Top Industry Leaders in the Autonomous Ships Market

Autonomous Ships Market Outlook

Strategies Adopted: Key players in the Autonomous Ships Market are implementing various strategies to gain a competitive advantage and drive market growth. These strategies include:

Technology Development: Companies are investing in research and development to enhance autonomous navigation systems, collision avoidance algorithms, sensor fusion technologies, and remote monitoring capabilities, enabling safe, efficient, and reliable autonomous operations in diverse maritime environments.

Strategic Partnerships: Collaborations with shipbuilders, maritime regulators, technology providers, and research institutions facilitate knowledge sharing, technology transfer, and regulatory compliance, accelerating the development and adoption of autonomous ship solutions and ecosystem development.

Market Segmentation: Companies tailor their autonomous ship solutions to address specific market segments, such as commercial shipping, offshore operations, passenger ferries, and unmanned vessels for environmental monitoring, offshore wind farms, and aquaculture, catering to diverse customer needs and use cases.

Regulatory Advocacy: Companies engage with maritime authorities, classification societies, and industry associations to shape regulations, standards, and guidelines for autonomous shipping, ensuring safety, security, and legal compliance while fostering industry-wide acceptance and adoption of autonomous vessel technology.

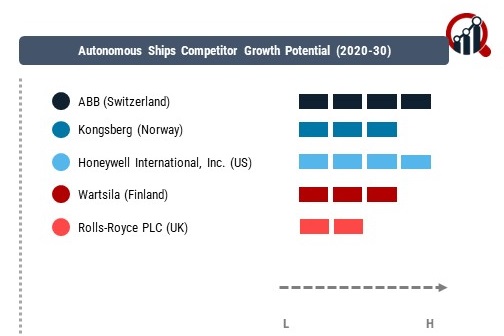

Competitive Landscape

ABB (Switzerland)

Kongsberg (Norway)

Honeywell International, Inc. (US)

Wartsila (Finland)

Rolls-Royce PLC (UK)

Factors for Market Share Analysis: Several factors influence market share in the Autonomous Ships Market, including:

Technological Differentiation: The performance, reliability, and sophistication of autonomous ship systems, including navigation accuracy, situational awareness, and decision-making capabilities, are critical factors in gaining market share, with companies offering advanced features and innovative solutions leading the market.

Customer Relationships: Strong relationships with shipowners, operators, charterers, and maritime stakeholders are essential for gaining market share, with companies providing comprehensive support, training, and consulting services, as well as demonstrating reliability, responsiveness, and transparency in their operations.

Cost Competitiveness: Competitive pricing, total cost of ownership, and return on investment are key considerations for customers evaluating autonomous ship solutions, with companies offering cost-effective, scalable solutions with clear economic benefits gaining preference and market share.

Regulatory Compliance: Compliance with maritime regulations, safety standards, and international conventions, such as SOLAS (Safety of Life at Sea) and COLREGs (International Regulations for Preventing Collisions at Sea), is critical for gaining market share and securing regulatory approval for autonomous ship operations.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the Autonomous Ships Market, bringing innovative technologies, business models, and market approaches. Some notable new and emerging companies in the market include:

OceanAlpha

Seafloor Systems

L3Harris ASV

Boston Dynamics

Sea Machines Robotics, Inc.

Zycraft

Metal Shark

Deep Ocean Engineering

Liquid Robotics (a Boeing Company)

AutoNaut

Industry News and Current Investment Trends: Recent developments and investment trends in the Autonomous Ships Market reflect a growing interest in unmanned vessel technology, maritime digitalization, and autonomy-enabled applications. Key highlights include:

Pilot Projects and Demonstrations: Increasing number of pilot projects and demonstrations of autonomous ships in real-world conditions, such as autonomous cargo ships, unmanned surface vessels (USVs) for hydrographic surveying, and remote-controlled vessels for port operations, showcase the potential and feasibility of autonomous shipping.

Regulatory Progress: Advancements in regulatory frameworks and guidelines for autonomous shipping, including IMO (International Maritime Organization) guidelines on Maritime Autonomous Surface Ships (MASS), signal regulatory progress and industry collaboration towards enabling safe and responsible adoption of autonomous vessel technology.

Investment and Funding: Growing investment and funding in autonomous ship startups, technology providers, and research initiatives, including venture capital funding, government grants, and corporate partnerships, indicate increasing confidence and interest in the long-term potential of autonomous shipping.

Overall Competitive Scenario: The Autonomous Ships Market is characterized by intense competition, technological innovation, and regulatory evolution. Established players leverage their expertise, resources, and industry partnerships to maintain market leadership, while new entrants disrupt the market with novel technologies and business models. As the autonomous shipping industry continues to evolve, companies that focus on technology leadership, customer collaboration, and regulatory compliance will position themselves for success in the competitive landscape of the Autonomous Ships Market.

Recent Developments

In 2019, South Korea had gained a major Autonomous Ships Market momentum and announced the launch of a prominent project to develop MASS by 2025. The project that has been announced aims to build vessels with the third level of autonomy as defined by the IMO.

The Korean Ministry of Commerce, followed by the Industry and Energy and the Ministry of Oceans and Fisheries have set up a specific working and professional group and have also, known to have allocated a market sum of USD 132 million to the project.

Sensors, as a part of the market, are expected to play a pivotal role in the rising development of connected and autonomous ships. In 2018, a prominent inclusion of the autonomous ships market - Kongsberg Maritime introduced a new and integrated technology platform for the working of autonomous ships to support the rising degree of situational awareness through the processes of sensor fusion technologies, where the traditional navigation sensors such as radar and sonar are likely to be combined with cameras and lasers.

In 2018, the commercial segment of the market had dominated the market and it is expected to register a higher CAGR during the forecast period that ends in 2028, as well. There has been an increasing demand for reduced operational costs and further, there is the rising use of autonomous ships for seaborne trade is driving the growth of the segment in the market premises.