Market Share

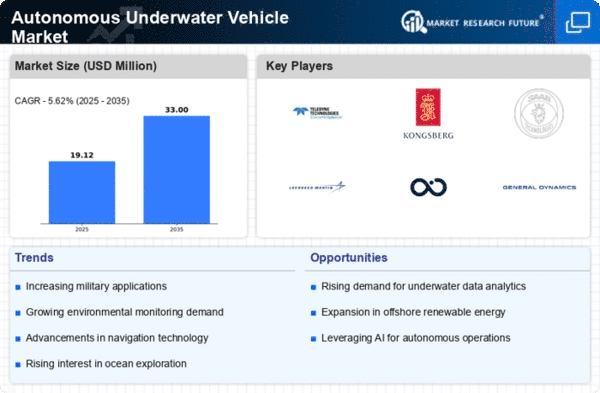

Autonomous Underwater Vehicle Market Share Analysis

AUV industry is a leader in such technologies due to constant innovations in technology and growing interest in software robotized solutions, which are keepers of AUV demand in different industries. In this diversity of the sea domain, market share positioning strategies become crucial to companies seeking to establish their niche and benefit from the unique idiosyncrasies of the marine world. For the AUV segment, critical approaches are established to position and to sustain market share over the industry that is as much as marine research as with the oil and gas sector.

Technology innovation and product differentiation define to AUV market the basic strategies. Companies spend considerably undeniably on research and development to upgrade AUV capably which may include some complex vital features like sensors, navigation, and data processing capabilities. The feature that will make this underwater drone unique is that it will yield a top-notch underwater mapping, surveillance and data collection. The adoption of various forms of technical innovations helps not only in pulling in newer customers but also reinforces brand loyalty and carves out a distinct market share for the companies amidst the cutthroat atmospheres of underwater technology industries.

Low-cost leadership also constitutes another key market positioning approach under AUV markets setting. Due to the large expense factor in nearly all marine research and far-thal exploration businesses, the companies which can work out the most efficient production techniques, lowering production costs and not sacrificing quality will definitely own the market. The development reliable and economical autonomous underwater vehicles technologies gives company a chance to stand above the market competition, as organizations will tend to buy these systems be it big or small organizations.

Collaborative strategy and partnership with various institutions take a critical position in the space market that has to do with AUV. The other imperative is to do the right partnership with the leading scientists and other bodies that are related to the marine like research institutions, government agencies or existing technology providers to utilize their know-how and expand the reach. Collaboration accomplish more than the usual respect among a company's users but in the end also opens avenues for other opportunities and markets. Brand partners join the effort and playing the significant role in the market expansion and competitiveness of the world AUV market.

Additionally, customer-oriented approach and the AUV market at present become the significant issue. The precise needs of clients in sectors such as sea exploration, maritime security or environmental monitoring is a determinant factor and needs to be understood. Organizations committed to customers' feedback, aftersales service with top priority and continuous improvement in their products based on users' experience, develop good name. Satisfied clients have greater chances of keepingoff and repurchasing the autonomous underwater vehicles (AUVs) from the company, and this high level of customer experience will directly reflect in higher market share.

Leave a Comment