Advancements in IoT Technology

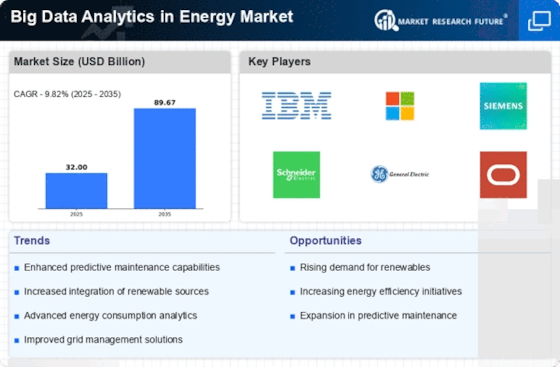

Advancements in Internet of Things (IoT) technology are transforming the Big Data Analytics in Energy Market. The proliferation of smart meters and connected devices generates vast amounts of data that can be analyzed to improve energy management. These technologies enable utilities to gather real-time data on energy consumption, leading to more accurate forecasting and demand response strategies. It is estimated that the number of connected devices in the energy sector will exceed 50 billion by 2030. This surge in data generation necessitates robust analytics capabilities, thereby driving the growth of Big Data solutions tailored for the energy market.

Regulatory Pressures and Compliance

Regulatory pressures and compliance requirements are increasingly influencing the Big Data Analytics in Energy Market. Governments worldwide are implementing stricter regulations aimed at reducing carbon emissions and promoting sustainable practices. These regulations often require utilities to report on their energy usage and emissions, creating a demand for advanced analytics to ensure compliance. The market for analytics solutions is projected to grow as companies seek to meet these regulatory demands efficiently. In fact, compliance-related analytics could account for a substantial portion of the overall analytics market in energy, highlighting the critical role of Big Data in navigating regulatory landscapes.

Consumer Demand for Energy Efficiency

Consumer demand for energy efficiency is a significant driver in the Big Data Analytics in Energy Market. As individuals and businesses become more environmentally conscious, they seek ways to reduce energy consumption and costs. Big Data Analytics provides insights into energy usage patterns, allowing consumers to make informed decisions about their energy consumption. Reports indicate that energy-efficient technologies can reduce energy use by up to 30% in residential settings. This growing awareness and demand for efficiency are likely to stimulate investments in analytics tools that help track and optimize energy usage, thereby enhancing the overall market for Big Data in energy.

Integration of Renewable Energy Sources

The integration of renewable energy sources into existing power grids is a pivotal driver for the Big Data Analytics in Energy Market. As the share of renewables like solar and wind increases, the complexity of managing these resources escalates. Big Data Analytics facilitates real-time monitoring and predictive modeling, enabling utilities to optimize energy distribution and consumption. According to recent data, renewable energy sources accounted for approximately 30% of total electricity generation, a figure that is expected to rise. This transition necessitates advanced analytics to ensure grid stability and efficiency, thereby propelling the demand for Big Data solutions in the energy sector.

Enhanced Grid Management and Reliability

Enhanced grid management and reliability are crucial drivers in the Big Data Analytics in Energy Market. As energy demands fluctuate, utilities must ensure that their grids can handle varying loads without compromising reliability. Big Data Analytics enables utilities to analyze historical and real-time data to predict demand spikes and optimize grid operations. This capability is particularly vital as energy consumption patterns evolve. Studies suggest that implementing advanced analytics can reduce outages by up to 25%, thereby improving service reliability. Consequently, the focus on grid management is likely to propel the adoption of Big Data solutions in the energy sector.