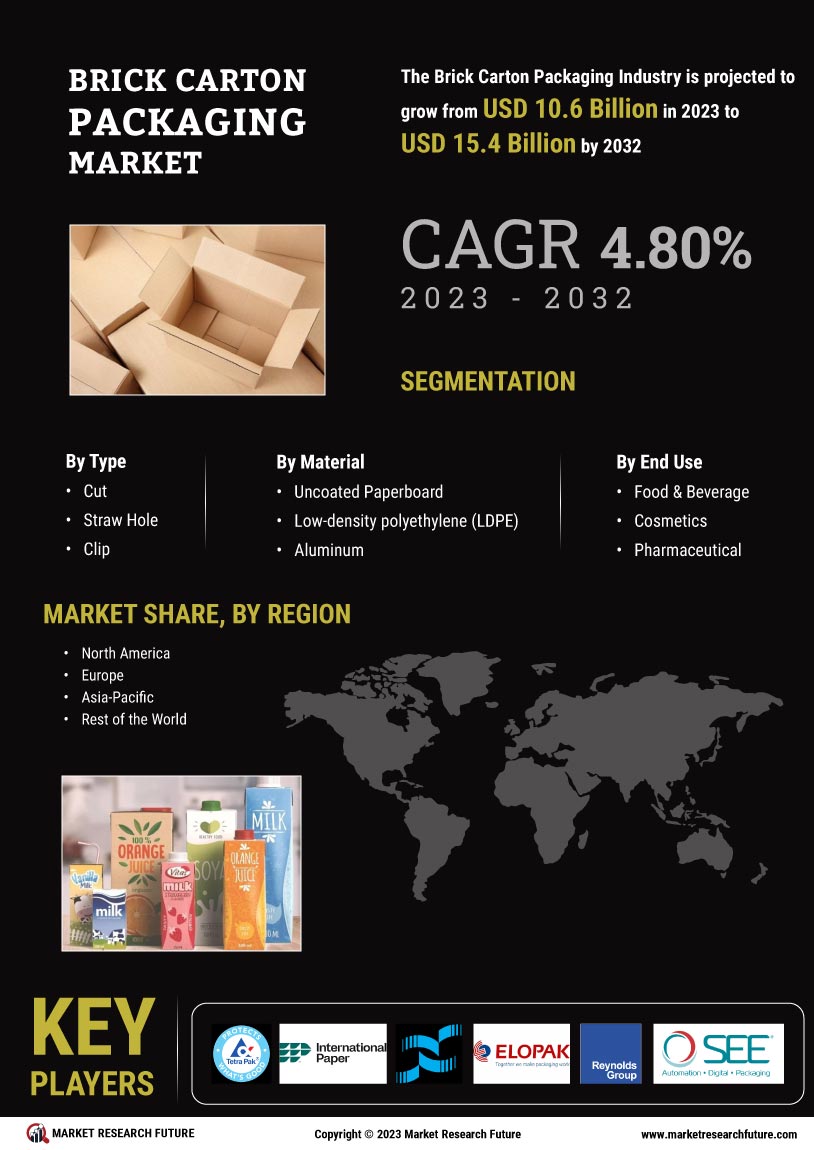

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Brick Carton Packaging Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Brick Carton Packaging Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Brick Carton Packaging Industry to benefit clients and increase the market sector. In recent years, the Brick Carton Packaging Industry has offered some of the most significant advantages to medicine. Major players in the Brick Carton Packaging Market, including Tetra Pak International S.A., Shanghai Skylong Aspetic Package Material Co., Ltd., International Paper, Nippon Paper Industries Co. Ltd., Elopak AS, Reynolds Group Holdings, Sealed Air, and Saxon Packaging Limited, are attempting to increase market demand by investing in research and development operations.

Elopak AS (Elopak), a division of FERD AS, is a corporation that specialises in packaging liquid food products. It creates, produces, and markets carton-based packaging solutions for liquid food products that are not carbonated. The company sells filling machines, trays, rolls, paperboard, caps, closures, and closures. Additionally, it provides a range of services, including printing, technical support, maintenance, and solutions for secondary packaging and material handling. Pure-Pak, Elo-Cap, Pure-Twist, and D-Pak are some of the brands that the company uses to promote its goods. Elopak also provides filling equipment for effectively filling aseptic and ESL liquid food items.

The business is run through a network of colleagues and market units spread throughout several nations. The headquarters of Elopak are in Oslo, Norway. Elopak AS and GLS announced their partnership in April 2022 with the goal of providing eco-friendly packaging options to customers all over India. Customers can order Roll-Fed aseptic cartons from GLS under the "ALPAK" brand, together with end-to-end service support, in a variety of sizes. The company intends to offer aseptic Pure-Pak cartons, fresh Pure-Pak cartons, and auxiliary services.

Carbonated soft drinks, fruit juices, ready-to-drink teas and coffee, still drinks, energy drinks, sport drinks, waters, plant-based and protein beverages, ready-to-drink iced tea, and other speciality drinks are all produced by Refresco Group BV (Refresco). Refresco provides beverage makers with co-packing, retailer brand, and contract manufacturing services. The business sells beverages in a variety of containers, including PET, carton, Aseptic PET, cans, and glass. In addition to procurement for third parties, the company provides storage and logistics, customer support, and other services.

In addition to the US, it also has manufacturing sites in Finland, Canada, Mexico, Benelux, Germany, France, and the UK. The headquarters of Refresco are in Rotterdam, Zuid-Holland, in the Netherlands. Refresco Group NV stated in October 2022 that it will be expanding into Australia and acquiring Tru Blu Beverages Pty Ltd, one of the producers of non-alcoholic beverages. The acquisition may further solidify the business's position as a provider of beverage solutions to global leaders in retail and branded customers, as well as open up new growth prospects.