Top Industry Leaders in the Bio Emulsion Polymers Market

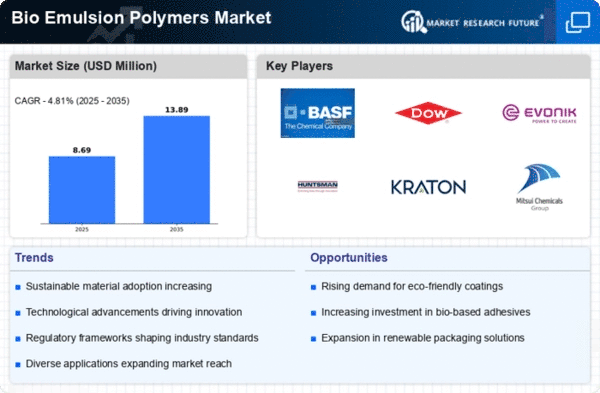

Bio-Emulsion Polymers Market

The bio-emulsion polymers market is steadily rising, driven by the growing demand for sustainable and environmentally friendly alternatives to conventional petrochemical-based polymers. These polymers, derived from renewable resources like vegetable oils and starches, offer numerous advantages, including biodegradability, lower volatility, and reduced dependence on fossil fuels. This has attracted significant interest from various industries, including construction, paints & coatings, adhesives, textiles, and pharmaceuticals.

Market Shares and Strategies:

-

Market Leaders: Renewable Chemicals Company (RCC), Evonik Industries, SEPPIC, DSM, and Roquette hold significant market shares. These companies focus on research & development, expanding product portfolios, and strategic partnerships to maintain their edge. RCC, for instance, recently patented starch nanoparticle (SNP) technology for adhesives, offering superior performance and sustainability. -

Regional Players: Smaller regional players like Tecnaro (UK), Green Bio Polymer (China), and BioAmber (US) are emerging with innovative bio-emulsion polymer solutions targeted to specific applications. Green Bio Polymer, for example, specializes in producing high-performance bio-based latexes for coatings and textiles. -

Sustainability Focus: A key market trend is the focus on maximizing bio-based content in polymers. Some companies, like SEPPIC, offer "100% bio-based" options for coatings and emulsions. Others, like DSM, emphasize life cycle assessments and carbon footprint reduction initiatives.

Factors Influencing Market Share:

-

Product Innovation: Continuously developing new bio-emulsion polymers with improved properties like water resistance, adhesion strength, and flexibility is crucial. Companies like Evonik are investing in biomimetic and nanotechnology research to achieve this. -

Cost Competitiveness: While bio-emulsion polymers offer environmental benefits, their cost can still be higher than traditional options. Reducing production costs through advancements in fermentation technologies and economies of scale will be critical for wider adoption. -

Regulatory Landscape: Increasingly stringent environmental regulations and consumer preference for sustainable products are driving demand for bio-emulsion polymers. Companies that adapt their strategies to comply with regulations and cater to eco-conscious consumers will gain a competitive edge.

List of Key Players in the Bio-Emulsion Polymers Market

- BASF SE (Germany)

- The Lubrizol Corporation (U.S.)

- Clariant (Switzerland)

- Cytec Industries Inc (U.S.)

- DIC CORPORATION (Japan)

- Arkema S.A.(France)

- Nuplex Industries Ltd (Australia)

- Trinseo (U.S.)

- OMNOVA Solutions Inc (U.S.)

- The Dow Chemical Company (U.S.)

Recent Developments:

Sept 2023: SEPPIC expands its Sepilife™ Nude emulsion line with a new variant offering improved water resistance and freeze-thaw stability, catering to the construction and coatings sectors.

Oct 2023: Evonik unveils a bio-based polyol for high-performance polyurethane foams, potentially disrupting the furniture and automotive industries.

Nov 2023: Roquette partners with a leading textile manufacturer to develop sustainable bio-based finishing agents for fabrics, aiming to reduce reliance on petrochemicals.

Dec 2023: The European Union proposes stricter regulations on volatile organic compounds (VOCs) in paints and coatings, further boosting the demand for bio-emulsion polymers as eco-friendly alternatives.