Government Initiatives and Support

Government initiatives play a pivotal role in shaping the Broadband Satellite Service Market. Various countries are implementing policies and funding programs aimed at expanding broadband access, particularly in underserved areas. For instance, initiatives to subsidize satellite internet services are becoming more common, as governments recognize the importance of connectivity for economic development and social inclusion. In 2025, it is anticipated that government support will continue to bolster the market, with increased funding for satellite projects and partnerships with private companies. This collaborative approach is likely to enhance the reach and affordability of broadband satellite services, making them more accessible to a broader population. Such initiatives are expected to significantly impact the growth trajectory of the Broadband Satellite Service Market.

Integration with Emerging Technologies

The integration of emerging technologies is significantly influencing the Broadband Satellite Service Market. Technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) are being incorporated into satellite services to enhance operational efficiency and customer experience. For example, AI can optimize satellite operations and improve data analytics, leading to better service delivery. As of 2025, the convergence of these technologies is likely to create new business models and service offerings, further driving market growth. The ability to provide tailored solutions for various sectors, including agriculture, healthcare, and transportation, is expected to expand the customer base for satellite services. This integration not only enhances the capabilities of the Broadband Satellite Service Market but also positions it as a key player in the broader telecommunications landscape.

Rising Demand for Internet Connectivity

The Broadband Satellite Service Market is witnessing a surge in demand for internet connectivity, particularly in rural and remote regions. As more individuals and businesses seek reliable internet access, satellite services are becoming an essential solution. According to recent data, approximately 3.7 billion people worldwide still lack internet access, highlighting a significant market opportunity. The increasing reliance on digital services, remote work, and online education has further amplified this demand. In 2025, the market is expected to cater to a diverse range of customers, from individual users to large enterprises, all seeking high-speed internet solutions. This growing demand is likely to drive investments in satellite infrastructure, thereby enhancing the overall service offerings within the Broadband Satellite Service Market.

Competitive Landscape and Market Dynamics

The competitive landscape of the Broadband Satellite Service Market is evolving, with numerous players vying for market share. Established companies are facing competition from new entrants, particularly those focusing on innovative satellite technologies and service models. This dynamic environment is fostering a climate of innovation, as companies strive to differentiate their offerings. In 2025, the market is likely to see increased mergers and acquisitions as firms seek to enhance their technological capabilities and expand their service portfolios. Additionally, pricing strategies are becoming more competitive, which may lead to improved service affordability for consumers. The interplay of these market dynamics is expected to shape the future of the Broadband Satellite Service Market, driving growth and enhancing service quality.

Technological Advancements in Satellite Technology

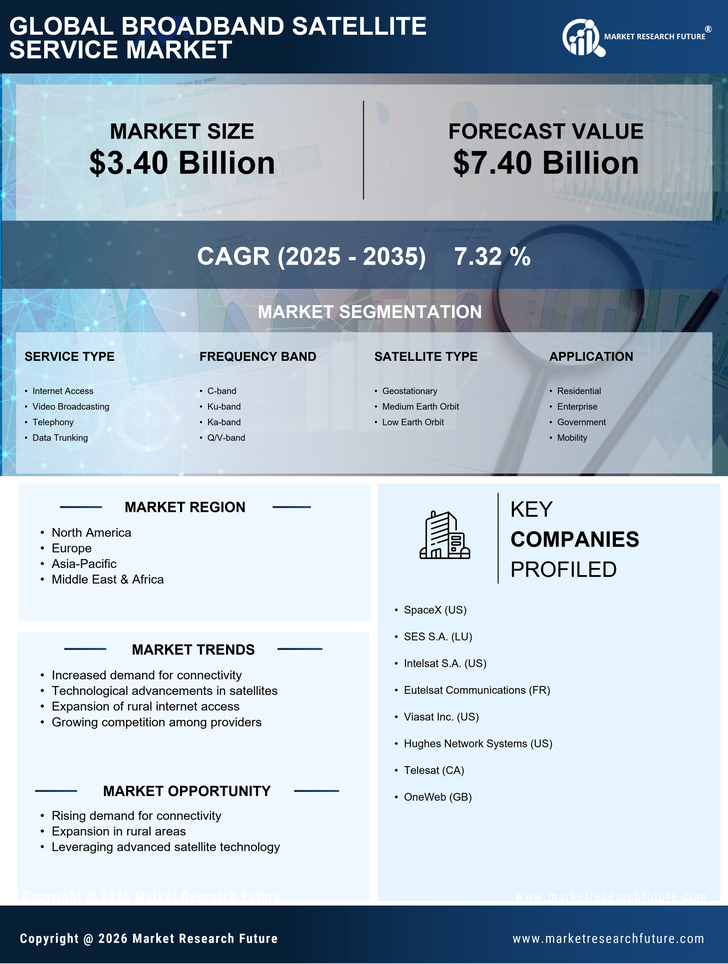

The Broadband Satellite Service Market is experiencing a transformative phase due to rapid technological advancements. Innovations such as high-throughput satellites (HTS) and low Earth orbit (LEO) satellite constellations are enhancing service quality and reducing latency. HTS technology allows for greater bandwidth and improved data transmission rates, which are crucial for meeting the increasing demand for high-speed internet. As of 2025, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the need for reliable internet access in remote and underserved areas, where traditional broadband infrastructure is lacking. The ongoing development of satellite technology is likely to further expand the capabilities of the Broadband Satellite Service Market.