Bio Emulsion Polymers Size

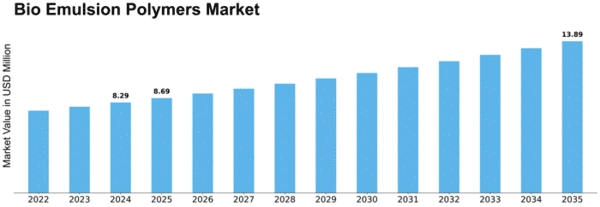

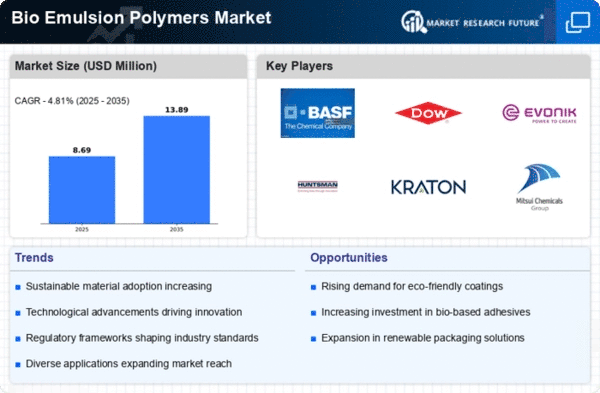

Bio Emulsion Polymers Market Growth Projections and Opportunities

The Bio-Emulsion Polymers Market is influenced by a variety of factors that collectively shape its dynamics. Stakeholders in the industry must grasp these key elements to navigate the market successfully and make informed decisions. Here's an exploration of the primary market factors in a concise, pointer format:

Growing Environmental Awareness: The shift towards sustainable and eco-friendly practices is a significant driver for the Bio-Emulsion Polymers Market. Increasing environmental consciousness among consumers and industries propels the demand for bio-based alternatives over traditional petroleum-based polymers.

Stringent Environmental Regulations: The regulatory landscape plays a pivotal role in the Bio-Emulsion Polymers Market. Stringent environmental regulations, such as restrictions on VOCs (volatile organic compounds) and efforts to reduce carbon footprints, encourage the adoption of bio-emulsion polymers as they often offer lower environmental impact.

End-User Industries: The demand for bio-emulsion polymers is closely linked to end-user industries such as paints and coatings, adhesives, textiles, and construction. Growth or contraction in these industries significantly influences the overall demand for bio-based emulsion polymers.

Renewable Resources: The availability and sustainability of raw materials derived from renewable resources are critical factors for the bio-emulsion polymers market. Manufacturers sourcing bio-based feedstocks contribute to a more sustainable supply chain, aligning with market trends favoring renewable resources.

Technological Advancements: Ongoing advancements in emulsion polymerization technologies contribute to market growth. Innovations in bio-based emulsion polymer formulations, production processes, and performance characteristics enhance the market's competitiveness.

Consumer Demand for Green Products: Increasing consumer awareness and demand for environmentally friendly products drive the market for bio-emulsion polymers. Industries responding to this demand by incorporating sustainable materials into their products gain a competitive edge in the market.

Competitive Pricing: While bio-emulsion polymers are recognized for their environmental benefits, competitive pricing remains crucial. Manufacturers need to balance the cost of production with market demands to ensure that bio-based alternatives are economically viable compared to traditional polymers.

Global Economic Conditions: Economic factors, including GDP growth, industrial output, and consumer spending, impact the demand for bio-emulsion polymers. Economic downturns may affect industrial activities, influencing the market negatively.

Collaborations and Partnerships: Collaborations between industry players and research institutions contribute to technological advancements and market growth. Partnerships in research and development foster innovation in bio-emulsion polymer formulations and expand the range of applications.

Packaging Industry Trends: The packaging industry, with its increasing focus on sustainable and biodegradable materials, is a key driver for bio-emulsion polymers. Bio-based emulsion polymers find applications in eco-friendly packaging materials, responding to changing consumer preferences.

Awareness in the Construction Sector: Bio-emulsion polymers are gaining traction in the construction sector due to their versatility and eco-friendly nature. The construction industry's awareness of sustainable building practices and green certifications drives the adoption of bio-based emulsion polymers in construction materials.

Investments in Research and Development: Companies investing in research and development to improve the performance, durability, and versatility of bio-emulsion polymers position themselves competitively. Innovation in bio-based emulsion polymer technologies is key to meeting evolving market demands.

Leave a Comment