Regulatory Support

Regulatory support is a significant driver for the Biobased Synthetic Polyamides Market. Governments worldwide are implementing policies and incentives to promote the use of renewable materials and reduce reliance on fossil fuels. This regulatory landscape encourages manufacturers to invest in biobased alternatives, as compliance with environmental regulations becomes increasingly stringent. For instance, initiatives aimed at reducing greenhouse gas emissions are likely to bolster the demand for biobased synthetic polyamides. Market data indicates that regions with strong regulatory frameworks are experiencing faster growth in the biobased sector, with projections suggesting a 15% increase in market size over the next five years. Consequently, the Biobased Synthetic Polyamides Market stands to gain from favorable policies that support sustainable practices.

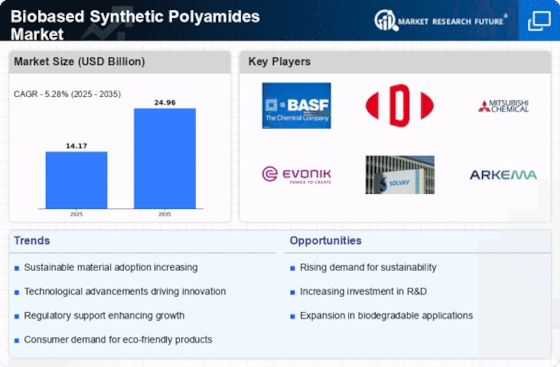

Sustainability Focus

The increasing emphasis on sustainability is a pivotal driver for the Biobased Synthetic Polyamides Market. As consumers and industries alike become more environmentally conscious, the demand for sustainable materials rises. Biobased synthetic polyamides, derived from renewable resources, offer a lower carbon footprint compared to traditional petroleum-based polyamides. This shift is reflected in market data, indicating a projected growth rate of approximately 8% annually in the biobased segment. Companies are increasingly investing in biobased alternatives to meet consumer preferences and regulatory requirements, thereby enhancing their market position. The Biobased Synthetic Polyamides Market is likely to benefit from this trend as manufacturers seek to align their products with sustainability goals, potentially leading to increased market share and profitability.

Technological Advancements

Technological advancements play a crucial role in shaping the Biobased Synthetic Polyamides Market. Innovations in production processes, such as improved fermentation techniques and enzymatic methods, enhance the efficiency and cost-effectiveness of biobased polyamide manufacturing. These advancements not only lower production costs but also improve the quality and performance of the final products. Market data suggests that the introduction of new technologies could lead to a reduction in production time by up to 30%, making biobased synthetic polyamides more competitive against traditional materials. As technology continues to evolve, the Biobased Synthetic Polyamides Market is expected to witness increased adoption rates, driven by the need for high-performance materials in various applications, including textiles, automotive, and packaging.

Versatility in Applications

The versatility of biobased synthetic polyamides across various applications serves as a key driver for the Biobased Synthetic Polyamides Market. These materials are utilized in diverse sectors, including textiles, automotive, and packaging, due to their favorable properties such as durability, flexibility, and resistance to chemicals. The ability to tailor biobased polyamides for specific applications enhances their appeal to manufacturers seeking high-performance materials. Market data suggests that the automotive sector alone is projected to account for over 25% of the biobased synthetic polyamides market by 2026, driven by the need for lightweight and sustainable materials. As industries continue to explore the potential of biobased synthetic polyamides, the market is expected to witness robust growth, reflecting the adaptability and functionality of these materials.

Consumer Demand for Eco-Friendly Products

The rising consumer demand for eco-friendly products significantly influences the Biobased Synthetic Polyamides Market. As awareness of environmental issues grows, consumers are increasingly seeking products that align with their values, including those made from renewable resources. This trend is evident in various sectors, such as fashion and automotive, where brands are prioritizing sustainable materials. Market data indicates that approximately 60% of consumers are willing to pay a premium for eco-friendly products, which is driving manufacturers to incorporate biobased synthetic polyamides into their offerings. The Biobased Synthetic Polyamides Market is likely to expand as companies respond to this demand, potentially leading to innovative product developments and enhanced brand loyalty.