Focus on Chronic Disease Management

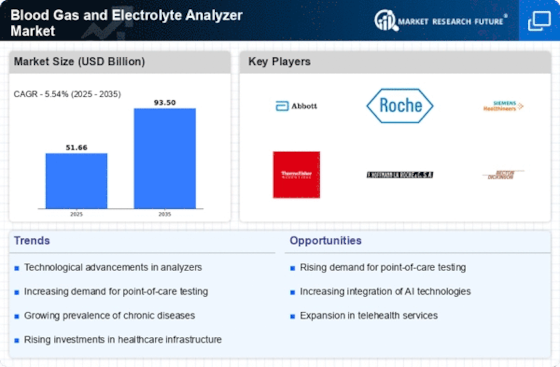

The Blood Gas and Electrolyte Analyzer Market is increasingly aligned with the focus on chronic disease management. As the prevalence of chronic conditions such as diabetes and cardiovascular diseases rises, the need for regular monitoring of blood gases and electrolytes becomes paramount. Healthcare providers are recognizing the importance of these analyzers in managing patient health, leading to a projected market growth of approximately 6% in the coming years. The ability to monitor patients' electrolyte levels and acid-base balance is critical in preventing complications associated with chronic diseases. This trend is prompting manufacturers to innovate and enhance their product offerings, ensuring that they meet the evolving needs of healthcare professionals in the Blood Gas and Electrolyte Analyzer Market.

Rising Demand for Point-of-Care Testing

The Blood Gas and Electrolyte Analyzer Market is witnessing a notable increase in demand for point-of-care testing solutions. This trend is largely attributed to the need for rapid diagnostic results in critical care settings, where timely decision-making is essential. Point-of-care analyzers facilitate immediate testing, allowing healthcare professionals to make informed decisions without delay. The market for point-of-care testing is expected to expand significantly, with estimates suggesting a growth rate of around 8% annually. This shift towards decentralized testing is reshaping the landscape of the Blood Gas and Electrolyte Analyzer Market, as hospitals and clinics seek to enhance patient outcomes through quicker diagnostics. Consequently, manufacturers are focusing on developing user-friendly, portable devices that cater to this growing demand.

Growing Awareness of Preventive Healthcare

The Blood Gas and Electrolyte Analyzer Market is experiencing growth driven by the increasing awareness of preventive healthcare among the population. As individuals become more proactive about their health, there is a rising demand for regular health check-ups and monitoring of vital parameters. This trend is leading to a greater emphasis on the use of blood gas and electrolyte analyzers in routine screenings. Market analysts project a growth rate of approximately 7% in the coming years, as healthcare providers respond to this demand by integrating these analyzers into their services. The focus on preventive healthcare is reshaping the Blood Gas and Electrolyte Analyzer Market, encouraging manufacturers to develop more accessible and efficient testing solutions.

Increasing Investment in Healthcare Infrastructure

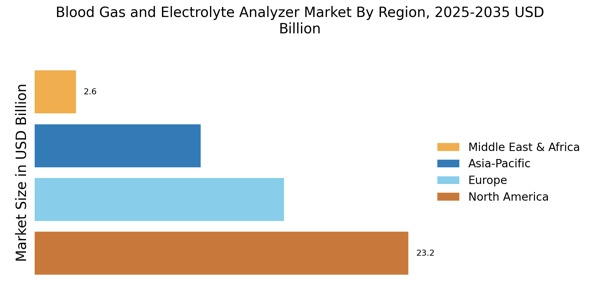

The Blood Gas and Electrolyte Analyzer Market is benefiting from increasing investments in healthcare infrastructure across various regions. Governments and private entities are allocating substantial resources to enhance laboratory capabilities and improve diagnostic services. This investment is particularly evident in emerging markets, where the establishment of new healthcare facilities is on the rise. As a result, the demand for advanced blood gas and electrolyte analyzers is expected to grow, with projections indicating a market expansion of around 5% annually. Enhanced healthcare infrastructure not only facilitates better access to diagnostic services but also encourages the adoption of innovative technologies in the Blood Gas and Electrolyte Analyzer Market, ultimately improving patient care.

Technological Advancements in Blood Gas and Electrolyte Analyzers

The Blood Gas and Electrolyte Analyzer Market is experiencing a surge in technological advancements, which are enhancing the accuracy and efficiency of diagnostic processes. Innovations such as miniaturization of devices and integration of artificial intelligence are streamlining operations in clinical settings. For instance, the introduction of portable analyzers allows for rapid testing in emergency situations, significantly reducing turnaround times. Furthermore, advancements in sensor technology are improving the precision of electrolyte measurements, which is crucial for patient management. The market is projected to grow at a compound annual growth rate of approximately 7% over the next few years, driven by these technological innovations. As healthcare providers increasingly adopt these advanced systems, the Blood Gas and Electrolyte Analyzer Market is likely to witness substantial growth.