Growth in Renewable Energy Storage

The expansion of renewable energy sources, such as solar and wind, necessitates efficient energy storage solutions, thereby propelling the Battery Binder Market. As energy storage systems become increasingly vital for balancing supply and demand, the need for reliable battery technologies rises. Reports suggest that the energy storage market is expected to reach a valuation of several billion dollars by the end of the decade. This growth directly correlates with the demand for advanced battery binders that enhance the efficiency and stability of energy storage systems. Manufacturers are investing in research and development to create binders that can improve the overall performance of batteries used in renewable energy applications, thus driving the Battery Binder Market forward.

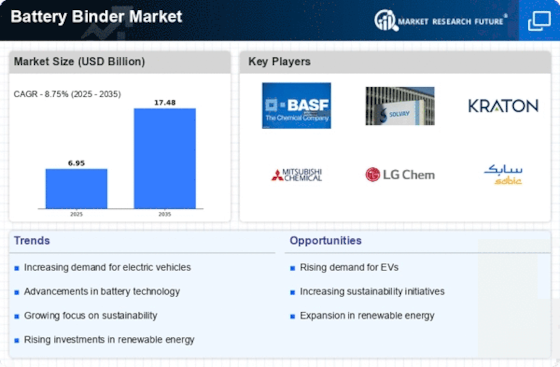

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Battery Binder Market. As consumers and manufacturers shift towards sustainable transportation solutions, the demand for high-performance batteries escalates. This trend is supported by data indicating that the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. Consequently, the need for efficient battery binders, which enhance the performance and longevity of battery cells, becomes critical. Manufacturers are focusing on developing advanced binder materials that can withstand the rigorous demands of EV applications. This shift not only boosts the Battery Binder Market but also encourages innovation in binder formulations to meet the specific requirements of next-generation batteries.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainability are increasingly shaping the Battery Binder Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting the use of eco-friendly materials in battery production. This regulatory support encourages manufacturers to adopt sustainable practices, including the use of bio-based or recyclable binder materials. As a result, the market for battery binders that align with these regulations is expected to expand. Data suggests that the market for sustainable battery materials is projected to grow significantly, reflecting a shift towards environmentally responsible manufacturing processes. This trend not only benefits the Battery Binder Market but also aligns with broader global sustainability goals.

Increasing Investment in Research and Development

The Battery Binder Market is witnessing a surge in investment directed towards research and development initiatives. As competition intensifies, manufacturers are recognizing the importance of innovation in maintaining market relevance. Investments in R&D are focused on developing new binder formulations that enhance battery performance, safety, and longevity. Reports indicate that R&D spending in the battery sector is expected to increase substantially, driven by the need for advanced technologies. This influx of investment is likely to lead to breakthroughs in binder materials, which could revolutionize the Battery Binder Market. As new and improved binders enter the market, they will play a crucial role in meeting the evolving demands of various battery applications.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are significantly influencing the Battery Binder Market. Innovations such as automated production lines and advanced coating techniques are enhancing the efficiency and quality of battery production. Data indicates that The Battery Binder is expected to witness substantial growth, with investments in new technologies reaching unprecedented levels. These innovations not only streamline production but also improve the performance characteristics of battery binders. As manufacturers adopt cutting-edge technologies, the demand for high-quality binders that can meet the evolving standards of battery performance is likely to increase, thereby fostering growth in the Battery Binder Market.

Leave a Comment