Research Methodology on Blockchain Technology Market

1. Introduction

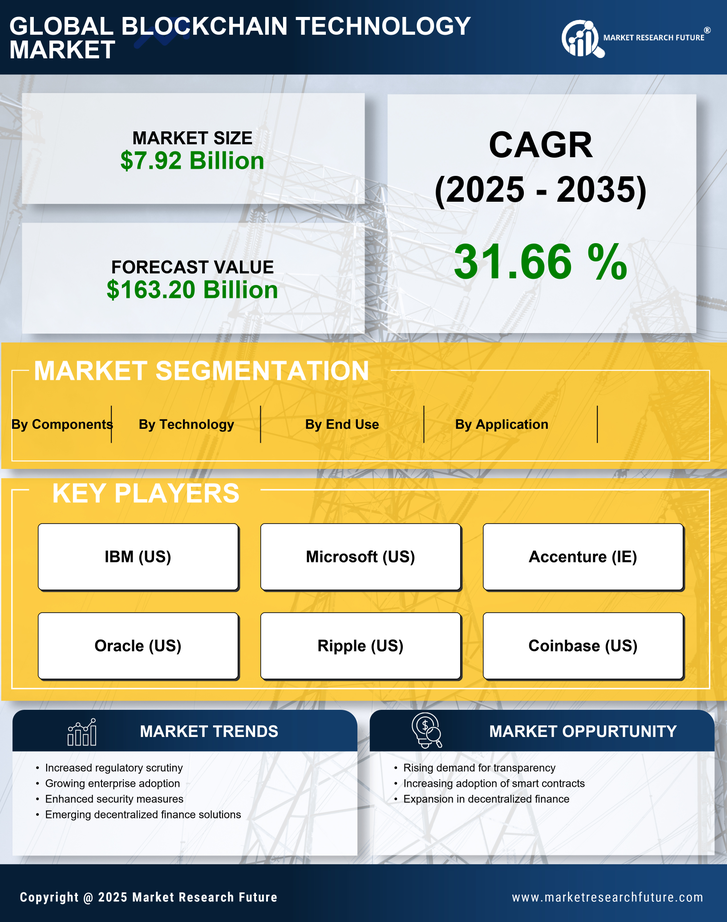

Blockchain technology is a revolutionary technology that promises to revolutionize the way data is stored, accessed, and managed. It is envisioned to revolutionize the way businesses and organizations interact with each other because it provides a secure and tamper-proof system for recording and verifying transactions. Market Research Future (MRFR) has conducted comprehensive research on the global Blockchain Technology Market and provides a detailed overview of the market’s current status and future prospects for the period 2023-2030.

2. Research Objectives

The broad research objective of this report is to analyze the global Blockchain Technology Market over the forecast period of 2023-2030. Specifically, the research aims to:

- Analyze the strategies adopted by the key players in the global Blockchain Technology Market.

- Provide a detailed market assessment of the market, with a focus on the market size and opportunities, constraints, and key trends.

- Examine the macro and microeconomic factors influencing the growth of the global Blockchain Technology Market over the said forecast period.

- Analyse the competitive landscape in terms of technological advancements, pricing trends, and technological R&D investments by the major players.

- Assess the potential of the Blockchain Technology Market in terms of investment strategy, key drivers and restraints, and competitive strategies of the market.

3. Research Methodology

In desirous of understanding the market dynamics and competitive landscape associated with the global Blockchain Technology Market, this study is conducted by employing a combination of both qualitative and quantitative data. Primary and secondary data sources are used to successfully conduct this study.

For primary data collection in this report, surveys, interviews, and corroboration from industry experts were used. Furthermore, top-level executives from key market participants operating in this industry were interviewed and their responses were analysed and verified for accuracy. Secondary data sources for conducting this study were company websites, whitepapers, investor presentations, journals, and online databases.

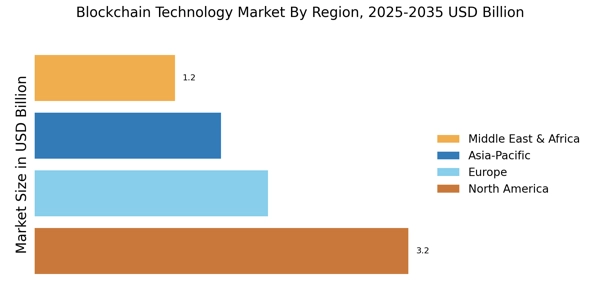

For developing a comprehensive and accurate picture of the current and future market scenario, the global blockchain technology market is segmented based on component, type, application, end-user and region. Moreover, the past and current market trends, developments, and many other factors were also taken into consideration while studying the global Blockchain technology market.

The analysis is conducted using Porter’s Five forces model which is a preferred model for developing a comprehensive analysis of the global Blockchain technology market. This model studies the influence of the collective bargaining power of suppliers, rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, and the threat of market substitutes.

The market attractiveness analysis is conducted and the result is used to understand the degree of competition prevailing in the global Blockchain technology market. Furthermore, the global Blockchain technology market was projected using advanced market models.

4. Research Scope

The report on the global Blockchain Technology Market offers a comprehensive assessment of the prevailing industry and a forecast of the market for the period between 2023 and 2030. The study provides a thorough assessment of traditional and emerging markets for the growth of the global Blockchain Technology Market.

The research covers the current market size of the global Blockchain Technology Market and its growth rates based on 5-year history data. It also covers the various types of segmentation such as by component, by type, by application, by end-user and by region. The study covers a detailed competitive outlook including the market share and company profiles of the key players operating in the global Blockchain Technology Market. The players profiled in the report include IBM, Microsoft, SAP SE, Oracle, Deloitte, Amazon.com, XinFin.org, BigchainDb, BTL Group, BlockCypher and Guardtime.

5. Conclusion

This report provides an in-depth assessment of the global blockchain technology market. It provides an unbiased and detailed analysis of the competitive landscape and the factors that affect this market’s growth path over the upcoming years. The report further provides information about the competitive strategies adopted by leading players in the market along with their regional presence, product portfolios, and recent developments. The report also covers the major trends and developments that shape the market’s future. The report further projects the size and valuation of the market over the forecast period 2023 to 2030.