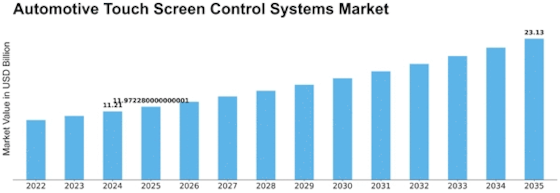

Automotive Touch Screen Control Systems Size

Automotive Touch Screen Control Systems Market Growth Projections and Opportunities

The market for automotive touch screen control systems is driven by a host of factors in the markets that together form dynamics. The increasing customer needs of technologically advanced and easy-to-use infotainment systems in vehicles further serve as one of the major demand drivers for this market. With the advent of new technologies, consumers’ demands led to developing advanced features for vehicles that include touch screen control systems as one component in fulfilling these needs. Government regulation and safety standards also play a vital role to determine the automotive touch screen control systems market. With safety issues on the rise, regulatory boards place several regulations regarding in-car entertainment systems such that they should not interfere with driver attention or pose threats to road security. In this market, manufacturers are required to maneuver through these regulations and come up with touch screen solutions that achieve a balance between innovation factors as well as safety compliance. The overall performance of the global automotive industry significantly affects touch control systems market. Economic factors like GDP growth, consumer purchasing power, and disposable income levels affect the demand for new vehicles which leads to higher integration of touch screen technologies into cars. During such periods of economic slowdown, the focus shifts from premium features to basic vehicle functionality which in turn affects the advanced touch screen control systems market. The market dynamics are also influenced by technological developments and innovations. Continuous advancement in technological sophistication is a critical driver of the automotive touch screen control systems market, which encompasses innovative responsive and intuitive touch interfaces; improved connectivity features; integration with AI. However, manufacturers that stay at the vanguard of such a technological movement are more likely to meet consumer needs and ensure competitive advantage in this market. The automotive touch screen control systems market is closely related to the overall consumer electronics industry. With the advances in smartphones and tablets, users get used to smooth touch interactions. This familiarity applies to their requirements for the touch screen systems in-car. The inclusion of capabilities such as smartphone mirroring, app connectivity, and voice recognition also puts automotive touch screen systems in line with the cues picked from the consumer electronics industry. Market competition is another significant driving factor for the automotive touch screen control systems market. Due to the large number of companies competing for market share, manufacturers are consistently looking for ways in which they can distinguish their products through innovation strategies and pricing models as well as customer orientation. The competitive environment makes the atmosphere for innovation, thus pushing companies to create better and more feature-rich touch screen control systems to attract customers. The market is also influenced by global trends and changes in society. The trend towards sustainability and environmental awareness is associated with the growing popularity of electric vehicles. Following the revolution of automotive industry towards electrification, touch screen control systems rise as a major component in these futuristic vehicles presenting market makers new opportunities and challenges.

Leave a Comment