Growth of the Automotive Aftermarket

The Automotive Timing System Market is witnessing substantial growth in the aftermarket segment. As vehicles age, the need for replacement and upgraded timing systems becomes more pronounced. This trend is particularly evident in regions with a high density of older vehicles, where maintenance and repair services are in demand. The aftermarket for timing systems is projected to expand, driven by the increasing awareness of vehicle performance and longevity among consumers. Additionally, the rise of e-commerce platforms is facilitating easier access to aftermarket components, further propelling this segment. Analysts predict that the aftermarket for automotive timing systems could account for a significant share of the overall market by 2028.

Rising Demand for Fuel-Efficient Vehicles

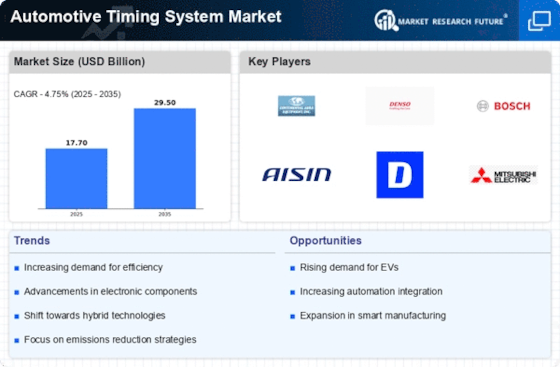

The Automotive Timing System Market is significantly influenced by the rising demand for fuel-efficient vehicles. As consumers become more environmentally conscious, automakers are compelled to develop engines that maximize fuel economy while minimizing emissions. Timing systems play a crucial role in achieving these objectives, as they directly impact engine efficiency. The market has seen a notable shift towards timing systems that support hybrid and electric vehicles, which are gaining traction in various regions. This trend is expected to propel the market forward, with projections indicating a compound annual growth rate (CAGR) of around 6% over the next five years.

Emergence of Smart Automotive Technologies

The Automotive Timing System Market is being transformed by the emergence of smart automotive technologies. Innovations such as connected vehicles and advanced driver-assistance systems (ADAS) are creating new opportunities for timing system manufacturers. These technologies require highly precise timing mechanisms to ensure optimal performance and safety. As automakers integrate more smart features into their vehicles, the demand for advanced timing systems that can support these functionalities is likely to increase. This trend suggests a potential shift in market dynamics, with forecasts indicating that smart automotive technologies could contribute to a market growth rate of approximately 5% annually over the next several years.

Regulatory Pressures for Emission Reductions

The Automotive Timing System Market is also shaped by stringent regulatory pressures aimed at reducing vehicle emissions. Governments worldwide are implementing more rigorous standards, compelling manufacturers to innovate and adopt advanced timing systems that can help meet these requirements. The introduction of regulations such as Euro 6 and similar standards in other regions has led to increased investments in research and development. Consequently, the demand for sophisticated timing systems that enhance engine performance while adhering to emission norms is likely to rise. This regulatory landscape is expected to drive market growth, with an anticipated increase in market size by approximately 4 billion USD by 2027.

Technological Innovations in Automotive Timing Systems

The Automotive Timing System Market is experiencing a surge in technological innovations, particularly with the integration of advanced materials and electronic components. These innovations enhance the precision and reliability of timing systems, which are critical for engine performance. For instance, the adoption of variable valve timing (VVT) technologies has been pivotal in optimizing fuel efficiency and reducing emissions. As manufacturers increasingly focus on improving engine dynamics, the market for timing systems is projected to grow significantly. Recent estimates suggest that the market could reach a valuation of approximately USD 5 billion by 2026, driven by these technological advancements.