Enhanced Customer Experience

The Blockchain in Insurance Market is increasingly influenced by the need for improved customer experience. With blockchain technology, insurers can offer personalized products and services based on real-time data analytics. This capability allows for tailored insurance solutions that meet individual customer needs, enhancing satisfaction and loyalty. Furthermore, the speed of transactions facilitated by blockchain can significantly improve the claims experience, as customers can receive payouts more quickly. As customer expectations evolve, the insurance sector's ability to leverage blockchain for a more responsive and personalized service is likely to be a key factor in its growth within the Blockchain in Insurance Market.

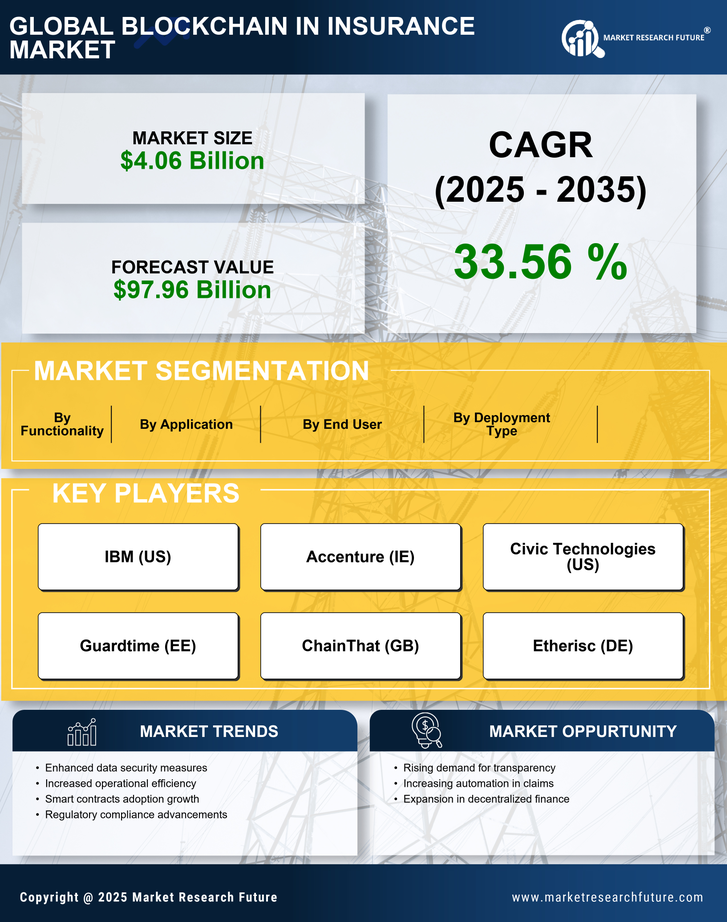

Increased Transparency and Trust

The Blockchain in Insurance Industry appears to be driven by the demand for enhanced transparency and trust among stakeholders. Blockchain technology enables immutable record-keeping, which can significantly reduce fraud and errors in insurance claims processing. According to recent estimates, the implementation of blockchain could reduce claims processing costs by up to 30%. This transparency fosters trust between insurers and policyholders, as all transactions are recorded in a decentralized ledger that is accessible to authorized parties. As consumers become more aware of data privacy issues, the appeal of blockchain's secure and transparent nature is likely to grow, further propelling the Blockchain in Insurance Market.

Collaboration and Ecosystem Development

Collaboration among industry players is emerging as a significant driver in the Blockchain in Insurance Industry. Insurers, technology providers, and regulatory bodies are increasingly forming partnerships to explore blockchain applications. These collaborations can lead to the development of shared platforms that enhance data sharing and interoperability among different stakeholders. By working together, companies can pool resources and expertise, accelerating the innovation process. The establishment of a robust ecosystem around blockchain technology may facilitate its adoption across the insurance sector, thereby driving growth in the Blockchain in Insurance Market.

Regulatory Compliance and Standardization

Regulatory compliance is a crucial driver for the Blockchain in Insurance Market. As governments and regulatory bodies increasingly recognize the potential of blockchain technology, there is a growing push for standardized regulations that govern its use in insurance. This regulatory framework can provide a clear pathway for insurers to adopt blockchain solutions while ensuring consumer protection and data privacy. The establishment of such standards may encourage more companies to invest in blockchain technology, as compliance becomes less of a barrier. Consequently, the alignment of blockchain initiatives with regulatory requirements is likely to foster growth in the Blockchain in Insurance Industry.

Cost Efficiency and Operational Streamlining

Cost efficiency is a pivotal driver in the Blockchain in Insurance Industry. By automating processes through smart contracts, insurers can minimize administrative costs and reduce the time taken for claims processing. Reports indicate that blockchain technology can potentially save the insurance industry billions annually by streamlining operations and reducing the need for intermediaries. The ability to execute transactions automatically when predefined conditions are met eliminates manual errors and accelerates the claims process. As companies seek to enhance their operational efficiency, the adoption of blockchain solutions is likely to increase, thereby driving growth in the Blockchain in Insurance Market.