Rising Data Generation

The exponential growth of data generation in Brazil is a primary driver for the server storage-area-network market. As businesses increasingly rely on data analytics and digital transformation, the demand for robust storage solutions intensifies. In 2025, it is estimated that data generation in Brazil will reach approximately 2.5 zettabytes, necessitating advanced storage technologies. This surge in data volume compels organizations to invest in server storage-area-network solutions that can efficiently manage, store, and retrieve vast amounts of information. Consequently, the server storage-area-network market is poised for growth as companies seek to enhance their data management capabilities and ensure seamless access to critical information. The need for scalable and reliable storage solutions is likely to drive innovation and investment in this sector, further solidifying its importance in the Brazilian economy.

Increased Regulatory Compliance

Brazil's evolving regulatory landscape, particularly concerning data protection and privacy, significantly influences the server storage-area-network market. The implementation of the General Data Protection Law (LGPD) mandates organizations to adopt stringent data management practices. As companies strive to comply with these regulations, the demand for secure and efficient storage solutions rises. In 2025, it is projected that compliance-related investments in data storage will account for over 30% of total IT budgets in Brazil. This trend underscores the necessity for server storage-area-network solutions that not only meet regulatory requirements but also enhance data security. Organizations are increasingly prioritizing investments in technologies that facilitate compliance, thereby driving growth in the server storage-area-network market. The focus on regulatory adherence is likely to shape the market dynamics, pushing companies to seek innovative storage solutions that align with legal standards.

Expansion of E-commerce and Digital Services

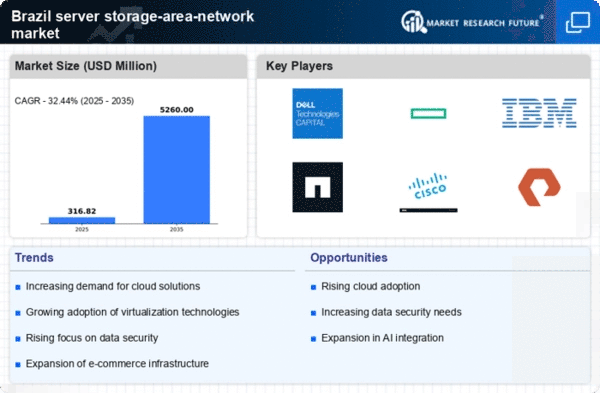

The rapid expansion of e-commerce and digital services in Brazil is a significant driver for the server storage-area-network market. As online retail and digital platforms continue to proliferate, the demand for reliable and scalable storage solutions intensifies. In 2025, it is projected that e-commerce sales in Brazil will exceed $50 billion, creating a pressing need for efficient data management systems. Server storage-area-network solutions are essential for handling the vast amounts of transactional data generated by these platforms. This growth in digital services necessitates investments in storage infrastructure that can support high availability and performance. As businesses adapt to the digital landscape, the server storage-area-network market is likely to benefit from increased investments aimed at enhancing data storage capabilities and ensuring seamless customer experiences.

Growing Adoption of Virtualization Technologies

The increasing adoption of virtualization technologies in Brazil is a crucial driver for the server storage-area-network market. As organizations strive to enhance operational efficiency and reduce costs, virtualization has become a key strategy. In 2025, it is estimated that over 60% of Brazilian enterprises will implement virtualization solutions, necessitating robust storage infrastructure to support these environments. Server storage-area-network solutions play a vital role in providing the necessary scalability and performance for virtualized workloads. This trend indicates a growing reliance on centralized storage systems that can efficiently manage multiple virtual machines. Consequently, the server storage-area-network market is likely to experience significant growth as businesses seek to leverage virtualization to optimize their IT resources and improve service delivery.

Technological Advancements in Storage Solutions

The server storage-area-network market in Brazil is significantly driven by rapid technological advancements in storage solutions. Innovations such as flash storage, software-defined storage, and hyper-converged infrastructure are transforming how organizations manage their data. In 2025, it is anticipated that the adoption of flash storage will increase by over 40% among Brazilian enterprises, reflecting a shift towards faster and more efficient storage options. These advancements not only enhance performance but also reduce operational costs, making them attractive to businesses. As organizations seek to optimize their IT infrastructure, the demand for cutting-edge server storage-area-network solutions is likely to rise. This trend indicates a competitive landscape where companies must continuously innovate to meet the evolving needs of their customers, thereby propelling growth in the server storage-area-network market.