Brazil Polyisobutylene Market Summary

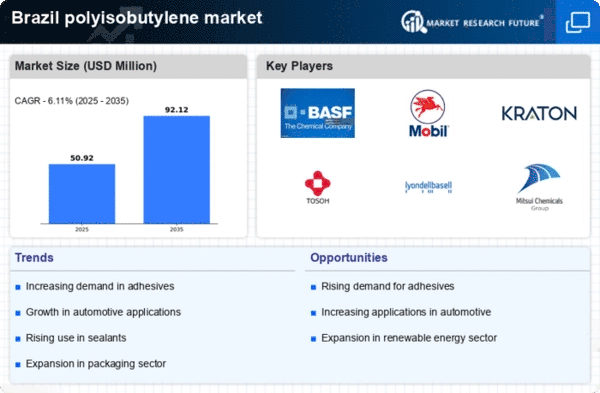

As per Market Research Future analysis, the Polyisobutylene market Size was estimated at 47.99 $ Million in 2024. The polyisobutylene market is projected to grow from 50.92 $ Million in 2025 to 92.12 $ Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Brazil polyisobutylene market is poised for growth driven by sustainability and technological advancements.

- The market is witnessing a notable shift towards sustainable material adoption, reflecting a broader global trend.

- Infrastructure development projects are significantly contributing to the demand for polyisobutylene in various applications.

- The automotive sector emerges as the largest segment, while the adhesives and sealants industry is recognized as the fastest-growing segment.

- Key market drivers include rising demand in the automotive sector and technological advancements in production processes.

Market Size & Forecast

| 2024 Market Size | 47.99 (USD Million) |

| 2035 Market Size | 92.12 (USD Million) |

| CAGR (2025 - 2035) | 6.11% |

Major Players

BASF SE (DE), ExxonMobil Chemical (US), Kraton Corporation (US), Tosoh Corporation (JP), LyondellBasell Industries (US), Mitsui Chemicals (JP), INEOS Group (GB), Chevron Phillips Chemical (US), Kuwait Petroleum Corporation (KW)