- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

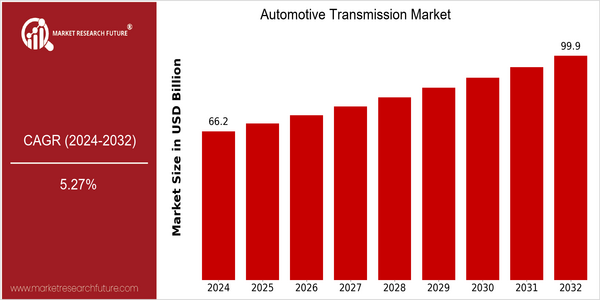

Automotive Transmission Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 66.24 Billion |

| 2032 | USD 99.93 Billion |

| CAGR (2024-2032) | 5.27 % |

Note – Market size depicts the revenue generated over the financial year

In the year 2024, the global car transmission market was valued at $ 66.24 billion and is expected to reach $ 99.93 billion by 2032. The CAGR of this growth is 5.27%. The main driving force for this market is the increasing demand for advanced transmission systems due to the increase in the production of electric vehicles and the need to improve the energy-saving performance of internal combustion engines. Also, the automation of vehicles and the integration of smart technology are expected to further increase the popularity of modern transmission solutions. The key players in the car transmission market, such as ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., and BorgWarner Inc., are investing heavily in research and development to improve their products and expand their market share. Strategic initiatives, such as establishing long-term cooperative relations with car manufacturers and investing in hybrid and electric vehicle technology, are shaping the competitive landscape. ZF, for example, is collaborating with several car manufacturers to develop next-generation transmission systems, which is an important sign of the industry's determination to meet the needs of the market and meet the requirements of the regulatory authorities. These trends and strategic initiatives will play an important role in the development of the car transmission market and will have a significant impact on its future development.

Regional Deep Dive

The market for the manufacture of car gears is in a state of evolution, the result of technological developments, regulatory changes, and changing consumer preferences. In North America, the market is characterized by a strong orientation towards the integration of electric vehicles (EV) and the development of new gearbox systems. In Europe, the regulatory framework for reducing emissions is the most advanced in the world, forcing manufacturers to innovate in terms of gearbox technology. The Asian-Pacific region is characterized by a high level of growth, the result of an increase in car production and a growing middle class. In the Middle East and Africa, economic diversification is gradually introducing modern gearboxes. Latin America, still in its developmental stage, is beginning to welcome new technologies as the presence of car manufacturers grows.

North America

- The recent success of electric vehicles has led to a major investment in the development of advanced transmissions that are adapted to the fundamentally different characteristics of electric motors.

- The manufacturers, pressed by the regulations, the CAFE, are making the effort to improve the transmission systems to meet the new requirements.

- For example, Ford and Waymo are working on new transmissions that improve performance and safety.

Europe

- In order to comply with the stricter exhaust gas regulations of the European Union, car manufacturers are investing in the development of continuously variable transmissions (CVTs) and dual-clutch gearboxes, which improve fuel consumption and reduce CO2 emissions.

- VW and BMW are working together with technology companies to develop new transmissions that can be connected to the Internet and, therefore, improve the overall performance of the car.

- There are also the increasing numbers of hybrid and electric cars, which need special drive systems, and which will therefore be a major focus of R&D in the future.

Asia-Pacific

- The Chinese automobile industry is developing rapidly, and local manufacturers such as BYD and Geely are competing with international manufacturers and introducing advanced transmission technology to meet the needs of the market.

- There is a flurry of interest in electric cars, and Toyota and Honda are developing hybrid drive systems that can be used for both conventional and electric-powered vehicles.

- In addition to the development of the modern power grid, governments are also investing in the development of electric vehicles and the construction of charging stations.

MEA

- The United Arab Emirates and Saudi Arabia are diversifying their economies away from oil, which is leading to a greater investment in the manufacture of automobiles and in modern drive technology.

- The increasing interest in electric vehicles has prompted local manufacturers to seek alliances with foreign companies to develop advanced transmissions adapted to the special conditions of the region.

- The regulatory framework is slowly evolving to support the innovation of the automobile, and governments are encouraging the adoption of cleaner vehicles. The demand for transmissions with reduced emissions of CO2 will probably increase.

Latin America

- Brazil and Mexico are becoming the leading countries in the automobile industry. The leading car manufacturers have established factories in both countries that are devoted to the production of modern automobile transmissions.

- The inclination towards electric and hybrid vehicles, arising from the growing consciousness of the environment and the incentive policy of the governments, will gradually be replaced by an increasing tendency towards the transmission of electricity.

- The local associations of the automobile industry are pleading for an improved road network and more favourable legislation in order to strengthen the competitiveness of the automobile industry, which would also benefit the transmission market.

Did You Know?

“About seventy per cent of the new vehicles sold in Europe are now automatic, which shows a marked change in the consumer’s taste towards comfort and convenience.” — European Automobile Manufacturers Association (ACEA)

Segmental Market Size

The automobile gear market is currently experiencing a period of stability, with a notable focus on automatic and hybrid gears. The main drivers are the growing demand for fuel-efficient vehicles, the stricter regulation of vehicle emissions, and the rapid development of electric vehicle (EV) technology. These factors are driving manufacturers to develop and improve gears to meet the ever-changing expectations of consumers and regulators.

It is now in its second stage of development, with the electric-engine car a mature and rapidly-developing industry, and with such companies as Toyota and Tesla already supplying electric-engine cars. The main applications are in passenger cars, commercial vehicles, and electric vehicles, where efficient power delivery is essential. In the context of the worldwide drive towards greater sustainability and the government-imposed reduction of emissions, this market is expected to grow rapidly. The latest developments in the evolution of automobile transmissions are dual-clutch systems and continuously-variable transmissions (CVTs). These are making it possible to provide smoother gearshifts and to increase fuel efficiency.

Future Outlook

Then the car rolled forward, and it became a stream. It was a glimmering stream. It was the stream of the future. It was the stream of the present. It was the stream of the past.

The application of artificial intelligence and machine learning to transmission systems, which will further improve the performance and efficiency of the vehicle. In addition, the tightening of government regulations to reduce CO2 emissions will increase the momentum of this trend towards more complex transmission solutions. The development of automatic and semi-autonomous transmission systems will also have a significant influence on the future market structure. Consequently, as manufacturers continue to invest in research and development to improve transmission technology, the market will continue to evolve, in line with the changing preferences of consumers and the needs of the automobile industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 58.9 Billion |

| Market Size Value In 2023 | USD 62.46345 Billion |

| Growth Rate | 6.05% (2023-2032) |

Automotive Transmission Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.