Rising Demand for Blood Products

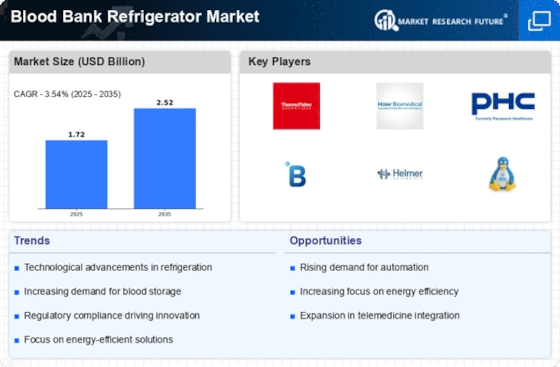

The Blood Bank Refrigerator Market is significantly influenced by the rising demand for blood products. As healthcare systems expand and the need for transfusions increases, blood banks are under pressure to maintain adequate supplies. Recent statistics indicate that blood donation rates have increased by 10% in various regions, necessitating enhanced storage solutions. Blood bank refrigerators play a crucial role in preserving the quality and safety of these products. Consequently, the demand for advanced refrigeration solutions is expected to rise, driving growth in the Blood Bank Refrigerator Market.

Regulatory Compliance and Standards

The Blood Bank Refrigerator Market is shaped by stringent regulatory compliance and standards set by health authorities. These regulations ensure that blood products are stored under specific conditions to prevent contamination and ensure patient safety. Compliance with these standards often requires blood banks to invest in high-quality refrigeration systems that meet or exceed regulatory requirements. As a result, the market for blood bank refrigerators is likely to expand, with an estimated growth rate of 12% anticipated over the next few years. This focus on compliance not only enhances safety but also fosters trust in blood donation and transfusion processes.

Focus on Sustainability and Energy Efficiency

The Blood Bank Refrigerator Market is increasingly focusing on sustainability and energy efficiency. As environmental concerns grow, blood banks are seeking refrigeration solutions that minimize energy consumption and reduce carbon footprints. Manufacturers are responding by developing energy-efficient models that comply with environmental regulations. Recent data indicates that energy-efficient blood bank refrigerators can reduce operational costs by up to 20%. This shift towards sustainable practices is expected to drive innovation and growth within the Blood Bank Refrigerator Market, as stakeholders prioritize eco-friendly solutions.

Increased Investment in Healthcare Infrastructure

The Blood Bank Refrigerator Market is benefiting from increased investment in healthcare infrastructure. Governments and private entities are allocating more resources to enhance healthcare facilities, including blood banks. This investment is crucial for improving the capacity and efficiency of blood storage systems. Recent reports suggest that healthcare spending is projected to grow by 8% annually, which will likely lead to a corresponding increase in the demand for blood bank refrigerators. Enhanced infrastructure not only supports the storage of blood products but also improves overall healthcare delivery, thereby positively impacting the Blood Bank Refrigerator Market.

Technological Advancements in Blood Bank Refrigerators

The Blood Bank Refrigerator Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as smart temperature control systems and IoT integration are enhancing the efficiency and reliability of blood storage. These technologies allow for real-time monitoring and alerts, ensuring that blood products are maintained at optimal temperatures. According to recent data, the adoption of advanced refrigeration systems is projected to increase by approximately 15% over the next five years. This trend not only improves safety but also reduces wastage, thereby supporting the overall growth of the Blood Bank Refrigerator Market.

.png)