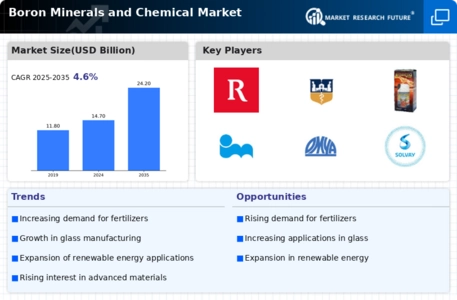

Rising Demand in Agriculture

The Boron Minerals and Chemical Market is experiencing a notable increase in demand from the agricultural sector. Boron is essential for plant growth and development, particularly in the formation of flowers and fruits. As agricultural practices evolve, the need for micronutrients, including boron, is becoming more pronounced. In 2023, the consumption of boron in fertilizers reached approximately 1.5 million tons, reflecting a growing awareness of its benefits among farmers. This trend is likely to continue as crop yields become increasingly critical to meet food security challenges. The Boron Minerals and Chemical Market is thus positioned to benefit from this rising demand, as agricultural stakeholders seek to enhance productivity and sustainability.

Expansion in Glass and Ceramics

The Boron Minerals and Chemical Market is witnessing significant growth due to the expansion of the glass and ceramics sector. Boron compounds are integral in the production of glass, providing thermal and chemical resistance. In 2023, the glass industry accounted for nearly 30% of boron consumption, driven by innovations in glass manufacturing techniques. Additionally, the ceramics industry utilizes boron to improve the strength and durability of products. As the demand for high-quality glass and ceramics continues to rise, the Boron Minerals and Chemical Market is likely to see increased consumption of boron minerals, further solidifying its role in these manufacturing processes.

Growing Demand for Renewable Energy

The Boron Minerals and Chemical Market is poised to benefit from the increasing demand for renewable energy technologies. Boron compounds are utilized in the production of advanced materials for solar panels and batteries, which are essential for energy storage solutions. As the shift towards renewable energy sources accelerates, the need for boron in these applications is likely to rise. In 2023, the renewable energy sector accounted for approximately 15% of boron consumption, indicating a growing trend. This demand is expected to expand as countries invest in sustainable energy infrastructure, positioning the Boron Minerals and Chemical Market as a key player in the transition to a greener economy.

Technological Innovations in Extraction

Technological advancements in the extraction and processing of boron minerals are reshaping the Boron Minerals and Chemical Market. Innovations such as improved mining techniques and more efficient processing methods are enhancing the yield and quality of boron products. For instance, the introduction of selective mining technologies has increased the efficiency of boron extraction, reducing costs and environmental impact. In 2023, the global production of boron minerals reached approximately 4 million tons, with a significant portion attributed to these technological improvements. As these innovations continue to evolve, they are expected to drive further growth in the Boron Minerals and Chemical Market, making it more competitive and sustainable.

Regulatory Support for Sustainable Practices

The Boron Minerals and Chemical Market is increasingly influenced by regulatory frameworks that promote sustainable practices. Governments are implementing policies aimed at reducing environmental impact and encouraging the use of eco-friendly materials. This regulatory support is fostering innovation within the industry, as companies seek to comply with new standards while maintaining profitability. In 2023, approximately 20% of boron production was derived from sustainable sources, reflecting a shift towards greener practices. As regulations continue to evolve, the Boron Minerals and Chemical Market is likely to adapt, ensuring that it meets both market demands and environmental responsibilities.