Rising Awareness of Blood Donation

Rising awareness regarding the importance of blood donation is significantly influencing the Blood Processing Device and Consumables Market. Campaigns aimed at educating the public about the critical need for blood donations are fostering a culture of altruism. This increased awareness is leading to higher donation rates, which in turn drives the demand for efficient blood processing devices. Organizations are investing in modernizing their blood collection and processing facilities to accommodate the growing influx of donations. Consequently, this trend is expected to bolster the market, as enhanced processing capabilities are required to manage the increased volume of blood donations effectively.

Increased Demand for Blood Services

The Blood Processing Device and Consumables Market is witnessing a surge in demand for blood services, driven by various factors including an aging population and rising incidences of chronic diseases. As healthcare systems strive to provide adequate blood supply, the need for efficient blood processing devices becomes paramount. Reports indicate that the demand for blood transfusions is projected to rise by approximately 5% annually, necessitating advancements in processing technologies. This growing demand is prompting manufacturers to innovate and expand their product offerings, thereby contributing to market growth. The interplay between demand for blood services and technological advancements is likely to shape the future landscape of the industry.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical driver in the Blood Processing Device and Consumables Market. Stringent regulations imposed by health authorities ensure that blood processing devices meet safety and efficacy standards. Compliance with these regulations not only enhances product quality but also fosters consumer trust. The increasing emphasis on quality assurance protocols is compelling manufacturers to invest in advanced technologies and training programs. This trend is reflected in the rising number of certifications and accreditations obtained by companies in the sector. As a result, the market is likely to witness a steady growth trajectory, with an estimated increase in market value driven by heightened regulatory scrutiny.

Technological Advancements in Blood Processing

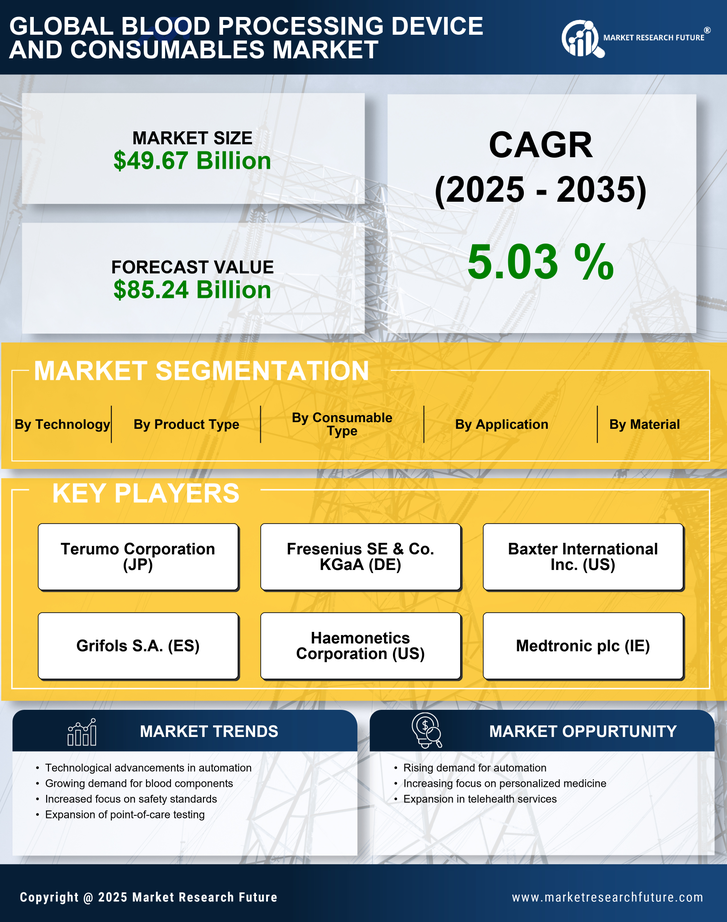

The Blood Processing Device and Consumables Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as automated blood processing systems and advanced separation technologies are enhancing efficiency and accuracy in blood component extraction. For instance, the introduction of point-of-care testing devices is streamlining the diagnostic process, allowing for quicker decision-making in clinical settings. Furthermore, the integration of artificial intelligence in blood processing devices is expected to improve predictive analytics, thereby optimizing inventory management and reducing waste. As these technologies evolve, they are likely to drive market growth, with projections indicating a compound annual growth rate of over 6% in the coming years.

Emerging Markets and Healthcare Infrastructure Development

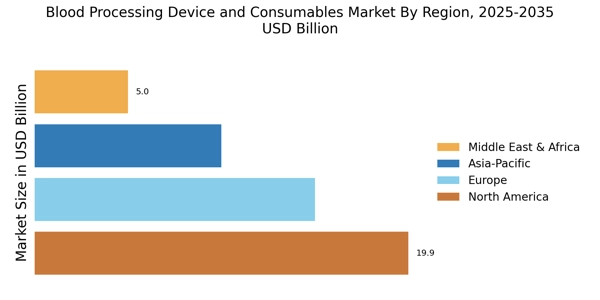

Emerging markets are becoming increasingly pivotal in the Blood Processing Device and Consumables Market. As healthcare infrastructure develops in these regions, there is a corresponding rise in the demand for blood processing technologies. Investments in healthcare facilities and blood banks are expanding access to essential blood services. Furthermore, government initiatives aimed at improving healthcare access are likely to stimulate market growth. The increasing focus on establishing robust healthcare systems in developing regions presents a substantial opportunity for manufacturers. As these markets evolve, they may contribute significantly to the overall expansion of the blood processing device sector.