Enhanced Data Security

Data security remains a paramount concern in the energy sector, and the Blockchain in Energy Utilities Market addresses this issue effectively. By utilizing blockchain technology, energy utilities can secure sensitive data against cyber threats and unauthorized access. The decentralized nature of blockchain ensures that data is not stored in a single location, making it less vulnerable to attacks. Reports indicate that energy companies implementing blockchain solutions have experienced a reduction in data breaches by approximately 40%. This enhanced security not only protects consumer information but also safeguards critical infrastructure. As the energy sector increasingly relies on digital solutions, the demand for secure data management through blockchain is expected to rise, further driving market growth.

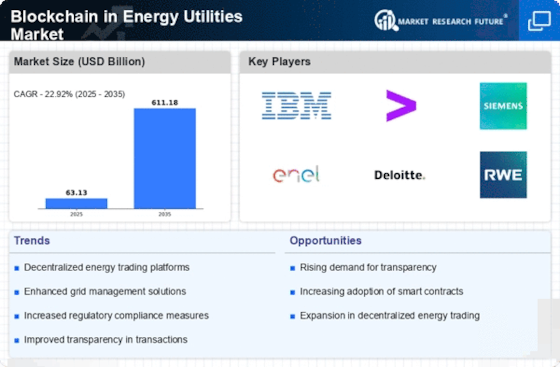

Decentralized Energy Trading

The Blockchain in Energy Utilities Market is witnessing a shift towards decentralized energy trading platforms. These platforms enable peer-to-peer energy transactions, allowing consumers to buy and sell energy directly. This model reduces reliance on traditional utility companies and enhances market efficiency. According to recent studies, decentralized trading could potentially increase market participation by up to 30%, fostering competition and driving down prices. Furthermore, the transparency and traceability offered by blockchain technology ensure that transactions are secure and verifiable, which is crucial for building trust among participants. As more consumers adopt renewable energy sources, the demand for decentralized trading solutions is likely to grow, positioning blockchain as a key enabler in the energy sector.

Integration with Smart Grids

The integration of blockchain technology with smart grids is transforming the Blockchain in Energy Utilities Market. Smart grids facilitate real-time monitoring and management of energy consumption, while blockchain provides a secure and transparent framework for data exchange. This synergy allows for improved demand response and energy distribution, optimizing resource allocation. Market analysis suggests that the adoption of blockchain in smart grids could enhance operational efficiency by up to 25%. Additionally, this integration supports the proliferation of renewable energy sources, as it enables better tracking of energy generation and consumption. As utilities seek to modernize their infrastructure, the combination of blockchain and smart grids is likely to play a pivotal role in shaping the future of energy management.

Increased Consumer Engagement

Consumer engagement is a critical driver in the Blockchain in Energy Utilities Market, as blockchain technology empowers consumers to take control of their energy usage. With the rise of prosumers—individuals who both produce and consume energy—blockchain facilitates direct interactions between consumers and energy providers. This engagement is enhanced through transparent billing systems and real-time data access, allowing consumers to make informed decisions about their energy consumption. Market studies indicate that utilities adopting blockchain solutions have seen a 20% increase in customer satisfaction. As consumers become more environmentally conscious and seek sustainable energy options, the demand for blockchain-enabled solutions that promote engagement and transparency is likely to grow, further propelling market dynamics.

Regulatory Support and Compliance

Regulatory frameworks are evolving to accommodate the Blockchain in Energy Utilities Market, providing a conducive environment for innovation. Governments are increasingly recognizing the potential of blockchain to enhance transparency and accountability in energy transactions. For instance, regulatory bodies in various regions are developing guidelines that encourage the adoption of blockchain solutions for energy trading and grid management. This regulatory support not only fosters trust among stakeholders but also incentivizes investment in blockchain technologies. As compliance with these regulations becomes essential, energy utilities are likely to invest in blockchain solutions to ensure adherence, thereby driving market growth. The alignment of regulatory frameworks with technological advancements is expected to create new opportunities for blockchain in the energy sector.