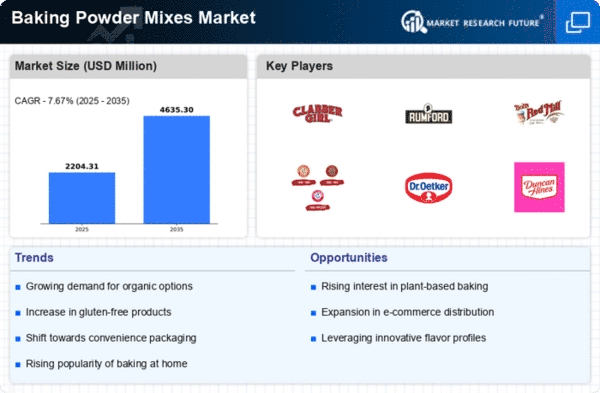

Market Growth Projections

The Global baking powder and mixes Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 3500 USD Million in 2024 and further increase to 5200 USD Million by 2035, the industry demonstrates a promising trajectory. The anticipated CAGR of 3.66% from 2025 to 2035 indicates a steady expansion, driven by various factors including health trends, convenience, and technological advancements. This growth reflects the evolving consumer preferences and the industry's ability to adapt to changing market dynamics.

Health and Wellness Trends

The Global baking powder and mixes Market Industry is significantly influenced by the rising health and wellness trends among consumers. There is an increasing awareness regarding dietary choices, leading to a demand for healthier baking options. This includes gluten-free, organic, and low-sugar baking mixes that align with health-conscious lifestyles. As consumers become more discerning about ingredients, manufacturers are adapting their offerings to include these healthier alternatives. This shift not only caters to a niche market but also broadens the overall consumer base, potentially contributing to the market's growth trajectory towards 5200 USD Million by 2035.

Expansion of Retail Channels

The Global Baking Powder and Mixes Market Industry benefits from the expansion of retail channels, which enhances product accessibility for consumers. The proliferation of supermarkets, hypermarkets, and online platforms facilitates a broader reach for baking products. This increased availability not only caters to traditional consumers but also attracts new demographics, including younger generations who are exploring baking as a hobby. The convenience of online shopping further supports this trend, allowing consumers to purchase a variety of baking powders and mixes from the comfort of their homes. This expansion is likely to contribute to the anticipated growth of the market.

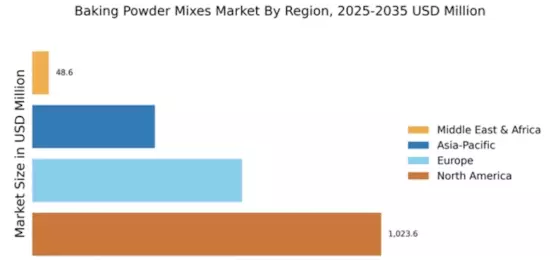

Emerging Markets and Urbanization

The Global Baking Powder and Mixes Market Industry is poised for growth due to urbanization and the emergence of new markets. As urban populations expand, there is a corresponding increase in demand for baking products, driven by changing dietary habits and lifestyles. Emerging economies are witnessing a rise in disposable incomes, leading to greater spending on food products, including baking mixes. This trend is expected to bolster the market, with a projected CAGR of 3.66% from 2025 to 2035. The combination of urbanization and rising incomes creates a fertile ground for the baking powder and mixes sector to flourish.

Rising Demand for Convenience Foods

The Global Baking Powder and Mixes Market Industry experiences a notable surge in demand for convenience foods, driven by changing consumer lifestyles and preferences. As more individuals seek quick and easy meal solutions, the popularity of baking mixes and ready-to-use baking powders increases. This trend is particularly evident in urban areas, where busy schedules lead to a preference for products that save time. The market is projected to reach 3500 USD Million in 2024, reflecting this growing inclination towards convenience. Manufacturers are responding by innovating and diversifying their product lines to cater to this evolving consumer behavior.

Technological Advancements in Production

Technological advancements in production processes are playing a crucial role in shaping the Global Baking Powder and Mixes Market Industry. Innovations in manufacturing techniques enhance product quality, consistency, and shelf life, which are vital for consumer satisfaction. Automation and improved mixing technologies allow for more efficient production, reducing costs and waste. These advancements enable manufacturers to meet the increasing demand for diverse baking products while maintaining high standards. As the industry evolves, these technologies may lead to a more competitive market landscape, fostering growth and innovation in product offerings.