Growth of the Beverage Industry

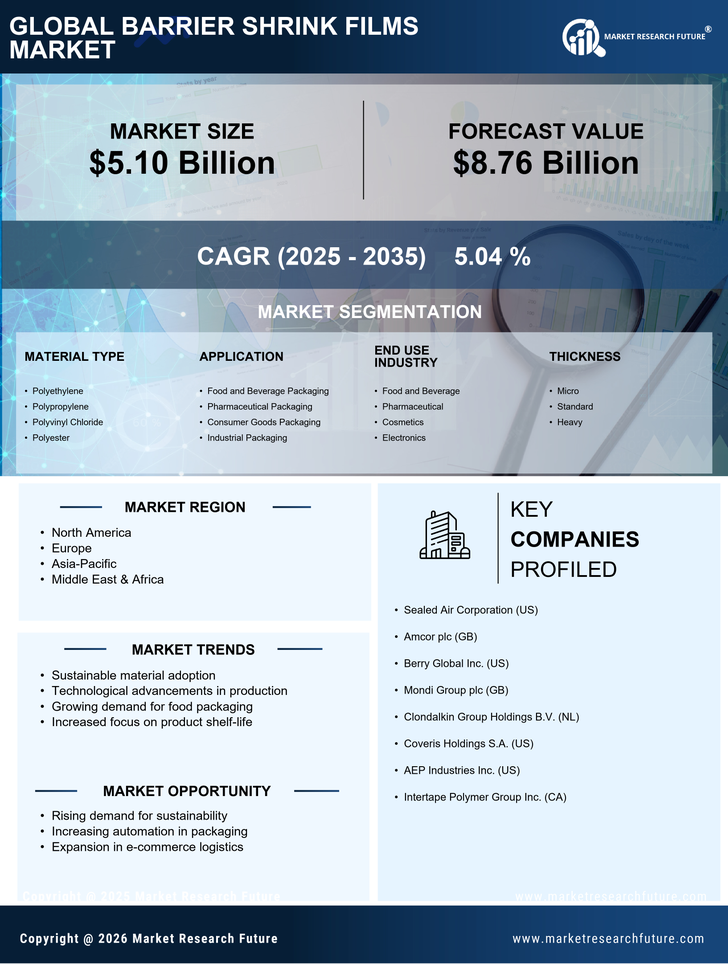

The beverage industry is a significant driver of the Barrier Shrink Films Market, as the demand for innovative packaging solutions continues to rise. With the increasing consumption of bottled and canned beverages, manufacturers are seeking effective ways to enhance product appeal and ensure safety. Barrier shrink films provide an excellent solution by offering tamper-evident features and preserving the quality of the contents. Recent statistics indicate that the beverage packaging segment is anticipated to grow at a rate of approximately 4% per year. This growth is likely to stimulate further investments in barrier shrink film technologies, thereby reinforcing the overall market dynamics.

Rising Demand for Food Packaging

The Barrier Shrink Films Market is experiencing a notable increase in demand for food packaging solutions. This trend is largely driven by the growing consumer preference for convenience and ready-to-eat meals. As per recent data, the food packaging segment is projected to account for a substantial share of the market, with an estimated growth rate of around 5% annually. The need for extended shelf life and protection against moisture and oxygen is pushing manufacturers to adopt advanced barrier shrink films. These films not only enhance product visibility but also ensure food safety, thereby appealing to both manufacturers and consumers. Consequently, the rising demand for food packaging is likely to propel the Barrier Shrink Films Market forward.

Regulatory Compliance and Safety Standards

The Barrier Shrink Films Market is also influenced by stringent regulatory compliance and safety standards imposed on packaging materials. Governments and regulatory bodies are increasingly focusing on ensuring that packaging materials meet specific safety and environmental criteria. This has led to a heightened demand for barrier shrink films that comply with these regulations. Manufacturers are compelled to innovate and adapt their products to meet these standards, which may involve using eco-friendly materials and processes. As a result, the emphasis on regulatory compliance is likely to drive the growth of the Barrier Shrink Films Market, as companies strive to align with evolving legal requirements.

Expansion of Retail and E-commerce Channels

The expansion of retail and e-commerce channels is a pivotal factor driving the Barrier Shrink Films Market. As online shopping continues to gain traction, the need for effective packaging solutions that ensure product integrity during transit has become paramount. Barrier shrink films are increasingly utilized for their ability to provide protection against physical damage and environmental factors. Recent market analyses suggest that the e-commerce sector is expected to grow at a rate of around 6% annually, further fueling the demand for innovative packaging solutions. This trend indicates that the Barrier Shrink Films Market is likely to benefit from the ongoing evolution of retail and e-commerce landscapes.

Technological Advancements in Film Production

Technological innovations in the production of barrier shrink films are significantly influencing the Barrier Shrink Films Market. The introduction of advanced polymer materials and manufacturing techniques has led to the development of films that offer superior barrier properties. For instance, the use of multilayer films has been shown to enhance the protective qualities against environmental factors. Recent advancements suggest that these technologies could reduce production costs while improving film performance. As a result, manufacturers are increasingly investing in research and development to create more efficient and sustainable products. This trend is expected to drive the growth of the Barrier Shrink Films Market as companies seek to meet evolving consumer demands.