Bluetooth In Automotive Size

Bluetooth in Automotive Market Growth Projections and Opportunities

The adoption of Bluetooth technology is experiencing a swift ascent within the automotive sector, representing a notable advancement. Widely acknowledged for its integration into features like hands-free calling systems and in-car infotainment, Bluetooth has become a standard inclusion in the equipment of myriad new cars and commercial vehicles.

The Automotive Bluetooth market is being propelled by diverse factors, particularly its escalating integration into car infotainment systems. This integration empowers both passengers and drivers, offering a hands-free calling system and facilitating in-car entertainment. As a testament to its ubiquity, Bluetooth is now considered a standard feature in the equipment of millions of new cars and commercial vehicles.

The burgeoning role of Bluetooth in car infotainment systems stands out as a key catalyst for the Automotive Bluetooth market. This technology opens avenues for drivers and passengers to enjoy music and access information seamlessly while on the road. Once paired with Bluetooth, drivers gain the ability to use applications for navigation, real-time traffic monitoring, perusal of the latest weather reports, and accessing information such as movie schedules and restaurant locations. Collectively, the incorporation of Bluetooth technology significantly enhances the overall driving experience.

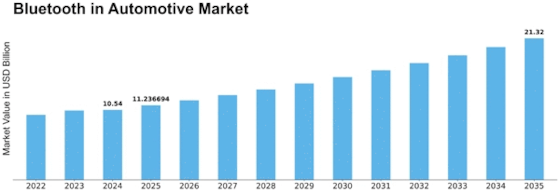

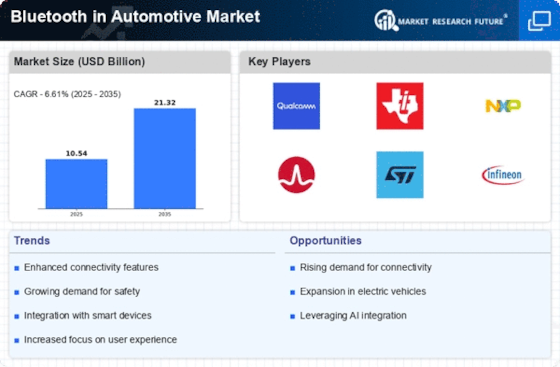

The global Bluetooth in the automotive market is poised for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) of 33.10% during the forecast period. In 2016, the market's dominance was led by the Asia-Pacific region, commanding a substantial share of 40.2%. Following closely were North America and Europe, contributing shares of 28.2% and 21.5%, respectively.

The increasing prevalence of Bluetooth technology in automotive applications underscores its pivotal role in reshaping the driving experience. Beyond being a mere feature, Bluetooth has become an integral component of the modern automotive landscape, providing connectivity and convenience that contribute to a safer and more enjoyable journey for both drivers and passengers alike.

Leave a Comment