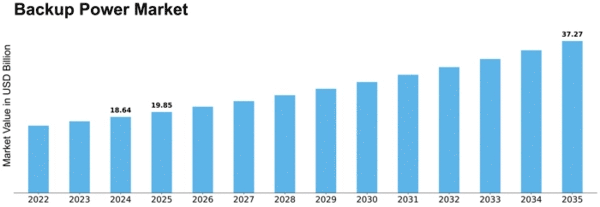

Backup Power Size

Backup Power Market Growth Projections and Opportunities

The Backup Power Market is influenced by a multitude of market factors that shape its dynamics and growth trajectory. One crucial factor is the increasing frequency and severity of power outages across various regions. As our reliance on electronic devices and technology continues to grow, the need for reliable backup power solutions becomes more pronounced. This heightened demand is further fueled by the expanding industrial sector, where uninterrupted power supply is essential for smooth operations.

The increasing consciousness of the need for backup power solutions by businesses and individuals is another notable market factor. Consumers have already become proactive in seeking reliable backup power systems to protect their critical operations and information, given the realization of severe consequences are attached if there would be interruptions concerning supplies of electricity. Awareness solidifies a move away from reactive measures towards proactivity by investing in backup power infrastructure.

The focus on sustainability and environmental conservation at a global level is another factor influencing the Backup Power Market. There is a growing demand of green and renewable energy solutions in the area of backup power due to governments, businesses all across globe placing emphasis on sustainable practices. In addition to addressing environmental issues, this shift towards cleaner alternatives like solar and wind power are also in line with the bigger agenda of turning to renewable sources of energy across the globe.

Backup Power Market is shaped by advances in technology. Back up power systems are improved owing to the perpetual development of technologies for energy storage, such as superior batteries and fuel cells. Not only do these technological innovations improve the efficiency of backup power solutions, but they have also led to more compact and portable options for both consumers with diverse needs.

The Backup Power Market is also greatly influenced by government regulations and policies. Some areas impose rules requiring particular backup power needs for critical infrastructure, healthcare facilities and other vital services. Additionally, governments support market growth by offering incentive programs and subsidies for the implementation of backup power solutions.

Other economic factors such as overall stability of economics affect the Backup Power Market. When the economical condition is favourable, businesses are more likely to invest in backup power systems that will ensure continuous operation of their business and safeguard what they have put as investment. On the other hand, economic slowdowns could result in a more conservative stance where organizations carefully weigh pros and cons of backup power solutions.

The Backup Power Market competitive landscape is affected by issues such as market consolidation, mergers and acquisitions, new entrants etc. With established companies striving to diversify their product offerings and grow further in the market, strategic partnerships and acquisitions become ordinary. At the same time, new entrants introduce novelty and rivalry which create an atmosphere of constant progression in technology.

The increasing prevalence of smart technologies and the Internet of Things (IoT) has a transformative effect on the Backup Power Market. Smart backup power solutions, equipped with remote monitoring and control capabilities, offer enhanced convenience and efficiency. This connectivity allows users to monitor their backup power systems in real-time, receive alerts, and remotely manage power distribution, contributing to a more responsive and user-friendly experience.

Leave a Comment