Emergence of Biosimilars

The emergence of biosimilars is reshaping the landscape of the biopharmaceutical industry, presenting both challenges and opportunities. As patents for original biologics expire, the demand for biosimilars is expected to surge, leading to increased competition and reduced costs. The Biopharmaceutical CMO and CRO Market is poised to benefit from this trend, as CMOs and CROs are essential for the development and manufacturing of biosimilars. With the biosimilars market projected to reach over USD 50 billion by 2025, CMOs and CROs are likely to expand their capabilities to accommodate the specific requirements of biosimilar production, thereby driving market growth.

Increased Investment in R&D

Investment in research and development (R&D) within the biopharmaceutical sector is on the rise, as companies seek to innovate and bring new therapies to market. The Biopharmaceutical CMO and CRO Market benefits from this trend, as CMOs and CROs play a crucial role in supporting R&D activities. In recent years, R&D spending has reached unprecedented levels, with estimates suggesting that biopharmaceutical companies allocate over 20% of their revenues to R&D. This influx of funding enables CMOs and CROs to enhance their service offerings, invest in advanced technologies, and expand their capabilities, ultimately driving growth in the market.

Focus on Quality and Compliance

Quality assurance and regulatory compliance are critical components of the biopharmaceutical industry, influencing the operations of CMOs and CROs. The Biopharmaceutical CMO and CRO Market is increasingly characterized by stringent regulatory requirements, necessitating that organizations maintain high standards in their processes. As regulatory bodies emphasize the importance of compliance, CMOs and CROs are investing in quality management systems and training programs to ensure adherence to guidelines. This focus on quality not only mitigates risks but also enhances the reputation of CMOs and CROs, making them more attractive partners for biopharmaceutical companies. The ongoing commitment to quality and compliance is expected to drive growth in the market.

Globalization of Clinical Trials

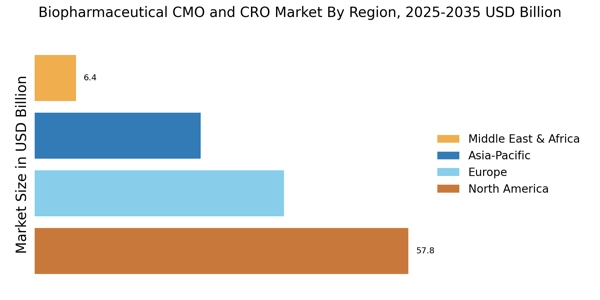

The globalization of clinical trials is a significant driver for the Biopharmaceutical CMO and CRO Market. As biopharmaceutical companies seek to conduct trials in diverse populations, the need for CROs with international reach has become paramount. This trend is reflected in the increasing number of clinical trials being conducted outside traditional markets, with emerging economies offering cost-effective solutions and access to large patient populations. The ability of CROs to navigate regulatory landscapes across different regions enhances their value proposition, making them indispensable partners for biopharmaceutical companies. This globalization trend is likely to continue, further propelling the growth of the market.

Rising Demand for Biopharmaceuticals

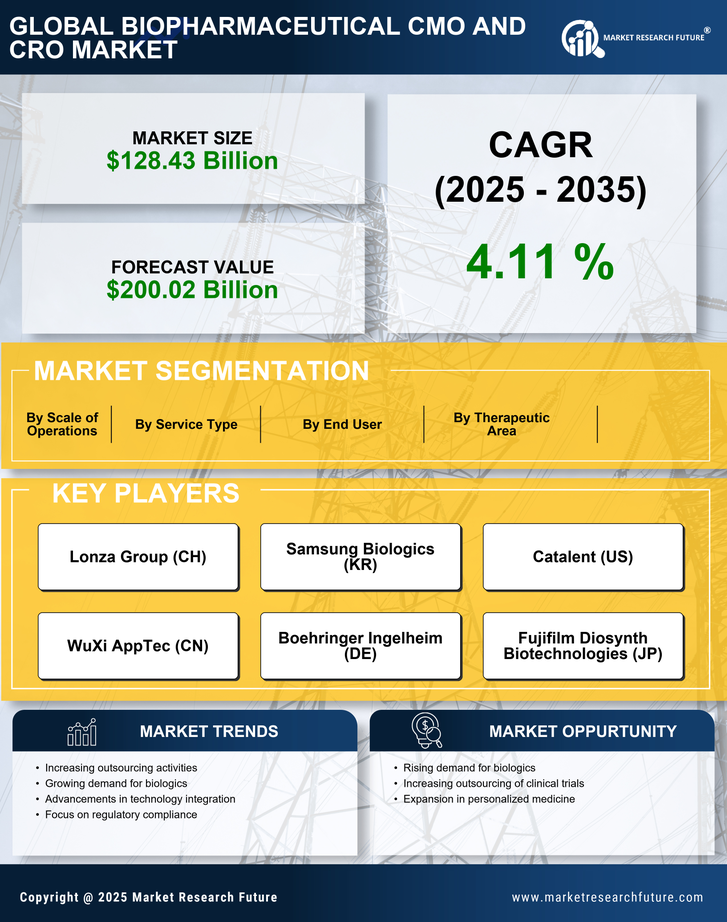

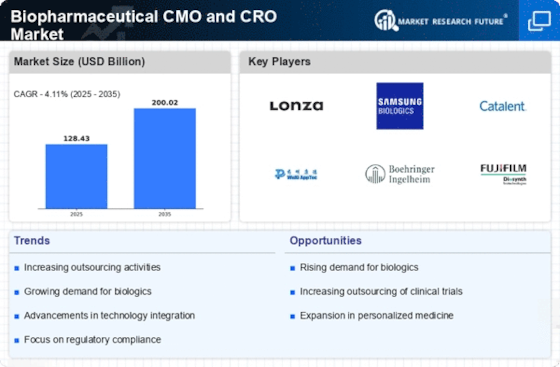

The increasing prevalence of chronic diseases and the aging population are driving the demand for biopharmaceuticals. This trend is particularly evident in therapeutic areas such as oncology, autoimmune diseases, and infectious diseases. As a result, the Biopharmaceutical CMO and CRO Market is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of over 8% in the coming years. The need for innovative therapies necessitates collaboration with contract manufacturing organizations (CMOs) and contract research organizations (CROs) to expedite drug development and production processes. This rising demand is likely to enhance the operational capabilities of CMOs and CROs, allowing them to meet the evolving needs of biopharmaceutical companies.