-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TYPE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- GROWTH OF THE FOODSERVICE INDUSTRY SUPPORTING ELEVATED SALES OF BLENDERS

- INCREASING DEMAND FOR INNOVATIVE KITCHEN APPLIANCES AMONG CONSUMERS

-

RESTRAINTS

- CHALLENGES IN DISTRIBUTION IMPACTING AVAILABILITY IN REMOTE AREAS

- LIMITED CONSUMER AWARENESS REGARDING THE ADVANTAGES OF HIGH-END BLENDERS

-

OPPORTUNITY

- EXPANSION OF E-COMMERCE PLATFORMS OFFERING GREATER ACCESSIBILITY TO BLENDERS

- GROWING TREND OF MEAL PREP AND SMOOTHIE CULTURE CREATING NEW CUSTOMER SEGMENTS

-

MARKET FACTOR ANALYSIS

-

PORTER'S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

IMPACT OF COVID-19 ON THE GLOBAL BLENDERS MARKET

-

GLOBAL BLENDERS MARKET, BY PRODUCT TYPE (USD MILLION), 4019-4035

-

OVERVIEW

-

COUNTERTOP BLENDERS

-

PERSONAL AND PORTABLE BLENDERS

-

IMMERSION AND HAND BLENDERS

-

COMMERCIAL AND HEAVY-DUTY BLENDERS

-

GLOBAL BLENDERS MARKET, BY POWER RATING

-

OVERVIEW

-

UP TO 300 WATTS

-

300–600 WATTS

-

600–900 WATTS

-

ABOVE 900 WATTS

-

GLOBAL BLENDERS MARKET, BY MATERIAL

-

OVERVIEW

-

PLASTIC

-

GLASS

-

STAINLESS STEEL

-

GLOBAL BLENDERS MARKET, BY PRICING RANGE

-

OVERVIEW

-

• MASS (LESS THAN $60, MID ($60–$150)

-

• PREMIUM ($150–$350)

-

• HIGH-END ($350–$700 AND ABOVE)

-

GLOBAL BLENDERS MARKET, BY END USER

-

OVERVIEW

-

• CONSUMER OR PERSONAL

-

• PROFESSIONAL OR COMMERCIAL

-

FOODSERVICE

-

SMOOTHIE SHOPS

-

QSR

-

CAFÉS

-

• HOSPITALITY,

-

GLOBAL BLENDERS MARKE, DISTRIBUTION CHANNEL

-

• BRICK-AND-MORTAR RETAIL

-

• SPECIALTY OR KITCHEN STORES

-

• ONLINE OR E-COMMERCE

-

• DIRECT-TO-CONSUMER (DTC)

-

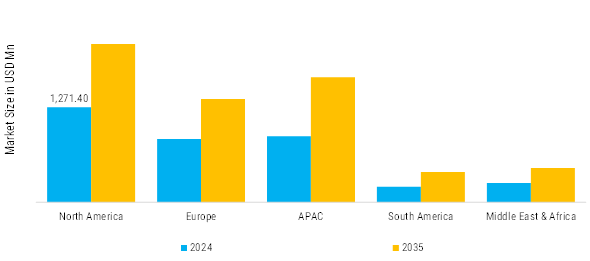

GLOBAL BLENDERS MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

-

EUROPE

- GERMANY

- FRANCE

- UK

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- MALAYSIA

- THAILAND

- INDONESIA

- REST OF ASIA-PACIFIC

-

SOUTH AMERICA

- BRAZIL

- MEXICO

- ARGENTINA

- REST OF SOUTH AMERICA

-

MIDDLE EAST AND AFRICA

- GCC COUNTRIES

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

MARKET SHARE ANALYSIS, 4044

-

COMPETITOR DASHBOARD

-

PUBLIC PLAYERS STOCK SUMMARY

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT LAUNCH

- PARTNERSHIP

- RECOGNITION

- ACQUISITION

- INTEGRATION

- STRATEGIC INNOVATION

-

COMPANY PROFILES

-

SHARKNINJA / NINJA

-

PHILIPS (VERSUNI)

-

KITCHENAID (WHIRLPOOL)

-

HAMILTON BEACH

-

VITAMIX

-

CUISINART (CONAIR)

-

DATA CITATIONS

-

LIST OF TABLES

-

FIGURE 1: GLOBAL BLENDERS MARKET SIZE, 2019-2035, USD MILLION

-

FIGURE 2: GLOBAL BLENDERS MARKET, Y-O-Y GROWTH ANALYSIS 2020-35 (%)

-

FIGURE 3: GLOBAL BLENDERS MARKET, BY REGION, MARKET SHARE 2024 (%)

-

FIGURE 4: GLOBAL BLENDERS MARKET SHARE, BY PRODUCT TYPE, 2024 (%)

-

FIGURE 5: GLOBAL BLENDERS MARKET SHARE, BY POWER RATING, 2024 (%)

-

FIGURE 6: GLOBAL BLENDERS MARKET SHARE, BY MATERIAL, 2024 (%)

-

FIGURE 7: GLOBAL BLENDERS MARKET SHARE, BY PRICE RANGE, 2024 (%)

-

FIGURE 8: GLOBAL BLENDERS MARKET SHARE, BY END USER , 2024 (%)

-

FIGURE 9: GLOBAL BLENDERS MARKET SHARE, BY DISTRIBUTION CHANNEL , 2024 (%)

-

FIGURE 10: GLOBAL BLENDERS MARKET GROWTH FACTOR ANALYSIS (2025-2035)

-

FIGURE 11: GLOBAL BLENDERS MARKET, BY PRODUCT TYPE, 2024 (%)

-

FIGURE 12: GLOBALBLENDERS MARKET, BY POWER RATING, 2024 (%)

-

FIGURE 13: GLOBAL BLENDERS MARKET SHARE, BY MATERIAL, 2024 (%)

-

FIGURE 14: GLOBAL BLENDERS MARKET SHARE, BY PRICE RANGE, 2024 (%)

-

FIGURE 15: GLOBAL BLENDERS MARKET SHARE, BY END USER , 2024 (%)

-

FIGURE 16: GLOBAL BLENDERS MARKET SHARE, BY DISTRIBUTION CHANNEL , 2024 (%)

-

FIGURE 17: GLOBAL BLENDERS MARKET VALUE, BY REGION, 2024 (USD MILLION)

-

FIGURE 18: GLOBAL BLENDERS MARKET SHARE ANALYSIS, BY REGION, 2024 (%)

-

FIGURE 19: NORTH AMERICA BLENDERS MARKET SHARE ANALYSIS, BY COUNTRY, 2024 (%)

-

FIGURE 20: US BLENDERS MARKET SHARE ANALYSIS, BY REGION, 2024 (%)

-

TABLE 1: GLOBAL BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 2: GLOBAL BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 3: GLOBAL BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 4: GLOBAL BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 5: GLOBAL BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 6: GLOBAL BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 7: GLOBAL BLENDERS MARKET, BY REGION, 2019-2035 (USD MILLION)

-

TABLE 8: NORTH AMERICA BLENDERS MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

TABLE 9: NORTH AMERICA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 10: NORTH AMERICA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 11: NORTH AMERICA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 12: NORTH AMERICA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 13: NORTH AMERICA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 14: NORTH AMERICA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 15: US BLENDERS MARKET, BY REGION, 2019-2035 (USD MILLION)

-

TABLE 16: US BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 17: US BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 18: US BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 19: US BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 20: US BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 21: US BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 22: NORTHEAST BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 23: NORTHEAST BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 24: NORTHEAST BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 25: NORTHEAST BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 26: NORTHEAST BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 27: NORTHEAST BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 28: SOUTHWEST BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 29: SOUTHWEST BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 30: SOUTHWEST BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 31: SOUTHWEST BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 32: SOUTHWEST BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 33: SOUTHWEST BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 34: WEST BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 35: WEST BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 36: WEST BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 37: WEST BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 38: WEST BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 39: WEST BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 40: SOUTHEAST BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 41: SOUTHEAST BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 42: SOUTHEAST BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 43: SOUTHEAST BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 44: SOUTHEAST BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 45: SOUTHEAST BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 46: MIDWEST BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 47: MIDWEST BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 48: MIDWEST BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 49: MIDWEST BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 50: MIDWEST BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 51: MIDWEST BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 52: CANADA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 53: CANADA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 54: CANADA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 55: CANADA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 56: CANADA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 57: CANADA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 58: EUROPE BLENDERS MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

TABLE 59: EUROPE BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 60: EUROPE BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 61: EUROPE BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 62: EUROPE BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 63: EUROPE BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 64: EUROPE BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 65: GERMANY BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 66: GERMANY BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 67: GERMANY BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 68: GERMANY BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 69: GERMANY BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 70: GERMANY BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 71: FRANCE BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 72: FRANCE BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 73: FRANCE BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 74: FRANCE BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 75: FRANCE BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 76: FRANCE BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 77: ITALY BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 78: ITALY BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 79: ITALY BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 80: ITALY BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 81: ITALY BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 82: ITALY BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 83: UK BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 84: UK BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 85: UK BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 86: UK BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 87: UK BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 88: UK BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 89: RUSSIA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 90: RUSSIA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 91: RUSSIA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 92: RUSSIA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 93: RUSSIA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 94: RUSSIA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 95: SPAIN BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 96: SPAIN BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 97: SPAIN BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 98: SPAIN BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 99: SPAIN BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 100: SPAIN BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 101: REST OF EUROPE BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 102: REST OF EUROPE BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 103: REST OF EUROPE BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 104: REST OF EUROPE BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 105: REST OF EUROPE BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 106: REST OF EUROPE BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 107: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY COUNTRY,, 2019-2035 (USD MILLION)

-

TABLE 108: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 109: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 110: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 111: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 112: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 113: ASIA-PACIFIC (APAC) BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 114: CHINA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 115: CHINA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 116: CHINA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 117: CHINA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 118: CHINA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 119: CHINA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 120: INDIA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 121: INDIA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 122: INDIA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 123: INDIA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 124: INDIA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 125: INDIA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 126: JAPAN BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 127: JAPAN BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 128: JAPAN BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 129: JAPAN BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 130: JAPAN BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 131: JAPAN BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 132: SOUTH KOREA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 133: SOUTH KOREA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 134: SOUTH KOREA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 135: SOUTH KOREA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 136: SOUTH KOREA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 137: SOUTH KOREA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 138: INDONESIA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 139: INDONESIA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 140: INDONESIA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 141: INDONESIA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 142: INDONESIA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 143: INDONESIA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 144: MALAYSIA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 145: MALAYSIA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 146: MALAYSIA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 147: MALAYSIA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 148: MALAYSIA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 149: MALAYSIA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 150: THAILAND BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 151: THAILAND BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 152: THAILAND BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 153: THAILAND BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 154: THAILAND BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 155: THAILAND BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 156: REST OF APAC BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 157: REST OF APAC BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 158: REST OF APAC BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 159: REST OF APAC BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 160: REST OF APAC BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 161: REST OF APAC BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 162: SOUTH AMERICA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 163: SOUTH AMERICA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 164: SOUTH AMERICA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 165: SOUTH AMERICA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 166: SOUTH AMERICA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 167: SOUTH AMERICA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 168: SOUTH AMERICA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 169: BRAZIL BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 170: BRAZIL BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 171: BRAZIL BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 172: BRAZIL BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 173: BRAZIL BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 174: BRAZIL BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 175: MEXICO BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 176: MEXICO BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 177: MEXICO BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 178: MEXICO BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 179: MEXICO BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 180: MEXICO BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 181: ARGENTINA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 182: ARGENTINA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 183: ARGENTINA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 184: ARGENTINA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 185: ARGENTINA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 186: ARGENTINA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 187: REST OF SOUTH AMERICA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 188: REST OF SOUTH AMERICA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 189: REST OF SOUTH AMERICA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 190: REST OF SOUTH AMERICA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 191: REST OF SOUTH AMERICA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 192: REST OF SOUTH AMERICA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 193: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 194: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 195: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 196: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 197: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 198: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 199: MIDDLE EAST & AFRICA (MEA) BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 200: GCC COUNTRIES BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 201: GCC COUNTRIES BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 202: GCC COUNTRIES BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 203: GCC COUNTRIES BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 204: GCC COUNTRIES BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 205: GCC COUNTRIES BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 206: SOUTH AFRICA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 207: SOUTH AFRICA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 208: SOUTH AFRICA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 209: SOUTH AFRICA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 210: SOUTH AFRICA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 211: SOUTH AFRICA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TABLE 212: REST OF MEA BLENDERS MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TABLE 213: REST OF MEA BLENDERS MARKET, BY POWER RATING, 2019-2035 (USD MILLION)

-

TABLE 214: REST OF MEA BLENDERS MARKET, BY MATERIAL, 2019-2035 (USD MILLION)

-

TABLE 215: REST OF MEA BLENDERS MARKET, BY PRICE RANGE, 2019-2035 (USD MILLION)

-

TABLE 216: REST OF MEA BLENDERS MARKET, BY END USE, 2019-2035 (USD MILLION)

-

TABLE 217: REST OF MEA BLENDERS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

-

LIST OF FIGURES

-

FIGURE 1

-

FIGURE 1: GLOBAL BLENDERS MARKET SIZE, 2019-2035, USD MILLION

-

FIGURE 2: GLOBAL BLENDERS MARKET, Y-O-Y GROWTH ANALYSIS 2020-35 (%)

-

FIGURE 3: GLOBAL BLENDERS MARKET, BY REGION, MARKET SHARE 2024 (%)

-

FIGURE 4: GLOBAL BLENDERS MARKET SHARE, BY PRODUCT TYPE, 2024 (%)

-

FIGURE 5: GLOBAL BLENDERS MARKET SHARE, BY POWER RATING, 2024 (%)

-

FIGURE 6: GLOBAL BLENDERS MARKET SHARE, BY MATERIAL, 2024 (%)

-

FIGURE 7: GLOBAL BLENDERS MARKET SHARE, BY PRICE RANGE, 2024 (%)

-

FIGURE 8: GLOBAL BLENDERS MARKET SHARE, BY END USER , 2024 (%)

-

FIGURE 9: GLOBAL BLENDERS MARKET SHARE, BY DISTRIBUTION CHANNEL , 2024 (%)

-

FIGURE 10: GLOBAL BLENDERS MARKET GROWTH FACTOR ANALYSIS (2025-2035)

-

FIGURE 11: GLOBAL BLENDERS MARKET, BY PRODUCT TYPE, 2024 (%)

-

FIGURE 12: GLOBALBLENDERS MARKET, BY POWER RATING, 2024 (%)

-

FIGURE 13: GLOBAL BLENDERS MARKET SHARE, BY MATERIAL, 2024 (%)

-

FIGURE 14: GLOBAL BLENDERS MARKET SHARE, BY PRICE RANGE, 2024 (%)

-

FIGURE 15: GLOBAL BLENDERS MARKET SHARE, BY END USER , 2024 (%)

-

FIGURE 16: GLOBAL BLENDERS MARKET SHARE, BY DISTRIBUTION CHANNEL , 2024 (%)

-

FIGURE 17: GLOBAL BLENDERS MARKET VALUE, BY REGION, 2024 (USD MILLION)

-

FIGURE 18: GLOBAL BLENDERS MARKET SHARE ANALYSIS, BY REGION, 2024 (%)

-

FIGURE 19: NORTH AMERICA BLENDERS MARKET SHARE ANALYSIS, BY COUNTRY, 2024 (%)

-

FIGURE 20: US BLENDERS MARKET SHARE ANALYSIS, BY REGION, 2024 (%)

-

FIGURE 21: EUROPE BLENDERS MARKET SHARE ANALYSIS, BY COUNTRY, 2024 (%)

-

FIGURE 22: ASIA-PACIFIC BLENDERS MARKET SHARE ANALYSIS, BY COUNTRY, 2024 (%)

-

FIGURE 23: SOUTH AMERICA BLENDERS MARKET SHARE ANALYSIS, BY COUNTRY, 2024 (%)

-

FIGURE 24: MIDDLE EAST AND AFRICA BLENDERS MARKET VALUE, BY COUNTRY, 2024 (USD MILLION)

-

FIGURE 25: MARKET SHARE ANALYSIS, 2024

-

FIGURE 26: COMPETITOR DASHBOARD: GLOBAL BLENDERS MARKET

-

FIGURE 27: SHARKNINJA / NINJA: SWOT ANALYSIS

-

FIGURE 28: PHILIPS (VERSUNI): SWOT ANALYSIS

-

FIGURE 29: KITCHENAID (WHIRLPOOL): SWOT ANALYSIS

-

FIGURE 30: HAMILTON BEACH: SWOT ANALYSIS

-

FIGURE 31: VITAMIX: SWOT ANALYSIS

-

FIGURE 32: CUISINART (CONAIR): SWOT ANALYSIS

-

FIGURE 33: BREVILLE / SAGE: SWOT ANALYSIS

-

FIGURE 34: PANASONIC: SWOT ANALYSIS

-

FIGURE 35: NUTRIBULLET (CAPITAL BRANDS): SWOT ANALYSIS

-

FIGURE 36: BLENDTEC: SWOT ANALYSIS

Leave a Comment