Regulatory Support and Guidelines

Regulatory support and guidelines play a crucial role in shaping the breast milk substitute Market. Governments and health organizations are establishing standards for infant nutrition, which can enhance consumer confidence in breast milk substitutes. These regulations often focus on safety, quality, and nutritional adequacy, ensuring that products meet specific health criteria. As a result, manufacturers are compelled to adhere to these guidelines, which can lead to improved product offerings. The presence of clear regulations may also encourage new entrants into the market, fostering competition and innovation, ultimately benefiting consumers.

Rising Working Mothers Population

The increasing number of working mothers is a significant driver for the Breast Milk Substitute Market. As more women enter the workforce, the demand for convenient feeding options rises. Breast milk substitutes provide a practical solution for mothers who may not be able to breastfeed exclusively due to work commitments. This demographic shift is influencing market dynamics, with estimates indicating that the market could expand by approximately 5% annually as more mothers seek reliable alternatives. The availability of various formats, such as ready-to-feed and powdered formulas, further supports this trend, catering to the needs of busy parents.

Innovations in Product Formulation

Innovations in product formulation are significantly shaping the Breast Milk Substitute Market. Manufacturers are investing in research and development to create formulas that closely mimic the nutritional profile of breast milk. This includes the incorporation of probiotics, prebiotics, and essential fatty acids, which are believed to enhance infant health. The introduction of organic and non-GMO options is also gaining traction, appealing to health-conscious consumers. Market data indicates that the segment of organic breast milk substitutes is experiencing rapid growth, reflecting a shift towards more natural and health-oriented products. Such innovations are likely to attract a broader consumer base.

E-commerce and Online Retail Growth

The growth of e-commerce and online retail is transforming the Breast Milk Substitute Market. With the increasing penetration of the internet and mobile devices, parents are turning to online platforms for purchasing infant nutrition products. This shift is particularly evident among younger, tech-savvy parents who prefer the convenience of online shopping. Market data suggests that online sales of breast milk substitutes are expected to rise significantly, potentially accounting for a substantial portion of total sales in the coming years. This trend not only enhances accessibility but also allows for a wider variety of products to be available to consumers.

Increasing Awareness of Infant Nutrition

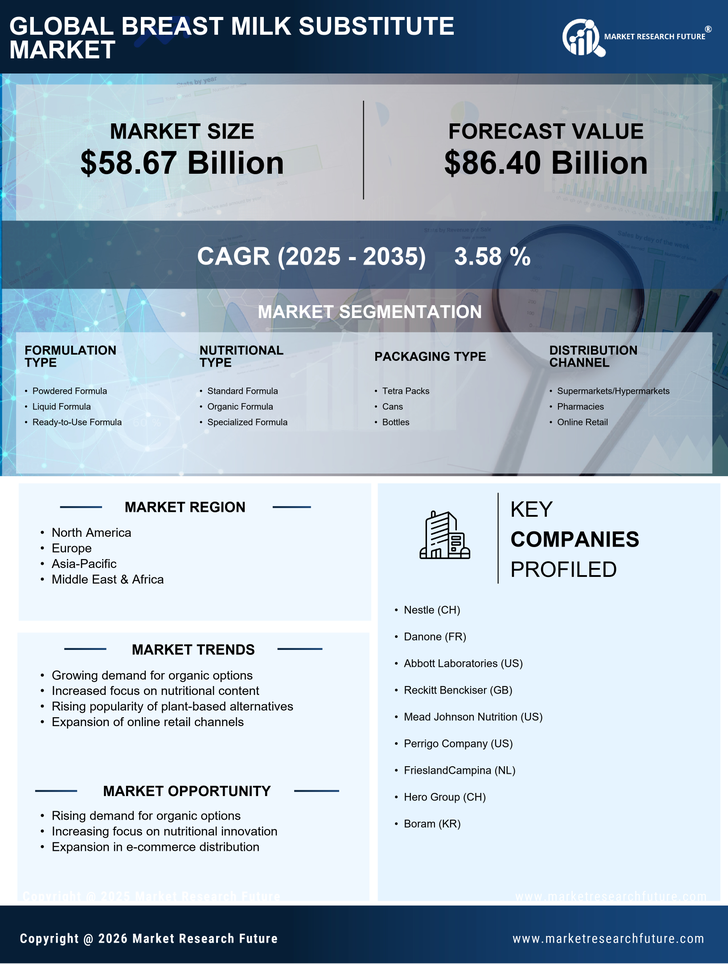

The rising awareness regarding the importance of infant nutrition is a pivotal driver for the Breast Milk Substitute Market. Parents are increasingly informed about the nutritional needs of their infants, leading to a surge in demand for high-quality substitutes. This trend is supported by various health organizations advocating for proper infant feeding practices. As a result, the market for breast milk substitutes is projected to grow, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This heightened awareness is likely to influence purchasing decisions, as parents seek products that align with their nutritional standards.