Research Methodology on Automotive Turbocharger Market

The research study, Automotive Turbocharger Market, encompasses a market attractiveness analysis and a competitive landscape, besides qualitative information such as drivers, restraints, challenges and opportunities, which affect the overall development of the automotive turbocharger market. In order to build a robust base for market research, Market Research Future (MRFR) has conducted an all-inclusive primary research report based on interviews with numerous industry experts, market players and stakeholders. Market responses regarding the present and future prospects of the market, the competitive scenario, the size and growth of the automotive turbocharger market and investment opportunities, have all been considered while pulling together the data. Additionally, secondary research was executed to validate the collected data. The multitude of perspectives on the automotive turbocharger market has been integrated and presented in this report.

Research Scope

The research scope of the automotive turbocharger market report consists of segment and forecast analysis based on three aspects.

- Technology

- Vehicle type

- Sales Channel

By technology, the market is segmented into variable geometry, wastegate, and others. Based on vehicle type, the market is segmented into passenger cars, lightweight commercial vehicles, and heavy commercial vehicles. Based on sales channels, the market is segmented into OEM and aftermarket. The market research study covers global and regional data for each segment mentioned above from 2023 to 2030.

Research Approach

MRFR follows a comprehensive research approach to capture the essential aspects related to the automotive turbocharger market. The data-gathering process utilized primary and secondary sources of information such as trade journals, surveys, corporate announcements, financial reports, and interviews among others. The primary and secondary sources of data have been combined to get the scope and size of the automotive turbocharger market. All of the research questions have been addressed using quantitative and qualitative methods and tools such as Porter's Five Forces Model.

Primary Research

The primary research is based on the opinions of top industry experts and stakeholders to get a holistic view of the automotive turbocharger market. This section involves interviews with industry experts to compile the qualitative and quantitative data. The interviews have been conducted with industry leaders and experienced professionals to get an insight into the automotive turbocharger market. The sources of primary research have included surveys, questionnaires, interviews, e-mailers and others.

Secondary Research

In the secondary research process, secondary data has been collected from the company websites, company reports, company presentations, industry reports published in the Automotive Industry, articles, published papers, and other industry resources. Further, the secondary research has provided an in-depth analysis of the leading players in the market and the strategies adopted by them to gain a market leadership position. The secondary data has given an insight into the market size, market share, growth rate, segments, trends, and geographical analysis of the automotive turbocharger market.

Data Triangulation

Data triangulation has been used to validate the quality of the data collected. The data collected from the primary and secondary sources has been consolidated and the data has been validated using the triangulation method.

Competitors Analysis

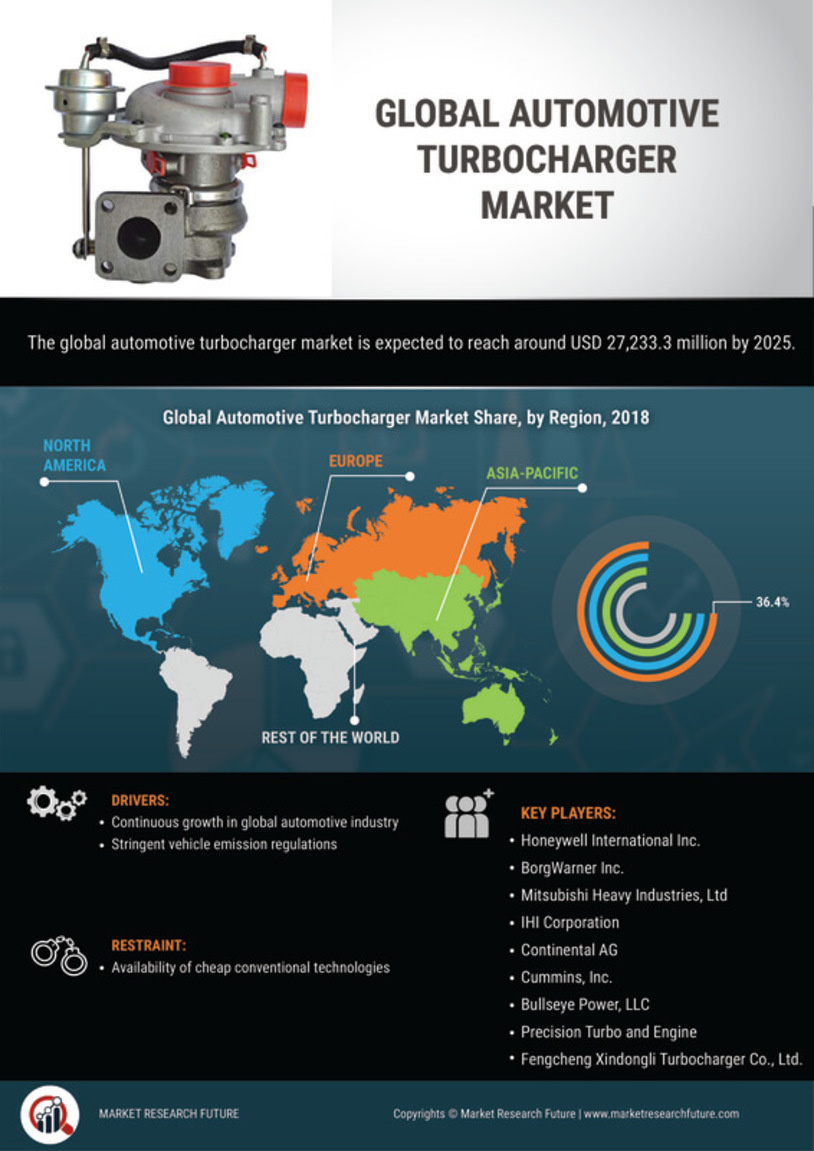

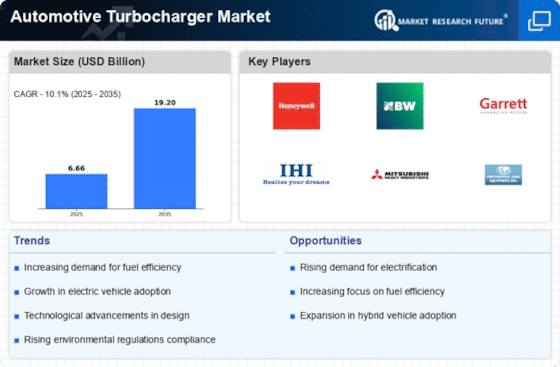

The report profiles some of the leading companies in the global automotive turbocharger market. These companies are Honeywell International, IHI Corporation, Continental AG, Mitsubishi Heavy Industries, Rotomaster Corporation, Adaptive Corporation, Hadley Corporation, Bosch Corporation, Grainger Corporation, Alfred Buechi GmbH, and Eaton Corporation.

Assumptions

The assumptions taken into consideration while compiling the research report are:

-

The automotive turbocharger market has been considered to be divided into technology, vehicle type, and sales channel for the period of 2023-2030

-

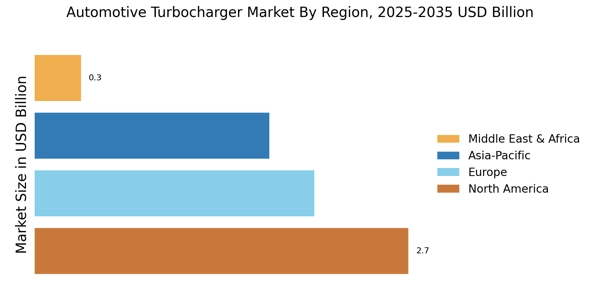

The revenue generated from the sales of automotive turbochargers in Europe, North America, Asia Pacific and the Rest of the World has been considered for the estimation of the market size.

-

The number of vehicles being sold in Europe, North America, Asia Pacific and the Rest of the World has been estimated for calculating the market size.

-

The market size of the automotive turbocharger is estimated using the bottom-up and top-down approaches and validated using both qualitative and quantitative methods of data collection.

-

The data collected from the primary and secondary sources have been verified with the help of data triangulation.