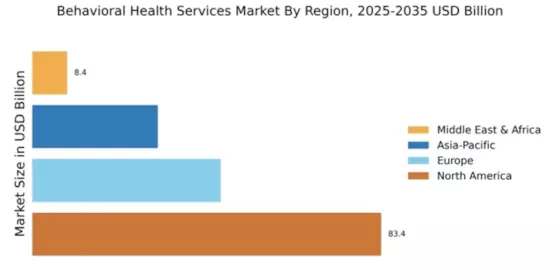

Market Growth Projections

The Global Behavioral Health Services Market Industry is poised for substantial growth, with projections indicating a market size of 137.0 USD Billion in 2024 and an anticipated increase to 250 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.62% from 2025 to 2035. Such figures underscore the increasing recognition of mental health as a critical component of overall health and well-being. As the industry evolves, it is likely to adapt to emerging trends and challenges, ensuring that services remain relevant and effective in meeting the needs of diverse populations.

Government Initiatives and Funding

Government initiatives aimed at improving mental health care access and funding are crucial drivers of the Global Behavioral Health Services Market Industry. Various countries are implementing policies to increase funding for mental health services, recognizing the need for comprehensive care. For instance, increased budget allocations for mental health programs are being observed, which enhances service availability and quality. This proactive approach is likely to stimulate market growth, with a projected compound annual growth rate of 5.62% from 2025 to 2035. Such initiatives not only promote awareness but also encourage the development of innovative treatment options.

Integration of Technology in Behavioral Health

The integration of technology into behavioral health services is transforming the Global Behavioral Health Services Market Industry. Telehealth and digital platforms are increasingly utilized to provide accessible mental health care, particularly in underserved regions. This technological shift not only enhances patient engagement but also streamlines service delivery. As a result, the market is expected to grow significantly, with projections indicating a rise to 250 USD Billion by 2035. The adoption of electronic health records and mobile health applications facilitates better monitoring and management of mental health conditions, thereby improving outcomes and patient satisfaction.

Focus on Preventive Care and Early Intervention

The emphasis on preventive care and early intervention is reshaping the Global Behavioral Health Services Market Industry. There is a growing recognition that addressing mental health issues early can lead to better long-term outcomes and reduced healthcare costs. Programs aimed at prevention and early detection are being implemented, which not only improve individual well-being but also alleviate the burden on healthcare systems. This focus is likely to drive market growth as more resources are allocated to preventive strategies. The industry's evolution towards proactive care models reflects a commitment to enhancing mental health services and outcomes.

Increasing Prevalence of Mental Health Disorders

The rising incidence of mental health disorders globally is a pivotal driver for the Global Behavioral Health Services Market Industry. Reports indicate that approximately 1 in 5 adults experience mental illness each year, leading to an increased demand for behavioral health services. This growing prevalence necessitates enhanced access to treatment and support, contributing to the market's expansion. As the industry adapts to these needs, the market is projected to reach 137.0 USD Billion in 2024, reflecting a significant response to the escalating mental health crisis. The focus on early intervention and comprehensive care models further underscores the importance of addressing these challenges.

Growing Awareness and Acceptance of Mental Health

The increasing awareness and acceptance of mental health issues are significantly influencing the Global Behavioral Health Services Market Industry. Public campaigns and educational programs are fostering a more supportive environment for individuals seeking help. This cultural shift is leading to reduced stigma associated with mental health disorders, encouraging more people to access services. As awareness grows, the demand for behavioral health services is expected to rise, contributing to market growth. The industry is responding to this trend by expanding service offerings and enhancing accessibility, which is vital for meeting the needs of a diverse population.