Market Trends

Key Emerging Trends in the Baking Powder Mixes Market

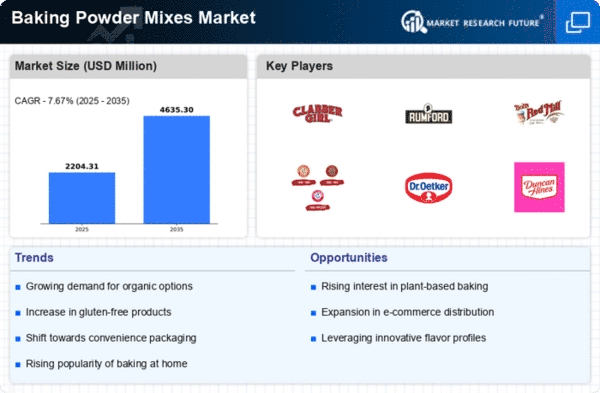

There are several trends in the baking powders and mixes market that reflect the dynamic landscape of consumer preferences, culinary innovation and growing convenience baking. One notable trend is the rise in popularity of gluten-free and allergen-free baking mixes. As more consumers follow a gluten-free diet and seek allergen-free options, manufacturers are introducing baking powders and mixes that meet these nutritional needs. This trend is in line with a broader movement towards wholesome and versatile foods that offer people with food sensitivities or allergies the opportunity to enjoy homemade baked goods. Health conscious options are driving the market and consumers are looking for baking mixes that meet their wellness goals. Manufacturers are responding by introducing healthier formulations that include natural and organic ingredients, reduce sugar content and avoid artificial additives. The demand for baking mixes that provide nutritional value without compromising taste reflects a growing awareness of the impact of nutrition on overall health. Convenience remains a key factor in the baking powder and mix market. Fast-paced lifestyles and the desire for easy-to-prepare baked goods are increasing the demand for low-strength baking mixes. Manufacturers are responding by offering prepackaged mixes with simplified instructions that allow consumers to easily make homemade treats. This trend is for timeless people who value comfort without sacrificing the joy of baking. Plant-based and vegan baking mixes are becoming more popular as consumers adopt a plant-based diet. Manufacturers are developing baking mixes that eliminate animal products while maintaining flavor and texture. This trend includes a growing number of flexiarians, vegetarians and vegans, reflecting a wider shift towards plant-based diets and sustainable food choices. The search for unique and exotic flavors is influencing the market for baking powder and mixes. Consumers are looking for new taste experiences in their baked goods, resulting in baked goods with different flavor profiles. From matcha-infused pastries to lavender-scented baking powders, this trend reflects culinary curiosity and a desire for adventurous flavor combinations in homemade treats.

Leave a Comment