Research Methodology on Bearing Market

Abstract

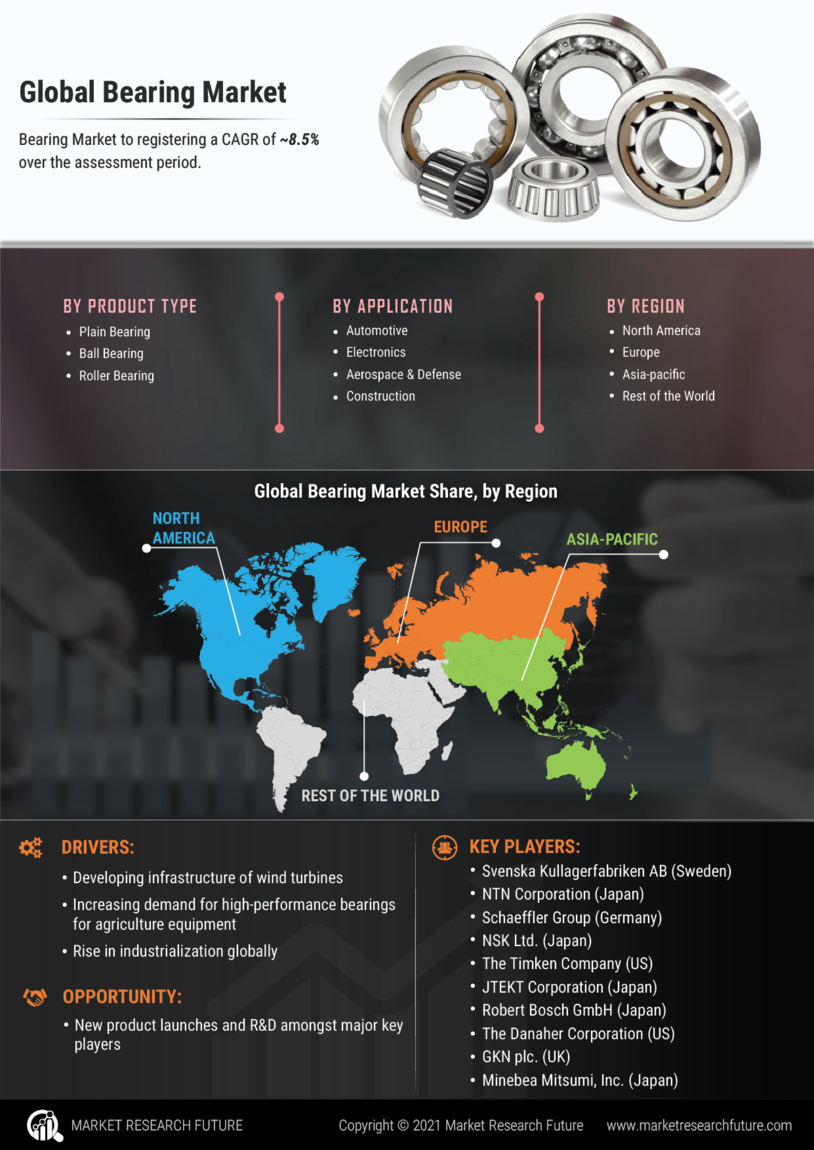

The increasing utilization of machines and automobiles is driving the bearing industry exponentially. The demand for bearings is growing day by day due to their various applications in the automotive, aerospace and industrial sectors. The extensive market research conducted by Market Research Future (MRFR) sheds light on the various factors such as the increasing usage of bearings in off-road vehicles accompanied by rising investments in the renewable energy sector are likely to drive the bearing market. The comprehensive research methodology employed by MRFR enables the compilation of a comprehensive report on the bearing market.

Introduction

The purpose of the study is to understand the significance and impact of bearing in the global market. Bearing is an essential component that is used in machinery, automobile and their components, construction, and many other applications. It acts as an essential part that helps to facilitate the rotational or linear movement in machines. The major drivers for the growth of the bearing market are the increasing demand for electric vehicles, the growing use of bearings in off-road vehicles, rising investments in the renewable energy sector, and the increasing demand for industrial machinery in developing countries. The bearing market is witnessing continuous growth over the forecast period 2023 to 2030, owing to the growing demand for robotic technologies, improving lifestyle, and the growing automotive industry globally.

Objectives

The main purpose of the study is to identify the key trends and driving factors impacting the global bearing market by conducting detailed primary, secondary and qualitative research. It is intended to provide an in-depth understanding of the bearing industry’s potential and to deliver valuable insights into the key players of the bearing industry.

Research Methodology

The research methodology employed in the study revolves around a three-phased process. Firstly, primary research is done on the bearing market which entailed interviews with leading clinicians, market makers, distributors and regulatory experts. The interviews through primary research are conducted to understand the market dynamics, interdependencies and industry-related trends. These interviews are conducted and recorded through an exclusively developed platform. The key stakeholders and participants identified through primary research constituted manufacturers, distributors, and buyers in the bearing industry.

For secondary research, existing research reports from established market intelligence companies and online databases are consulted and deemed as secondary sources. The secondary data is gathered from sources such as Factiva, trade and research journals, industry association publications, SEC filings, company annual reports, and data from the World Bank and International Trade Centre (ITC), and the Investment Commission of China. The various factors such as the current market trends and size, market share and pricing strategy which are difficult to obtain from the primary research are covered in the secondary research phase.

Finally, the qualitative data obtained from the primary and secondary research is verified and validated through a triangulation process. This helps to obtain an objective view of the project. The market size is plotted based on research information obtained from primary and secondary research and industry experts. The data is segregated into technical and non-technical information thereby enabling the carrying out of a comprehensive comparison of primary, secondary and tertiary data sources.

Conclusion

The findings of the study provide a comprehensive overview of the bearing market. It reveals the key drivers, restraints, opportunities and trends that are impacting the market’s growth. The research methodology used in the study helps us to obtain an in-depth understanding of the global bearing market and its potential. The report stands as a valuable source of information for companies wanting to extend their presence in the bearing industry. The study furnishes a detailed view of the market’s competitive landscape as well in terms of various technological and product innovations, and other competitive strategies.