Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Big Data Technology Service Market. With billions of devices generating vast amounts of data, organizations are increasingly seeking solutions to manage and analyze this information effectively. The IoT sector is expected to contribute substantially to the big data landscape, with projections suggesting that the number of connected devices could reach over 75 billion by 2025. This influx of data necessitates advanced big data technologies to process and derive actionable insights, thereby driving market growth. As businesses adapt to this new reality, the demand for big data services tailored to IoT applications is likely to escalate, further solidifying the industry's position.

Rising Demand for Data Analytics

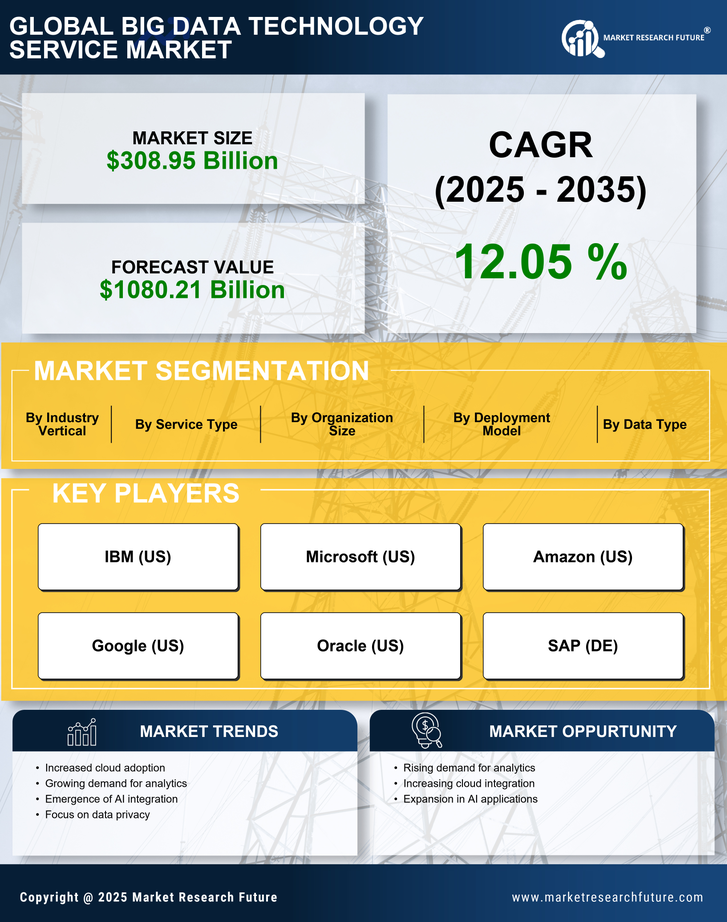

The increasing reliance on data-driven decision-making across various sectors appears to be a primary driver for the Big Data Technology Service Market. Organizations are recognizing the value of analytics in enhancing operational efficiency and customer engagement. According to recent estimates, the analytics segment is projected to grow at a compound annual growth rate of over 25% in the coming years. This surge in demand for data analytics services is compelling businesses to invest in big data technologies, thereby propelling the overall market forward. As companies strive to harness insights from vast datasets, the need for sophisticated big data solutions becomes more pronounced, indicating a robust growth trajectory for the industry.

Increased Investment in Data Security

The rising concerns regarding data security and privacy are driving significant investments in the Big Data Technology Service Market. Organizations are becoming increasingly aware of the potential risks associated with data breaches and are prioritizing the implementation of robust security measures. Recent data indicates that the global spending on cybersecurity is expected to exceed 200 billion dollars by 2025. This heightened focus on data protection is compelling businesses to adopt advanced big data technologies that offer enhanced security features. As regulatory frameworks evolve and compliance becomes more stringent, the demand for secure big data solutions is likely to grow, further propelling the market forward.

Advancements in Machine Learning and AI

The integration of machine learning and artificial intelligence technologies is significantly shaping the Big Data Technology Service Market. These advancements enable organizations to automate data analysis processes, uncover patterns, and make predictions with greater accuracy. The market for AI-driven big data solutions is projected to expand rapidly, with estimates suggesting a growth rate of over 20% annually. As businesses seek to leverage these technologies for enhanced decision-making, the demand for big data services that incorporate machine learning capabilities is likely to increase. This trend not only enhances operational efficiency but also fosters innovation, positioning the industry for sustained growth in the coming years.

Growing Focus on Real-Time Data Processing

The shift towards real-time data processing is emerging as a crucial driver for the Big Data Technology Service Market. Organizations are increasingly recognizing the importance of timely insights for competitive advantage. The ability to analyze data as it is generated allows businesses to respond swiftly to market changes and customer needs. Recent studies indicate that the real-time analytics segment is expected to witness a growth rate exceeding 30% in the next few years. This trend underscores the necessity for robust big data solutions capable of handling high-velocity data streams. As companies prioritize agility and responsiveness, the demand for real-time processing technologies is likely to surge, enhancing the overall market landscape.