Focus on Safety Features

Safety remains a critical concern in the automotive sector, driving the adoption of Bluetooth Low Energy (BLE) in Automotive Market. BLE technology supports various safety features, such as collision detection systems and emergency response applications, which can communicate vital information to drivers and emergency services. The integration of BLE in safety systems is expected to grow, with market analysts estimating that the safety technology segment will account for a significant portion of the automotive market by 2026. This focus on safety not only enhances the driving experience but also aligns with regulatory requirements for advanced safety features, compelling manufacturers to adopt BLE solutions to meet these standards.

Enhanced Vehicle Connectivity

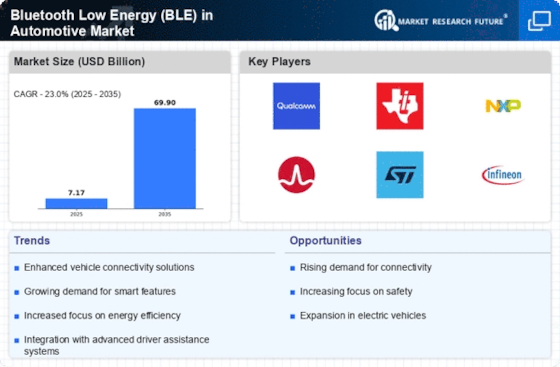

The demand for enhanced vehicle connectivity is a primary driver in the Bluetooth Low Energy (BLE) in Automotive Market. As vehicles become increasingly integrated with smart technologies, the need for seamless communication between devices is paramount. BLE technology facilitates this connectivity by enabling low-power communication between vehicles and smartphones, wearables, and other devices. This trend is underscored by the fact that the automotive sector is projected to witness a compound annual growth rate of approximately 20% in connected vehicle technologies over the next few years. Consequently, manufacturers are investing heavily in BLE solutions to ensure that their vehicles can support a wide array of applications, from navigation to entertainment, thereby enhancing the overall user experience.

Integration with IoT Ecosystem

The integration of vehicles into the broader Internet of Things (IoT) ecosystem is a pivotal driver for the Bluetooth Low Energy (BLE) in Automotive Market. As IoT devices proliferate, the ability for vehicles to communicate with other smart devices becomes essential. BLE technology enables this connectivity, allowing vehicles to interact with home automation systems, smart city infrastructure, and other IoT applications. This trend is expected to accelerate, with estimates suggesting that the number of connected IoT devices will exceed 30 billion by 2025. Consequently, automotive manufacturers are increasingly adopting BLE solutions to ensure their vehicles can seamlessly integrate into this expanding ecosystem, thereby enhancing functionality and user experience.

Consumer Demand for Smart Features

Consumer preferences are evolving, with a marked shift towards smart features in vehicles, which is a significant driver for the Bluetooth Low Energy (BLE) in Automotive Market. Modern consumers expect their vehicles to offer advanced functionalities, such as remote start, vehicle tracking, and personalized settings, all of which can be facilitated through BLE technology. Recent surveys indicate that over 70% of consumers are willing to pay extra for vehicles equipped with smart features, highlighting the lucrative potential for manufacturers. As a result, automotive companies are increasingly incorporating BLE solutions to meet these consumer demands, thereby enhancing their competitive edge in the market.

Growth of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is reshaping the automotive landscape, significantly impacting the Bluetooth Low Energy (BLE) in Automotive Market. As these vehicles become more prevalent, the need for efficient communication systems becomes increasingly important. BLE technology offers a low-power solution for connecting various vehicle components and external devices, which is essential for the operation of autonomous systems. Market forecasts suggest that the electric vehicle segment alone could reach a valuation of over 800 billion dollars by 2027, further driving the demand for BLE solutions. This growth presents opportunities for manufacturers to innovate and integrate BLE technology into their electric and autonomous vehicle offerings.

Leave a Comment