Automotive Trailer Market Summary

As per Market Research Future analysis, the Automotive Trailer Market Size was estimated at 22.78 USD Billion in 2024. The Automotive Trailer industry is projected to grow from 23.81 USD Billion in 2025 to 36.98 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Trailer Market is poised for growth driven by sustainability and technological advancements.

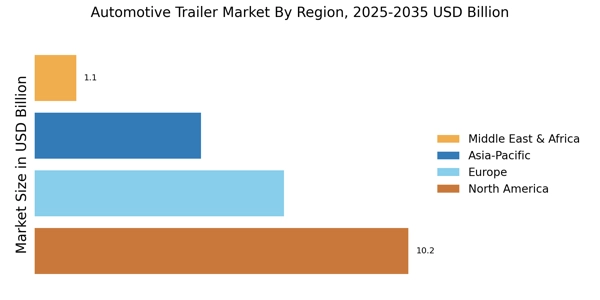

- North America remains the largest market for automotive trailers, reflecting robust demand across various segments.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing infrastructure development and urbanization.

- Passenger car trailers dominate the market, while commercial vehicle trailers are experiencing rapid growth due to rising logistics needs.

- Key market drivers include the rising demand for e-commerce logistics and the increased adoption of electric vehicles, which are reshaping the industry landscape.

Market Size & Forecast

| 2024 Market Size | 22.78 (USD Billion) |

| 2035 Market Size | 36.98 (USD Billion) |

| CAGR (2025 - 2035) | 4.5% |

Major Players

Utility Trailer Manufacturing Company (US), Wabash National Corporation (US), Great Dane Trailers (US), Trailmobile (US), Schmitz Cargobull AG (DE), Kögel Trailer GmbH & Co. KG (DE), Fruehauf Trailer Corporation (US), Dorsey Trailers (US), CIMC Vehicles Group (CN)