacturers are prioritizing the integration of these sensors in their designs, further propelling market growth. The interplay between consumer preferences and technological advancements is likely to shape the future landscape of the industry.