Government Initiatives and Incentives

Government initiatives aimed at promoting energy efficiency and reducing emissions are significantly influencing the Batteries For Forklift Market. Various countries are implementing policies that encourage the adoption of electric forklifts and their associated battery technologies. Incentives such as tax breaks, grants, and subsidies for businesses transitioning to electric material handling equipment are becoming more prevalent. These measures not only support environmental goals but also stimulate market growth by making electric forklifts more financially viable for companies. In 2025, the impact of these government initiatives is expected to be profound, as more businesses recognize the long-term cost savings associated with electric forklifts and their batteries. Thus, the Batteries For Forklift Market is likely to experience accelerated growth due to favorable regulatory environments.

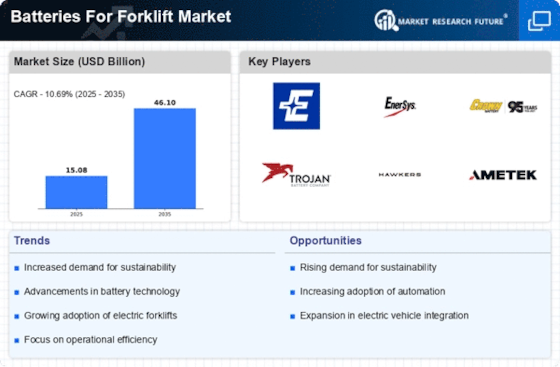

Increasing Demand for Sustainable Solutions

The Batteries For Forklift Market is experiencing a notable shift towards sustainable energy solutions. As businesses increasingly prioritize environmental responsibility, the demand for eco-friendly batteries is on the rise. This trend is driven by regulatory pressures and consumer preferences for greener alternatives. In 2025, the market for lithium-ion batteries, which are favored for their efficiency and lower environmental impact, is projected to grow significantly. Companies are investing in research and development to enhance battery performance while minimizing ecological footprints. This focus on sustainability not only aligns with corporate social responsibility goals but also offers competitive advantages in attracting environmentally conscious clients. As a result, the Batteries For Forklift Market is likely to see a surge in the adoption of sustainable battery technologies.

Rising E-commerce and Warehousing Activities

The surge in e-commerce and warehousing activities is a key driver for the Batteries For Forklift Market. As online shopping continues to gain traction, the demand for efficient material handling solutions has escalated. Forklifts equipped with advanced battery systems are essential for optimizing warehouse operations, ensuring timely deliveries, and managing inventory effectively. In 2025, the market is projected to expand as businesses invest in modernizing their logistics and supply chain operations. The need for reliable and high-performance batteries is paramount in meeting the increasing demands of fast-paced e-commerce environments. Consequently, the Batteries For Forklift Market is likely to benefit from this trend, as companies seek to enhance their operational efficiency through improved battery technologies.

Technological Advancements in Battery Technology

Technological innovations are reshaping the Batteries For Forklift Market, leading to enhanced battery performance and longevity. Recent advancements in battery chemistry, such as solid-state batteries, are expected to revolutionize the industry by offering higher energy densities and faster charging times. In 2025, the market is anticipated to witness a significant increase in the adoption of these advanced technologies, which could potentially reduce operational costs for businesses. Furthermore, the integration of smart technologies, such as battery management systems, allows for real-time monitoring and optimization of battery usage. This not only improves efficiency but also extends the lifespan of batteries, making them a more attractive option for forklift operators. As a result, the Batteries For Forklift Market is poised for substantial growth driven by these technological advancements.

Focus on Operational Efficiency and Cost Reduction

The relentless pursuit of operational efficiency and cost reduction is a driving force in the Batteries For Forklift Market. Companies are increasingly recognizing that investing in advanced battery technologies can lead to significant savings in operational costs. High-performance batteries reduce downtime and maintenance expenses, thereby enhancing productivity. In 2025, the market is expected to see a rise in demand for batteries that offer longer run times and faster charging capabilities. This focus on efficiency is particularly relevant in sectors such as manufacturing and logistics, where time is of the essence. As businesses strive to optimize their operations, the Batteries For Forklift Market is likely to benefit from the growing emphasis on cost-effective and efficient battery solutions.