Expansion of Poultry Production and Trade

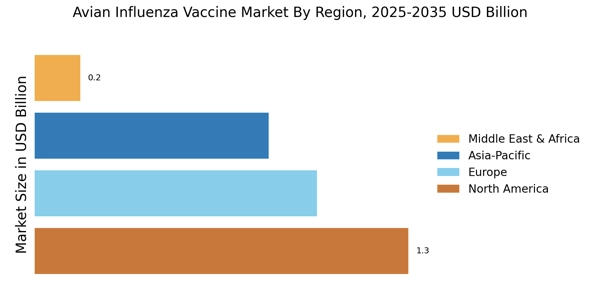

The expansion of poultry production and trade is a critical driver for the Avian Influenza Vaccine Market. As the global demand for poultry products continues to rise, producers are increasingly focused on maintaining healthy flocks to meet consumer needs. This expansion is accompanied by a heightened risk of avian influenza transmission, necessitating robust vaccination programs. Countries with significant poultry industries are investing in vaccination initiatives to protect their livestock and ensure the sustainability of their production systems. The market is expected to grow as producers recognize the importance of vaccination in safeguarding their operations against potential outbreaks, thereby enhancing the overall resilience of the poultry sector.

Rising Incidence of Avian Influenza Outbreaks

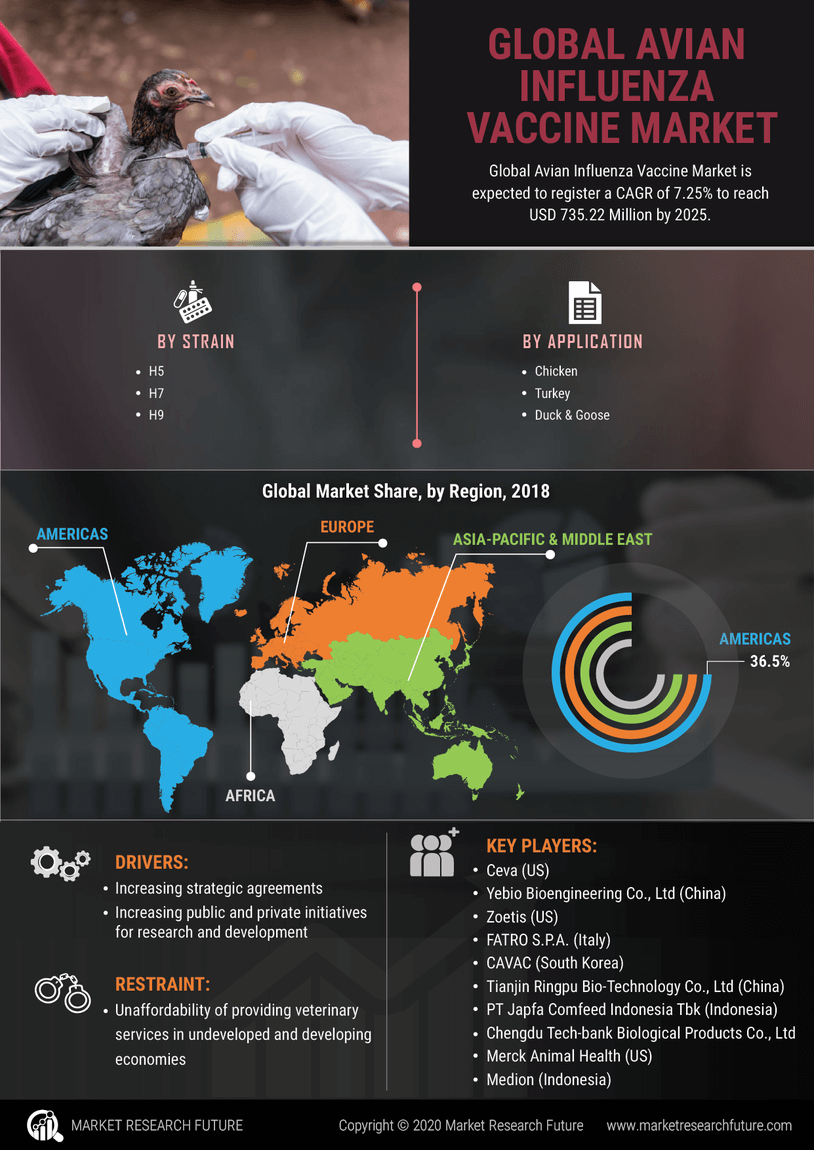

The Avian Influenza Vaccine Market is experiencing heightened demand due to the increasing frequency of avian influenza outbreaks. These outbreaks have been reported in various regions, leading to significant economic losses in the poultry sector. For instance, the World Organization for Animal Health has documented numerous cases of H5N1 and H7N9 strains, which have raised concerns among poultry producers and consumers alike. Consequently, the need for effective vaccination strategies has become paramount. The market is projected to grow as stakeholders seek to mitigate the risks associated with these outbreaks, ensuring the health of poultry populations and the safety of food supplies. This trend indicates a robust market potential for vaccine manufacturers and distributors, as they respond to the urgent need for preventive measures against avian influenza.

Emerging Markets and Increased Poultry Consumption

Emerging markets are playing a pivotal role in shaping the Avian Influenza Vaccine Market, as rising incomes and changing dietary preferences lead to increased poultry consumption. Countries in Asia and Africa are witnessing a surge in poultry demand, prompting local producers to adopt vaccination strategies to protect their flocks from avian influenza. This trend is likely to drive market growth, as vaccine manufacturers seek to establish a presence in these burgeoning markets. Furthermore, the collaboration between governments and private sectors in these regions is fostering an environment conducive to vaccine distribution and accessibility. As a result, the Avian Influenza Vaccine Market is expected to expand, driven by the dual forces of rising consumption and the need for effective disease management.

Growing Awareness of Food Safety and Public Health

The Avian Influenza Vaccine Market is significantly influenced by the rising awareness of food safety and public health concerns. Consumers are becoming more informed about the potential risks associated with avian influenza, leading to increased demand for vaccinated poultry products. This shift in consumer behavior is prompting poultry producers to prioritize vaccination as a means of ensuring the safety of their products. Additionally, regulatory bodies are emphasizing the importance of vaccination programs to prevent the spread of avian influenza, further driving market growth. The intersection of consumer awareness and regulatory pressure is likely to create a favorable environment for vaccine manufacturers, as they strive to meet the growing demand for safe and healthy poultry products.

Increased Investment in Vaccine Research and Development

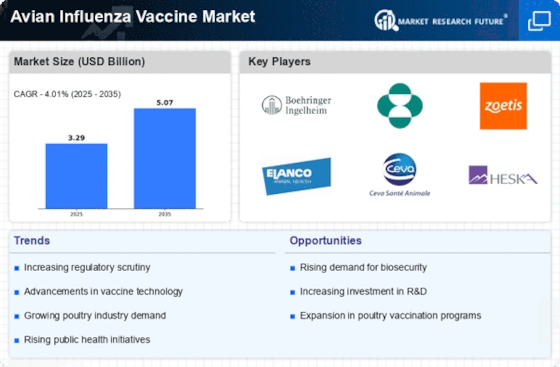

Investment in research and development within the Avian Influenza Vaccine Market is on the rise, driven by the need for innovative and effective vaccines. Governments and private entities are allocating substantial funds to develop new vaccine formulations that can provide broader protection against various strains of avian influenza. This trend is evidenced by the establishment of partnerships between academic institutions and pharmaceutical companies, aimed at accelerating vaccine development. The market is likely to benefit from advancements in vaccine technology, such as recombinant vaccines and adjuvants, which enhance immune responses. As a result, the industry is poised for growth, with an increasing number of products entering the market to address the evolving challenges posed by avian influenza.