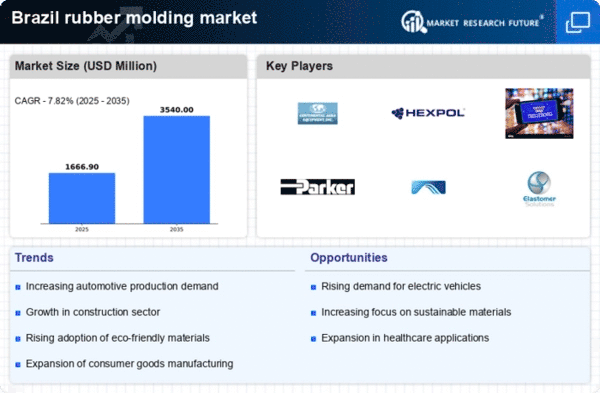

The rubber molding market in Brazil is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, aerospace, and consumer goods. Key players are actively engaging in strategies that emphasize innovation, regional expansion, and sustainability. For instance, Continental AG (DE) has positioned itself as a leader in technological advancements, focusing on the development of high-performance materials that cater to the evolving needs of the automotive industry. Similarly, Hexpol AB (SE) is enhancing its operational focus on sustainable practices, which aligns with the growing consumer preference for eco-friendly products. These strategic initiatives collectively shape a competitive environment that is increasingly focused on differentiation through quality and innovation.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. This approach is particularly relevant in Brazil, where logistical challenges can impact operational efficiency. The market structure appears moderately fragmented, with several key players exerting influence while also facing competition from smaller, specialized firms. The collective actions of these major companies contribute to a competitive atmosphere that encourages continuous improvement and adaptation to market demands.

In October Trelleborg AB (SE) announced the opening of a new manufacturing facility in São Paulo, aimed at enhancing its production capabilities for high-performance rubber components. This strategic move is significant as it not only increases Trelleborg's capacity to meet local demand but also reinforces its commitment to the Brazilian market, potentially leading to improved customer service and reduced delivery times. Such investments are likely to strengthen Trelleborg's competitive position in the region.

In September Parker Hannifin Corporation (US) launched a new line of advanced rubber molding solutions designed specifically for the aerospace sector. This initiative reflects Parker's strategic focus on innovation and its intent to capture a larger share of the aerospace market, which is experiencing robust growth. By introducing cutting-edge products, Parker Hannifin aims to differentiate itself from competitors and establish a strong foothold in this lucrative segment.

In August Freudenberg Group (DE) entered into a strategic partnership with a local Brazilian firm to enhance its distribution network and improve market penetration. This collaboration is indicative of a broader trend where companies are seeking to leverage local expertise to navigate the complexities of the Brazilian market. Such partnerships may facilitate better access to customers and streamline operations, thereby enhancing competitive advantage.

As of November current trends in the rubber molding market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) into manufacturing processes. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and efficiency. The competitive landscape is shifting from a focus on price-based competition to one that prioritizes technological advancement, product quality, and supply chain reliability. This evolution suggests that companies that can effectively leverage these trends will likely emerge as leaders in the market.