Regulatory Frameworks

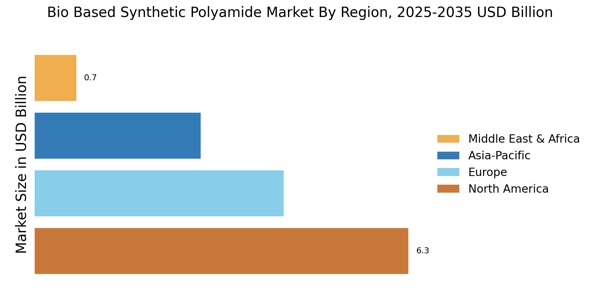

The establishment of supportive regulatory frameworks is a key driver for the Bio Based Synthetic Polyamide Market. Governments worldwide are implementing policies that promote the use of bio based materials, incentivizing manufacturers to transition from conventional to sustainable alternatives. For instance, regulations aimed at reducing carbon emissions and promoting renewable resources are creating a favorable environment for bio based synthetic polyamides. Market data indicates that regions with stringent environmental regulations are experiencing a faster adoption of bio based materials, with growth rates exceeding 10% in some areas. This regulatory support not only encourages innovation but also enhances the market potential for the Bio Based Synthetic Polyamide Market.

Technological Innovations

Technological advancements play a crucial role in shaping the Bio Based Synthetic Polyamide Market. Innovations in production processes, such as the development of more efficient catalysts and fermentation techniques, have significantly improved the yield and quality of bio based synthetic polyamides. These advancements enable manufacturers to produce high-performance materials that meet stringent industry standards. Market data suggests that the introduction of new technologies could enhance production efficiency by up to 30%, thereby reducing costs and increasing competitiveness. As a result, the Bio Based Synthetic Polyamide Market is likely to witness a surge in new entrants and product offerings, further driving market growth.

Sustainability Initiatives

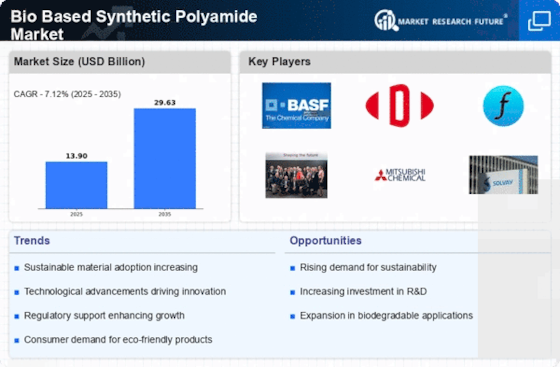

The increasing emphasis on sustainability is a pivotal driver for the Bio Based Synthetic Polyamide Market. As consumers and industries alike become more environmentally conscious, the demand for sustainable materials is surging. Bio based synthetic polyamides, derived from renewable resources, offer a viable alternative to traditional petroleum-based polyamides. This shift is reflected in market data, indicating a projected growth rate of approximately 8% annually in the bio based segment. Companies are investing in sustainable practices, which not only enhance their brand image but also align with global sustainability goals. The Bio Based Synthetic Polyamide Market is thus positioned to benefit from this trend, as manufacturers seek to innovate and develop products that meet the growing demand for eco-friendly materials.

Collaboration and Partnerships

Collaboration and partnerships among stakeholders are emerging as a vital driver for the Bio Based Synthetic Polyamide Market. Companies are increasingly forming alliances with research institutions, universities, and other industry players to foster innovation and accelerate the development of bio based synthetic polyamides. These collaborations facilitate knowledge sharing and resource pooling, which can lead to breakthroughs in material science and production techniques. Market data suggests that partnerships in the bio based sector have increased by 25% in recent years, indicating a growing recognition of the importance of collaborative efforts. As a result, the Bio Based Synthetic Polyamide Market is likely to benefit from enhanced innovation and a more robust supply chain.

Consumer Demand for Eco-Friendly Products

The rising consumer demand for eco-friendly products is significantly influencing the Bio Based Synthetic Polyamide Market. As awareness of environmental issues grows, consumers are increasingly seeking products that are sustainable and have a lower ecological footprint. This trend is evident in various sectors, including textiles, automotive, and packaging, where bio based synthetic polyamides are being adopted as sustainable alternatives. Market data reveals that the demand for eco-friendly materials is expected to increase by 15% over the next five years, driving manufacturers to invest in bio based synthetic polyamide production. Consequently, the Bio Based Synthetic Polyamide Market is likely to expand as companies respond to this shift in consumer preferences.