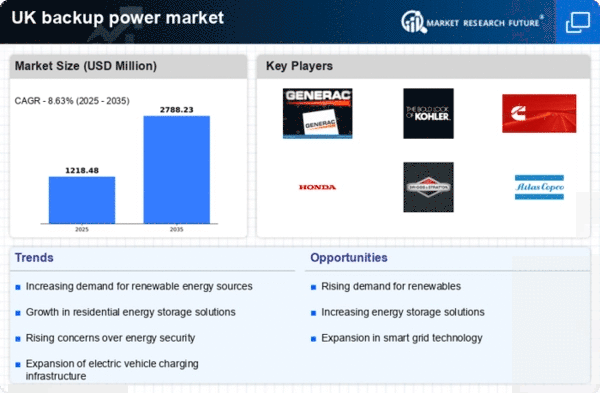

Growing Awareness of Energy Security

In the UK, there is a growing awareness of energy security among consumers and businesses, which is significantly impacting the backup power market. The public's concern regarding energy supply reliability has led to increased investments in backup power solutions. Reports indicate that around 60% of businesses are now prioritizing energy security in their operational strategies. This trend is likely to continue as more entities recognize the importance of having a reliable backup power system in place. The backup power market is thus positioned to benefit from this heightened focus on energy security, as consumers seek to protect their assets and ensure uninterrupted operations.

Increasing Frequency of Power Outages

The backup power market is experiencing growth due to the increasing frequency of power outages in the UK. Factors such as extreme weather events and aging infrastructure contribute to this trend. According to government reports, the number of power outages has risen by approximately 15% over the past five years. This situation compels both residential and commercial sectors to invest in backup power solutions to ensure continuity of operations. The backup power market is thus witnessing heightened demand for generators, uninterruptible power supplies (UPS), and other backup systems. As businesses and households seek to mitigate the risks associated with power disruptions, the market is likely to expand further, driven by the need for reliable energy sources during outages.

Shift Towards Renewable Energy Sources

The transition towards renewable energy sources in the UK is influencing the backup power market. As more households and businesses adopt solar panels and wind turbines, the need for backup power systems becomes increasingly apparent. The intermittent nature of renewable energy necessitates reliable backup solutions to ensure a consistent power supply. The backup power market is adapting to this shift by offering hybrid systems that integrate renewable energy with traditional backup solutions. This trend is expected to grow, with projections indicating that the share of renewable energy in the UK energy mix could reach 50% by 2030. Consequently, the demand for backup power systems that complement renewable sources is likely to rise.

Regulatory Incentives for Backup Power Solutions

The UK government is implementing regulatory incentives to promote the adoption of backup power solutions, which is positively impacting the backup power market. Initiatives such as tax breaks and grants for energy-efficient systems encourage businesses and homeowners to invest in backup power technologies. Recent data suggests that approximately 30% of new installations in the backup power market are influenced by these incentives. The backup power market is thus benefiting from a supportive regulatory environment that fosters innovation and investment in energy resilience. As these incentives continue to evolve, they are likely to further stimulate market growth and adoption of advanced backup power systems.

Technological Innovations in Backup Power Systems

Technological innovations are playing a crucial role in shaping the backup power market in the UK. Advances in battery technology, energy management systems, and smart grid solutions are enhancing the efficiency and reliability of backup power systems. The integration of IoT and AI technologies allows for better monitoring and management of energy resources, which is appealing to both consumers and businesses. The backup power market is witnessing a surge in demand for these advanced solutions, as they offer improved performance and cost-effectiveness. As technology continues to evolve, it is expected that the market will see further innovations that enhance the capabilities of backup power systems, making them more attractive to a wider audience.