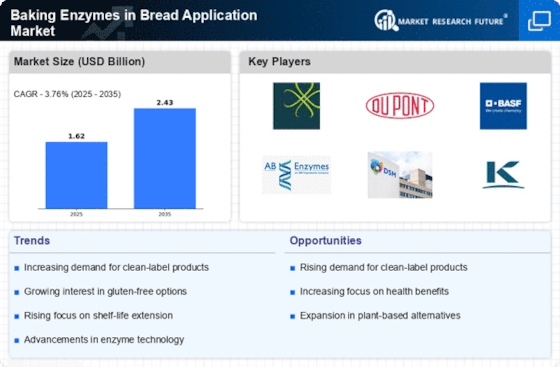

Health and Wellness Focus

The increasing consumer emphasis on health and wellness is a pivotal driver in the baking enzymes in bread application Market. As consumers become more health-conscious, they seek products that are not only nutritious but also free from artificial additives. This trend has led to a rise in demand for clean-label products, which often utilize baking enzymes to enhance nutritional profiles and improve shelf life. According to recent data, the market for clean-label baked goods is projected to grow significantly, with enzymes playing a crucial role in meeting these consumer preferences. The incorporation of enzymes such as amylases and proteases helps in improving the digestibility and nutritional value of bread, thereby aligning with the health trends that consumers prioritize.

Artisanal Bread Popularity

The growing popularity of artisanal bread is reshaping the Baking Enzymes in Bread Application Market. Consumers are increasingly drawn to products that offer unique flavors and textures, which artisanal bread provides. This trend has prompted bakers to explore the use of specialized enzymes that enhance fermentation processes and improve dough handling. The demand for artisanal bread has surged, with market reports indicating a notable increase in sales over the past few years. Enzymes such as xylanases and lipases are being utilized to achieve the desired characteristics in artisanal bread, thus catering to the evolving tastes of consumers. This shift towards artisanal products not only supports local bakers but also drives innovation in enzyme applications, further propelling the market.

Sustainability and Clean Label Trends

Sustainability and clean label trends are increasingly shaping the Baking Enzymes in Bread Application Market. Consumers are becoming more aware of the environmental impact of their food choices, leading to a preference for products that are sustainably sourced and produced. This trend has prompted bakers to seek enzymes that not only improve product quality but also align with sustainability goals. Enzymes derived from natural sources are gaining traction, as they contribute to cleaner ingredient lists and reduced environmental footprints. Market Research Future indicates that the demand for sustainable baking solutions is on the rise, with consumers willing to pay a premium for products that meet these criteria. This shift towards sustainability not only benefits the environment but also enhances brand loyalty among consumers, thereby driving growth in the baking enzyme market.

Technological Advancements in Enzymes

Technological advancements in enzyme production and application are significantly influencing the Baking Enzymes in Bread Application Market. Innovations in biotechnology have led to the development of more efficient and effective enzymes that can be tailored for specific baking needs. These advancements allow for improved performance in dough processing, resulting in better texture, volume, and shelf life of bread products. The market is witnessing a shift towards enzyme formulations that are more sustainable and environmentally friendly, aligning with the increasing regulatory focus on food safety and quality. As a result, the adoption of these advanced enzymes is expected to rise, with market analysts projecting a steady growth trajectory in the coming years. This technological evolution not only enhances product quality but also supports the overall growth of the baking industry.

Rising Demand for Gluten-Free Products

The rising demand for gluten-free products is a significant driver in the Baking Enzymes in Bread Application Market. As awareness of gluten-related disorders increases, more consumers are seeking gluten-free alternatives. This trend has led to a surge in the production of gluten-free bread, which often requires the use of specific enzymes to improve texture and taste. Enzymes such as transglutaminase and amylase are crucial in formulating gluten-free bread, as they help mimic the properties of traditional wheat-based products. Market data indicates that the gluten-free segment is expanding rapidly, with projections suggesting continued growth as more consumers adopt gluten-free diets for health reasons. This shift not only creates opportunities for bakers but also drives innovation in enzyme applications, further enhancing the market landscape.