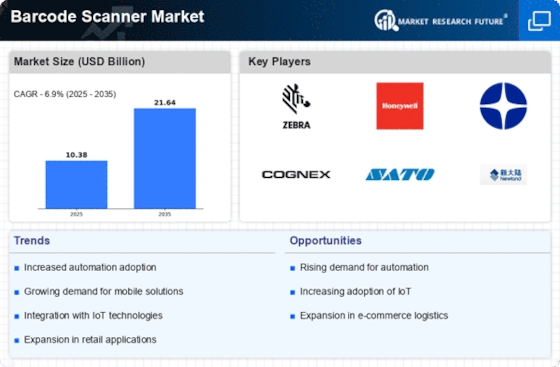

Expansion of E-commerce and Online Retail

The Barcode Scanner Market is significantly influenced by the rapid expansion of e-commerce and online retail. As more consumers turn to online shopping, the need for efficient inventory management and order fulfillment processes becomes critical. Barcode scanners play a vital role in streamlining these operations, enabling businesses to track inventory accurately and expedite shipping processes. Recent statistics indicate that e-commerce sales have seen substantial growth, leading to increased investments in logistics and supply chain technologies. This trend necessitates the implementation of advanced barcode scanning solutions to enhance operational efficiency and reduce errors. As a result, the Barcode Scanner Market is poised for growth, driven by the demand for reliable scanning technologies that support the evolving landscape of online retail.

Increasing Demand for Contactless Solutions

The Barcode Scanner Market is witnessing a notable surge in demand for contactless solutions. As businesses strive to enhance customer experiences, the adoption of contactless payment systems and self-checkout solutions is becoming prevalent. This trend is particularly evident in retail and hospitality sectors, where efficiency and safety are paramount. According to recent data, the market for contactless payment solutions is projected to grow significantly, which in turn drives the need for advanced barcode scanning technologies. The integration of contactless barcode scanners not only streamlines transactions but also minimizes physical contact, aligning with consumer preferences for hygiene and convenience. Consequently, this shift towards contactless solutions is likely to propel the Barcode Scanner Market forward, as companies invest in innovative scanning technologies to meet evolving consumer expectations.

Growing Need for Inventory Management Solutions

The Barcode Scanner Market is driven by the growing need for effective inventory management solutions across various sectors. Businesses are increasingly recognizing the importance of accurate inventory tracking to minimize losses and improve operational efficiency. Barcode scanners facilitate real-time inventory management, allowing companies to monitor stock levels and streamline replenishment processes. Recent studies indicate that organizations implementing barcode scanning systems have reported significant reductions in inventory discrepancies and improved order accuracy. This trend is particularly pronounced in industries such as manufacturing, retail, and warehousing, where efficient inventory management is crucial. As a result, the demand for barcode scanning technologies is likely to rise, further propelling the growth of the Barcode Scanner Market as businesses seek to enhance their inventory management capabilities.

Technological Advancements in Scanning Solutions

The Barcode Scanner Market is experiencing a transformation due to technological advancements in scanning solutions. Innovations such as 2D imaging, laser scanning, and mobile scanning applications are enhancing the capabilities of barcode scanners. These advancements enable faster and more accurate data capture, which is essential for various industries, including healthcare, logistics, and retail. The introduction of smart barcode scanners equipped with artificial intelligence and machine learning algorithms is also gaining traction, as they offer improved data analytics and inventory management. Market data suggests that the adoption of these advanced scanning technologies is likely to increase, as businesses seek to optimize their operations and improve customer service. Consequently, the Barcode Scanner Market is expected to benefit from these technological developments, leading to enhanced product offerings and increased market penetration.

Rising Adoption of Automation in Various Industries

The Barcode Scanner Market is benefiting from the rising adoption of automation across various industries. As companies strive to enhance productivity and reduce operational costs, the integration of automated systems is becoming increasingly prevalent. Barcode scanners are integral to these automated processes, enabling seamless data capture and processing. Industries such as manufacturing, logistics, and healthcare are particularly focused on automating their operations to improve efficiency and accuracy. Market analysis indicates that the automation trend is expected to continue, with businesses investing in advanced barcode scanning technologies to support their automation initiatives. This shift towards automation is likely to drive the growth of the Barcode Scanner Market, as organizations seek to leverage technology to optimize their workflows and enhance overall performance.