Market Analysis

In-depth Analysis of Automotive Turbocharger Market Industry Landscape

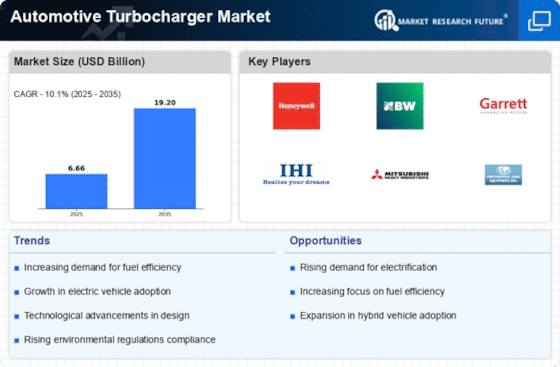

The automotive turbocharger market is a dynamic sector that experiences fluctuations influenced by various factors, shaping its supply, demand, and overall trends. Fundamentally, this market is shaped by technological innovations, regulatory standards that include fuel efficiency requirements and consumer preferences along with conditions on the global economic front.

Manufacturing methods and material innovations largely influence supply dynamics in the automotive turbocharger market. Another factor that is critical for manufacturing turbochargers entails the availability of raw materials like steel, aluminum and other alloys. They also impact supply, as innovations in precision engineering and assembly processes allow manufactures to produce turbochargers efficiently and cost-effectively.

Global automotive production trends and consumer preferences are affectors of demand dynamics for turbochargers in the automobile industry. Demand is also driven considerably by the increase in production and adoption of vehicles equipped with downsized engines that use turbochargers to improve power and fuel efficiency. Also, governments across the world have tightened fuel efficiency and emission standards forcing automakers to move towards turbocharged engines in order to comply with these requirements.

Demand forces within the turbocharger market are influenced by consumer preferences for stronger vehicles that consume less fuel. Buyers look for enhanced engine performance without losing on fuel economy, which turbocharged offer by increasing the power of their engines through utilization of exhaust gases. Also, the emerging trend among consumers for sportier models of vehicles increases demand on turbocharged engines as they provide greater performance rating.

Automotive turbochargers market dynamics are largely affected by regulative standards and environmental issues. Automakers have resorted to introducing turbocharging technology as a solution for compliance with emission regulations and standards, which seek reductions in greenhouse gas emissions and improved fuel efficiency. Manufacturers need to keep innovating turbocharger designs that not only meet these stringent standards but also perform optimally.

Competitive dynamics is one of the main factors that contribute to a small turbocharger market. The global players of the industry compete on technological innovation, product efficiency and pricing strategies. Manufacturers of turbochargers will always invest in research and development, so that they can produce advanced and more efficient products for the market whenever possible.

Besides, the aftermarket segment is of crucial importance for turbocharger market trends. Once the consumers are looking to improve their vehicles’ performance, they usually refer to aftermarket turbocharger kits which in its turn creates an alternative market where competition and innovation stand between numerous various aftermarket suppliers. Global economic conditions and market trends also shape the dynamics of the automotive turbocharger market. Factors like economic growth, fluctuating oil prices, and shifts in consumer purchasing power influence vehicle sales and, consequently, the demand for turbocharged engines.

Leave a Comment