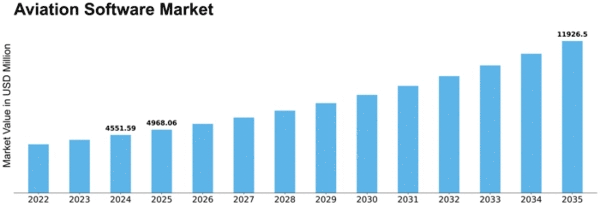

Aviation Software Size

Aviation Software Market Growth Projections and Opportunities

The aviation software market has seen significant growth due to a host of factors that enable effective utilization of software solutions in the aviation field as people become more reliant on such innovation for improved efficiency and safety. One of the key factors contributing to this market is an increasing demand for digitalization across different sectors in aviation operations. From the airlines and airports to ATCs as well as maintenance organizations, aviation software solutions have been on high demand in recent years due to their ability simplify processes and aid decision-making for adhering with changing regulatory standards.

The aviation software market is greatly influenced by technological advancements. Innovations concerning cloud computing, artificial intelligence and data analytics continue to shape the aviation software landscape. Cloud-based solutions allow real time data access and collaboration, ensuring easy communication and coordination between various stakeholders in the aviation community. Advanced aviation software that utilizes artificial intelligence and machine learning algorithms enables predictive maintenance, optimal route planning, safety measures etc. Compliance with regulations has a significant impact under the dynamics of the aviation software market. The aviation industry works under tough regulatory environments to guarantee the safety and security of travelling by air. Aviation software solutions should meet international aviation standards and local regulations, which required to update it frequently in order to adapt them into new requirements. It is essential that software providers can guarantee compliance with all applicable regulations if an environment of trust should be created among airlines, airports and aviation authorities. Market competition and the presence of significant players affect greatly aviation software market. The development and delivery of aviation software solutions are conducted by established software providers as well as emerging technology companies. The presence of intense competition ensures innovation; hence companies invest in research and development to create software that is more user friendly as well feature rich with scalability. Competitive landscape helps determining the pricing strategies and service offerings, creating a wide variety of opportunities for aviation organizations to improve their operational efficiencies. Global economic circumstances also significantly influence the aviation software market. The demand for aviation software solutions is affected by economic conditions such as airline profitability, fleet expansion plans and investment in technology infrastructure.

Leave a Comment