Market Analysis

In-depth Analysis of Biorational Pesticides Market Industry Landscape

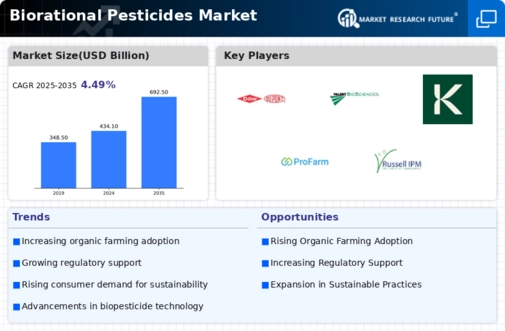

Biorational Pesticides Market Size is significantly influenced by various market factors that collectively shape its growth and prominence in modern agriculture. A key driving force is the increasing global awareness and emphasis on sustainable farming practices. As concerns about environmental impact and human health continue to rise, farmers are turning towards biorational pesticides as a more eco-friendly and targeted alternative to traditional chemical pesticides. This shift is reinforced by the growing demand from consumers for food produced through environmentally responsible means, contributing to the expansion of the biorational pesticides market. The research on Biorational Pesticides Market size indicates a growth rate of 4.49% in the forecast period from 2021 to 2028. It is anticipated to reach a value of USD 555.97 billion by 2028. Government regulations and policies play a pivotal role in shaping the Biorational Pesticides Market Size. Regulatory bodies worldwide are implementing stringent measures to control the use of chemical pesticides due to their adverse effects on ecosystems and human health. The favorable regulatory environment for biorational pesticides, which are often considered safer and more environmentally friendly, acts as a catalyst for market growth. Incentives and support programs encouraging the adoption of biorational pesticides further contribute to their increased acceptance among farmers.

The escalating global population and the subsequent demand for food security are critical factors driving the adoption of biorational pesticides. As traditional agricultural practices face challenges such as pest resistance and environmental concerns, biorational pesticides offer a sustainable solution. Their eco-friendly nature, coupled with effective pest management, makes them an attractive option for farmers aiming to boost yields without compromising long-term environmental health.

Advancements in biotechnology and research contribute to the innovation within the Biorational Pesticides Market. Ongoing efforts in the development of new strains of biorational pesticides, their optimization, and the discovery of novel mechanisms for pest control enhance the effectiveness and versatility of these products. These innovations keep the market dynamic, offering farmers a range of biorational pesticide options tailored to specific crops and pest challenges.

Economic considerations, such as the cost-effectiveness of biorational pesticides, influence their adoption rates among farmers. While initial costs may sometimes be higher compared to traditional chemical pesticides, the long-term benefits, including sustainable pest management and reduced environmental impact, make biorational pesticides economically viable. Economic stability and the availability of financial support further contribute to the market's growth.

The ongoing global emphasis on integrated pest management (IPM) practices also plays a crucial role in the Biorational Pesticides Market. Integrated pest management focuses on a holistic approach that combines various pest control methods, including the use of biorational pesticides. As IPM gains recognition as a sustainable and effective pest management strategy, the demand for biorational pesticides is expected to increase, fostering market expansion.

Environmental sustainability and consumer preferences for organic products contribute to the market's growth. Biorational pesticides align with the principles of organic farming, as they are derived from natural sources and have minimal impact on non-target organisms. As consumers increasingly seek organic and sustainably produced food, the demand for crops treated with biorational pesticides rises, creating a positive feedback loop for market expansion.

Collaborations and partnerships within the agricultural industry are essential factors shaping the Biorational Pesticides Market. Collaborative efforts between research institutions, agricultural input suppliers, and farmers facilitate the development, testing, and adoption of biorational pesticides. These partnerships contribute to the dissemination of knowledge, ensuring that farmers are well-informed about the benefits and proper application of these products.

Leave a Comment