Battery Separator Size

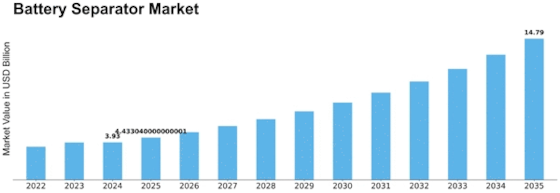

Battery Separator Market Growth Projections and Opportunities

The battery separator market is influenced by several key market factors that shape its growth trajectory. One significant factor is the increasing demand for batteries across various sectors such as automotive, consumer electronics, and energy storage systems. As the global push for electric vehicles (EVs) gains momentum, there is a consequent surge in the demand for lithium-ion batteries, which directly impacts the demand for battery separators. Additionally, the growing adoption of portable electronic devices like smartphones, laptops, and wearable technology further drives the demand for batteries and, consequently, battery separators.

Separator’s role is to electrically insulate the cathode and anode sheets from one another in a battery to prevent short circuit. It is generally made of microporous membrane and coated with materials such as polyolefins and ceramics.

Another crucial market factor is technological advancements in battery separator materials and manufacturing processes. Manufacturers are constantly innovating to develop separators with improved performance characteristics such as higher thermal stability, enhanced mechanical strength, and superior electrolyte wettability. These advancements not only cater to the evolving needs of end-users but also contribute to the overall efficiency and safety of batteries, thereby influencing the purchasing decisions of consumers and businesses.

Moreover, regulatory initiatives aimed at promoting energy efficiency and reducing carbon emissions play a significant role in shaping the battery separator market. Governments worldwide are implementing stringent regulations and standards to encourage the adoption of clean energy technologies, including electric vehicles and renewable energy storage solutions. Compliance with these regulations often necessitates the use of high-quality battery separators that meet specific performance and safety criteria, driving market demand.

Market dynamics such as supply chain disruptions, raw material availability, and pricing fluctuations also impact the battery separator market. The production of battery separators relies on various raw materials, including polymers, ceramics, and metals, whose availability and prices are subject to market forces and geopolitical factors. Fluctuations in raw material prices or disruptions in the supply chain can significantly affect manufacturing costs and, consequently, product pricing and market competitiveness.

Furthermore, the competitive landscape and industry consolidation play a crucial role in shaping market dynamics. The battery separator market is characterized by the presence of several prominent players competing for market share. Intense competition often leads to strategies such as product differentiation, technological innovation, and strategic partnerships to gain a competitive edge. Mergers, acquisitions, and collaborations among key players further influence market dynamics by reshaping the competitive landscape and market concentration.

Consumer preferences and changing market trends also drive innovation and product development in the battery separator market. For instance, the growing preference for electric vehicles with longer driving ranges necessitates the development of high-performance batteries with advanced separator technologies. Similarly, the increasing demand for lightweight and compact electronic devices fuels the need for thinner and more flexible battery separators that offer higher energy density without compromising safety or reliability.

Moreover, macroeconomic factors such as GDP growth, industrialization, and urbanization rates influence the overall demand for batteries and, consequently, battery separators. Emerging economies experiencing rapid urbanization and industrial growth present significant opportunities for market expansion, driven by increased investments in infrastructure development, transportation, and consumer electronics.

Leave a Comment